Consider this scenario: you receive your property insurance renewal proposal, and the insurance company has added a convective storm deductible. You may be wondering what this means and what impact it will have on total cost.

The

use of various storm deductibles is on the rise, and the number of storm categories is also increasing. In addition to the storm deductible categories of named storm, hurricane, flood, and wind/hail, policyholders must now contend with the newer

(and broad) convective storm deductible, as well as the ever-expanding geographic scope of the wind/hail deductible.

As a result of significant storm-related losses in recent years, insurance companies are obligating policyholders to take on increased risk-sharing of storm losses via deductibles.

Convective Storms

Convective storms are also known as thunderstorms. In other words, “convective storm” is just a fancy name for a strong thunderstorm, not a new weather phenomenon.

According to The National Severe Storms Laboratory (NSSL) of NOAA,

convective storms are usually created by surface heating. Convection is upward atmospheric motion that transports whatever is in the air along with it – especially any moisture available in the air. A thunderstorm is a result of convection.1

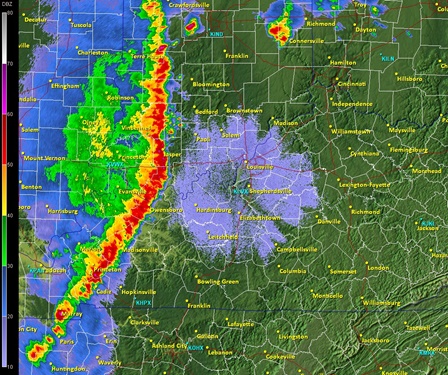

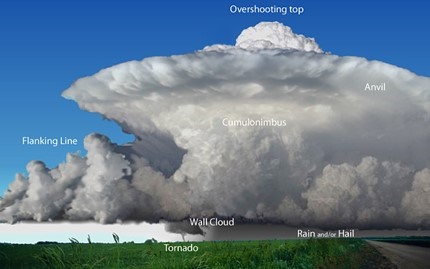

Squall line and supercell systems are examples of convective storms. The NSSL provides the following definitions and graphic representations of these storms.2

- A squall line is a group of storms arranged in a line, often accompanied by “squalls” of high wind and heavy rain. Squall lines tend to pass quickly and are less likely to produce tornadoes than supercells. Squall lines can be hundreds of miles long and are typically between 10 to 20 miles wide.

A supercell is a long-lived (greater than one hour) and highly organized storm feeding off an updraft (a rising current of air) that is tilted and rotating. This rotating updraft – as large as 10 miles in diameter and up to 50,000 feet tall – can be present as much as 20 to 60 minutes before the formation of a tornado.

In the Midwest region of the United States, squall lines and supercells are a common part of spring and summer weather. These intense storms have always been part of the region’s climate. Therefore, convective storms are not a new concept.

Policyholder Risk Sharing

Deductibles represent risk sharing by a policyholder. For each loss paid by the insurance company, the policyholder contributes dollars through the application of a deductible.

It is not uncommon for a property insurance policy

to have multiple deductibles. The “all other perils” (or AOP) deductible represents the deductible for all insured perils unless a specific deductible otherwise applies. If hazardous perils such as hurricane/named

storm, flood, or earthquake are insured on the property policy, those perils commonly have their own specific deductible because they are considered excessive risk perils. On occasion, insurers require a specific deductible for hail and/or

wind in geographic areas that have historically generated significant losses for the peril(s) of hail and/or wind (such as hail in Texas).

Traditionally, the AOP deductible included weather elements associated with thunderstorm

systems such as wind, hail, heavy rain, lightning, and tornado. A convective storm deductible replaces the AOP deductible for elements of a thunderstorm system.

Convective Storm Deductibles

A convective storm deductible without boundaries and a specific definition will create a significant and potentially unjustified burden for policyholders. This is because underwriters impose higher risk-sharing deductibles when they perceive the overall

risk exposure for a given peril to be excessive. For example, it is reasonable for a policyholder to have a higher risk-sharing obligation for the peril of hurricane wind and storm surge for their coastal property in Florida. However,

is it reasonable for severe thunderstorm risks in other states to receive the same high deductibles as hurricane in Florida?

Let’s assume that a policy includes the following deductibles:

$10,000 for all perils except: $100,000 for Convective Storm

If the convective storm deductible is undefined, under what conditions will it apply? Would the deductible apply to all thunderstorms? Or would this deductible apply only to “severe” thunderstorms, and if so, how is a “severe”

storm defined? The NSSL classifies a thunderstorm as “severe” when it contains one or more of the following: hail one inch or greater, winds gusting in excess of 57.5 mph, or tornado.1 Who would determine when

a thunderstorm warrants the higher convective storm deductible?

Thunderstorm risk has traditionally been insured in the standard all perils deductible (e.g. $10,000). The new convective storm deductible creates a dilemma –

does the existence of a convective storm deductible on a policy mean ALL thunderstorms have the higher $100,000 deductible? Without definitive wording, the situation is left to interpretation at the time of a loss. To avoid confusion

during the claims process, if a convective storm deductible is required, the deductible should be defined – and its application clearly explained in the policy. Flushing out the application of a deductible at the time of a loss can

be challenging and time-consuming.

According to the NSSL, there are 16,000,000 thunderstorms each year worldwide, with an estimated 2,000 thunderstorms in progress at any given moment. There are roughly 100,000 thunderstorms each

year in the United States alone.1 As a result, the potential for triggering a convective storm deductible is significant, especially compared to an earthquake, flood, or hurricane/named storm. Therefore, it is in the best

interest of the insured that the wording of a convective storm deductible be clearly defined.

Severe Storms – Tornado

Of the various elements associated with convective or severe storms, tornadoes are of particular concern to the insurance industry because of the potential for catastrophic damage. According to NOAA, several factors can create a misleading appearance of an increasing trend in tornado frequency:

- Increased national Doppler radar coverage

- Increased population

- Greater emphasis on tornado reporting

NOAA has stated that one of the main difficulties with historical tornado records is that a tornado (or evidence of such) must have been observed to be recorded in the past. Therefore, if people did not witness a tornado or there was no evidence

of tornado damage, the tornado was not recorded. Today, most of the United States is monitored by NOAA’s Doppler weather radars. Therefore, increased reports of tornados do not necessarily indicate that there are more tornados

today than 50 years ago.

In fact, NOAA has determined that the U.S. Annual Count of EF-1+ Tornadoes from 1954-2014 does not trend upwards. Rather, the U.S. Annual Count of Strong to Violent Tornadoes EF-3+ from 1954 – 2014

has decreased during much of that period, including the years 2012 – 2014.3

NOAA further states that 77% of tornadoes in the United States are considered weak (EF-0 or EF-1), and about 95% of all tornadoes in

the United States are below EF-3 intensity. Only about 0.1% of tornadoes – or 1 out of every 1,000 tornadoes – reach an EF-5 status.3

Tornadoes can be part of different weather events. The manner in

which deductibles apply to tornadoes will depend on the circumstances of the tornado and the types of deductibles on the policy. For example, did the tornado occur during a traditional severe thunderstorm, and if so, does the policy have

a specific wind deductible or convective storm deductible? Did the tornado occur during a hurricane/named storm, and if so, is there a specific deductible for hurricane/named storm?

Expanded Use of Wind / Hail Deductibles

Wind and hail deductibles have been applied for years, and certain geographic areas of the United States face excessive risk for the peril of wind and/or hail. Policyholders with property assets in these high-risk areas may be required to assume

a higher risk obligation through a deductible in order to obtain insurance protection.

The Insurance Information Institute’s recent report on hail events revealed that4:

- Although the frequency of damaging hail events can vary significantly year-to-year, the number of U.S. properties affected by one or more hail events decreased by 15% from 2016 to 2017.

- Texas had the highest number of properties affected by hail events. However, as a percent of properties affected in the state, Kansas had the largest percentage of their properties affected by hail in 2017 (57%).

- Oklahoma, Kansas and Nebraska appear to have an increased likelihood of exposure to hail.

Hail events can be very costly, and policyholders with property assets in high-risk areas can expect to be asked to contribute more through deductibles. The issue is whether the hail deductible will apply just to the higher-risk geographic areas

or whether the hail deductible will apply to all insured locations, regardless of where they are located. The answer will lie in the deductible wording and application thereof.

The reality is, every state has a risk of hail.

Increased risk sharing through deductibles should occur when the risk to hail is excessive and not simply because the risk exists.

Conclusion

As insurance companies contend with significant weather-related claims, they are incorporating new methods of sharing risk with policyholders, including the convective storm deductible. If a convective storm deductible is required, it should be clearly

defined – and its application explained – in the policy in order to avoid confusion during the claims process.

As with similar elevated-risk perils (e.g. hurricane), the risk-sharing obligation of the policyholder

may be tempered by working with the insurance company to understand the exact risk concerns (e.g. hail in specific high-risk Texas counties vs. all counties in Texas) and avoiding misleading information concerning the rise of a risk (e.g. tornadic

activity). By crafting the deductible wording to clearly reflect the specific risk to which the higher deductible applies, it may be possible to avoid a blanket application of the deductible to all of the policyholder’s locations.

About the Author

This article was authored by Jennifer Walker, CPCU, CRM, CIC, CEBS, CIT, GBA, ARM, AIM, AIC, ALCM, associate broker with AmWINS Brokerage of Georgia in Atlanta and a member of AmWINS’ national Property practice.

1 The National Severe Storms Laboratory. Severe Weather 101 – Thunderstorm Basics. https://www.nssl.noaa.gov/education/svrwx101/thunderstorms/.

2 The National Severe Storms Laboratory. Severe Weather

101 – Thunderstorm Types. https://www.nssl.noaa.gov/education/svrwx101/thunderstorms/types/

3 NOAA National Centers for Environmental Information. Historical Records and Trends. https://www.ncdc.noaa.gov/climate-information/extreme-events/us-tornado-climatology/trends.

4 Insurance Information Institute. Facts + Statics: Hail. https://www.iii.org/fact-statistic/facts-statistics-hail.