As we kick off 2024, the insurance marketplace continues to experience many of the same highs and lows we encountered in 2023. Some markets are less challenging than others, with a competitive rate environment and more favorable underwriting, while others grapple with one of the most demanding markets we’ve ever seen. While this report is meant to take a high-level snapshot of these conditions, we face the challenge of capturing an ever-evolving marketplace.

Our goal is less about making market predictions and more about a promise to you, our clients. We are dedicated to providing you with the best products and services the market can offer, regardless of current trends and conditions. Leveraging the Amwins team’s industry experience and innovative problem-solving skills, as well as our exclusive offerings, we’re here to assist you in navigating the challenges and changes that come your way.

Within this comprehensive State of the Market report, experts spanning each Amwins division delve into the factors impacting market conditions. They share valuable insights covering rate fluctuations, capacity and evolving coverage trends across diverse lines of business and industries in the United States, London and Bermuda.

Market Summaries

Property

Market Conditions

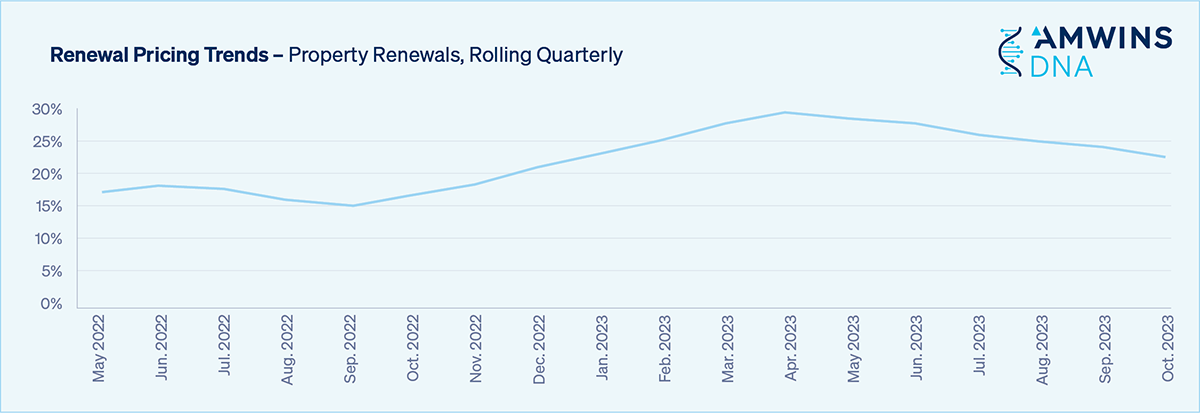

As we head into 2024, the property market remains challenging. However, we have begun to see signs of softening and anticipate a slowdown in the pace of rate increases for most insureds. We also expect the upcoming reinsurance renewal season to be much more organized than last year, with retention levels stabilizing and rates staying at or near where they are currently.

We are confident underwriting discipline and risk selection will prevail. Perils once considered secondary will continue to face higher scrutiny while the definition of CAT exposure across the U.S. will be re-examined. At the same time, the effect of RMS modeling revisions has yet to be fully vetted and contemplated within reinsurer and carrier model results. Accounts with better risk characteristics (e.g., construction, losses, geographic location, industry class, etc.) will achieve better results overall.

Valuation will remain an important underwriting factor; however, we do not expect the same drastic increases we’ve seen over the past few years. Most markets have implemented guidelines around insurance to value (e.g., imposing minimums or using proprietary forms of measurement). It will be critical to maintain proper valuation that considers inflation and property values alike.

Of course, there are – and will continue to be – certain classes of business and geographic areas that will face higher rates as well as more restrictive terms and conditions. CAT-exposed accounts will continue to face challenges as carriers continue to manage their aggregate. And while there is new capacity entering the market, it is too early to appreciate the full impact to the market and its effect on competition.

Parametric insurance is trending up as a supplement to traditional coverages. This year alone, there has been a 500% increase in submission volume within Amwins, and we expect this growth to continue as the structures become more sophisticated, insured awareness grows and exposures increase in complexity and outgrow their traditional coverages.

London

There are some signs that the significant flow of new admitted business into the E&S markets in London has begun to slow. The vast majority of Lloyds’ syndicates have already submitted their 2024 business plans and had them approved and many of these involve growth in their portfolios. This may also allow for expansion of anywhere from 10% to 15%, the increase being deployed on either their existing core portfolio or new accounts.

Only time will tell how this may – or may not – impact rates. The considerable increases seen during the last few quarters are likely to be greatly moderated. Terms and conditions are expected to stay the same, with high deductibles continuing for the foreseeable future. Accounts with coinsurance can expect questions about valuations to persist and underinsured clients should assume that penalty clauses will remain.

Bermuda

The Bermuda market is likely to see rate increases in the coming year that range from 5% to 10% on clean, non-CAT accounts. CAT accounts, however, may see even higher rate increases, depending on RMS model impact (which could drive U.S. hurricane AAL’s up next year) and any new capacity entering the market. Florida and California will continue to see higher rates, and it is unlikely that many companies will want to take on more aggregate in these states.

Markets are anticipating premium growth of 10% to 15%, with most of this growth coming from rate increases on existing accounts, select markets deploying more capacity and increases in valuations due to inflation.

Small Business

Looking ahead there is some optimism that the small commercial property market will stabilize as well. Terms and conditions will be pushed and forms tightened, but we see limited new capacity entering the space and we expect rate increases will begin to moderate as a result. Small business that contributes to carrier PML and aggregate will struggle to meet minimum premium levels required by capital deployment.

Be on the Lookout:

As we wrap up 2023 and soon head into the new year, we are seeing high levels of buyer’s fatigue – even on accounts with minimal to no loss. We have seen certain insureds choose to purchase less overall limit, retain higher deductibles, reduce CAT sublimits and/or self-insure a portion of the primary layer to assist in controlling the ultimate cost of their respective renewal.

With more potentially viable markets than ever, partnering with a specialty wholesaler who can provide full market access and creative/comprehensive solutions is essential.

Select image to view larger

Insight provided by:

- Harry Tucker, EVP and Amwins’ National Property Practice Leader

- Jessica Zuiker, VP and Amwins’ Assistant National Property Practice Leader

- Bob Black, EVP and National Real Estate Practice Leader Amwins Brokerage

- Toby Colls, Managing Director, Property with Amwins Global Risks

- Steve Knight, Head of Open Market, Amwins Global Risks

- Kayla Bridgewater, VP, Amwins Bermuda

- Nicola Golder, SVP, Amwins Access

Casualty

Market Conditions

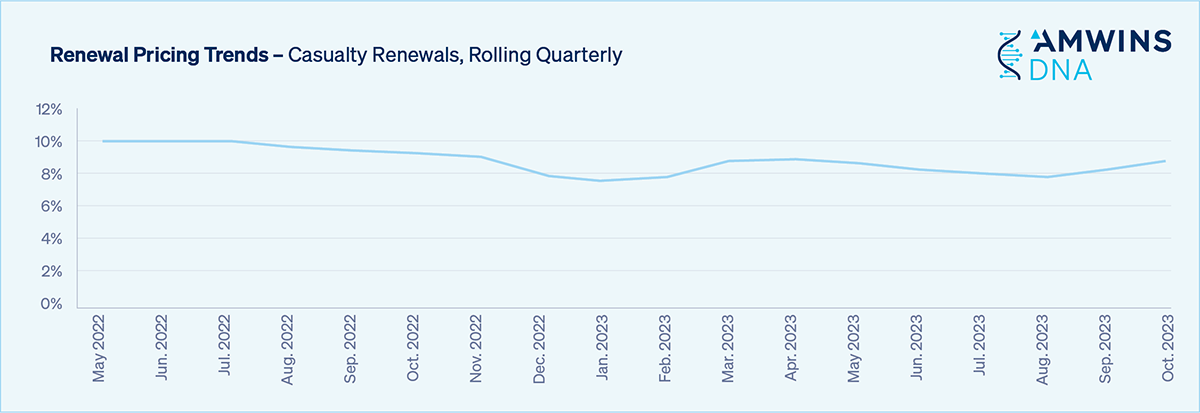

There has been increased discussion regarding the casualty market over the past few weeks with several carriers addressing adverse development in accident years 2016–2020 in their third quarter earnings calls. We anticipate some additional firming of rates in 2024 in order to keep up with loss trends for target business. Long-tail classes, including residential construction, habitational and large trucking/auto-based risks continue to face a firm and unpredictable market.

As outlined below, Third-Party Litigation Funding, social inflation and aberration verdicts remain key factors to the continued upward pressure on rates. Loss ratios and adequate reserving are being watched closely, with short limits controlling aggregate capacity. We anticipate U.S. Casualty will be a focus point for 2024 treaty renewals as reinsurers look to keep pace with these trends.

In the excess space, carriers do not anticipate changes in attachment points and capacity deployed. Middle market business, specifically insureds with premiums between $10,000 to $100,000, remains the most pursued class of business as carriers find it more profitable overall. We anticipate this segment will become even more competitive throughout 2024.

Traditional carriers continue to feel the effect of the new capacity that entered the market within the past few years. To mitigate this competitive landscape and differentiate themselves, they are stressing their financial strength, claims handling abilities and long-term track record in the E&S space. Many are also using this time to invest in new tools designed to help increase underwriter efficiency, including AI to prioritize submissions within a target appetite, monitor broker hit ratios and streamline IT infrastructure for quicker rate/quote/bind.

Tort Reform

Earlier this year, Florida passed House Bill (HB) 837, widely expected to reduce the number of frivolous lawsuits in the state. There has been little impact to date as we wait for the influx of claims filed before the new law took effect to work their way through the system.

Florida’s Senate Bill 360 was a welcome change for carriers, written to help reduce long-tail exposure on construction risk in the state. However, there has been no immediate effect on pricing and terms – as expected. Claimants have until July 1, 2024, before the bill takes effect retroactively, so we expect a similar wave of lawsuits as those filed in response to HB 837.

Social Inflation and Third-Party Litigation Funding

Claims litigation continues to evolve with aberration verdicts (verdicts of more than $10M) on the rise. Changes in the legal landscape and tactics designed to scare jurors into lashing out with large verdicts have resulted in social inflation making up 26% of today’s inflation rate.1

A recent report by the Institute for Legal Reform, also shows that from 2010–2019 the median aberration verdict increased by 27.5% from $19.3M to $24.6M. When combined with the rise of third-party litigation funding, these tactics have driven capacity reduction on individual accounts.2 In some cases, carriers have gone from $25M down to $10M in deployed capacity on single deals, ultimately reducing coverage to $5M or less for accounts on which they were in a lead position. In general, research suggests social inflation could be causing losses to increase faster than general inflation by 2% to 3% per year.

London

London capacity is expected to stay stable heading into 2024. We don’t anticipate there will be any additional new entrants into the market and overall rate increases will remain low – anywhere from zero to 5% – with well performing industries seeing some softening especially in the mid- to mid-high excess layers. Challenging placements for the upcoming year will continue in industry classes such as New York City construction. Trucking and accounts with large auto schedules will have particular focus where large settlement and verdict values persist, leading to issues with pricing and capacity.

Social inflation is expected to impact rates as we push further into the year. Courts have reopened and are working to clear their dockets of any remaining claims filed during the COVID pandemic. Settlements are still trending up and we expect to see more of the same over the next 12 months.

It’s important for retailers to have a strategy going into renewal. The earlier submissions can be completed, the better. Be prepared to allow for at least 90 days prior to renewal for proper underwriting – especially when working with a new carrier.

Bermuda

The market in Bermuda has stabilized during 2023 and continues to maintain a strong position in providing much needed excess capacity. Rate increases are still the norm but are now more likely to be in the range of 5% to 10%, although this may vary depending on class of business and loss experience.

Continuing deterioration in loss trends, driven by social inflation and aberration verdicts, has resulted in some carriers withdrawing from certain classes such as Transportation. In keeping with the broader market, other carriers have reduced capacity from a high of $25M to $5M (or even lower), depending on the class of business and attachment.

Underwriters continue to pay close attention to aggregate exposure and expect to see restrictions on limits deployed and/or aggregate limits, especially where a carrier has exposure to the same loss from multiple clients.

Demand for alternative risk transfer solutions has not abated as insureds seek to offset the effects of renewal pricing and retention increases. Structured deals have become more popular, providing the opportunity for insureds with good loss experience to take risk while, at the same time, securing protection for worse than expected losses. Interest in captive and rent-a-captive (cell captive) solutions also remains high in Bermuda.

Reinsurance treaty renewals during 2024 will be watched closely with some sources in Bermuda anticipating rate and retention increases as reinsurers react to deteriorating loss results from prior years.

As always, in a market such as this, submissions that are complete and credible are more likely to get to the top of the pile. The quality and reliability of data, especially loss and exposure data, will be key, with many carriers now requiring 10 years of ground-up loss and exposure data for modeling purposes.

Small Business

In general, we expect casualty pricing to remain steady as we head into the new year. While pockets of instability for challenging classes (e.g., habitational) and regions (e.g., New York City, Florida) persist, rate increases will be incremental and more targeted.

We have seen an influx of new excess liability product offerings as markets are looking to grow and diversify their portfolios. Specific coverages for contractors, long tail business and completed operations related exposures continue to be much sought after.

Liquor liability is a particular challenge for small businesses in states like South Carolina where owners are struggling to get the coverage they need to protect themselves and remain open for business. States like Alabama have recognized the problem and are passing reforms. You can read more about this in the special Hospitality section of this report.

Insight provided by:

- Tom Dillon – EVP and National Casualty Practice Leader

- Nate Schepers – VP and Assistant National Casualty Practice Leader

- Alan Mooney – CEO of Amwins Bermuda

- Kelly Carney – SVP, Amwins Access

1 D&P Composite NPE Mix by Estimated Inflation Type

2What you Need to Know About Third Party Litigation Funding - ILR (instituteforlegalreform.com)

Select image to view larger

Professional Lines

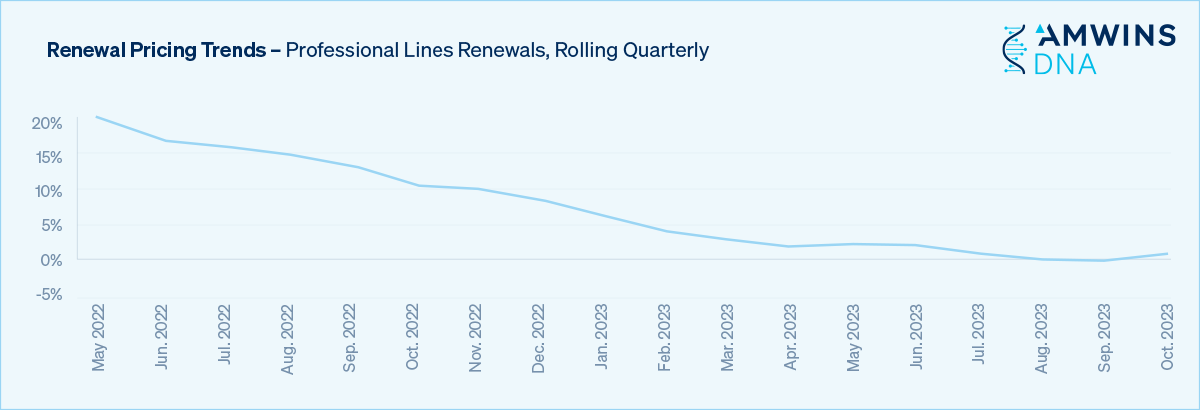

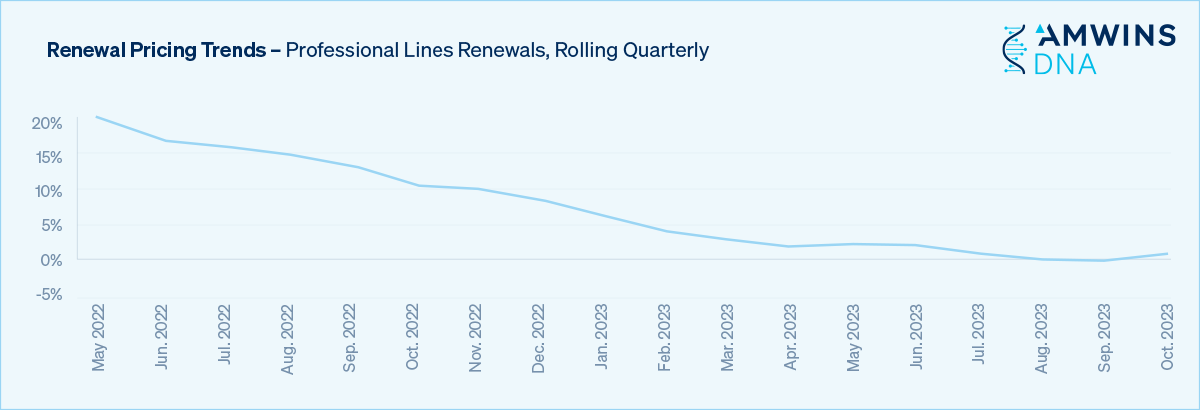

Across multiple professional and executive risk lines of business, excess available capacity continues to drive softer market conditions as year-end approaches. Specific commentary across the various products include:

Directors & Officers Liability (D&O)

The D&O market for private and non-profit organizations is one of the more competitive landscapes within the professional liability arena. Many “newer entrants” have shifted focus from excess only appetite to being competitive primary writers in the space. Outside of the capacity available, certain carriers/MGAs are including technology based underwriting strategies in their portfolio to streamline business. While there are more solutions available to the average insured due to softer market cycles, retailers should take care to ensure that a lower premium does not come at the expense of a simplified or stripped-down product.

Legacy carriers with data to mine are more selectively aggressive, so it’s easy to envision divergent paths between established and newer capacity on the horizon should pricing continue to fall. When it comes to larger publicly traded towers, we expect limit pricing adequacy to become a hot topic again which may lead to more insured conversations differentiating between the carriers’ offering options. In general, all carriers are motivated to keep deals out of the marketplace and are generally accepting of placement objectives, including lower price points and improved coverage.

While broader coverage appears to be generally available across the sector, one coverage restriction that continues to be prevalent across the marketplace relates to the Biometric Information Privacy Act (BIPA). The marketplace does not have a uniform response to how they want to underwrite this exposure nor how they want their insurance policy to potentially respond. Many carriers are defaulting to blanket exclusions or sublimits in reaction to developing claims trends, but others are willing to take a more risk by risk approach and attempt to underwrite the exposure – either way it feels like there will be separation across the industry in policy language.

How long this soft market continues is the question. New risks are on the horizon, including technology and the growth of artificial intelligence (AI) which, if inappropriately applied or developed, could lead to shareholder action. Despite current fierce competition in the D&O space, any sort of external event could cause it to contract very rapidly.

Be on the Lookout:

Inflation will ultimately have a huge impact on D&O, especially as it pertains to rising interest rates. Many companies experiencing already thin margins or those that are excessively leveraged will find themselves in an unsustainable position after a refinance. A potential wave of bankruptcy filings in the coming 12 months would drive up D&O loss costs.

Employment Practices Liability Insurance (EPLI)

After several years of firming in the EPLI market, it is now flat to softening. Retentions at renewal are generally the same, but renewal premiums can often be had at around 10% less than expiring. Direct markets are being more aggressive. We are also seeing markets that were conservative on wage and hour coverage loosen up, and those that might have offered lower sublimits are increasing those sublimits where it makes underwriting sense. However, the market is becoming more sophisticated, with risks seeing separate retentions for certain states, high wage earners or for multi-plaintiff/mass-class to manage severity, which is now creeping into this line of coverage.

After adding restrictions throughout the pandemic, underwriters are now open to broadening coverage by offering enhancements when asked. California continues to be of concern – higher limits are difficult to obtain, and high retentions remain. We expect the rate to continue to soften slightly, but not at the same pace as other lines.

Lawyers Professional Liability

In the small firm segment (fewer than 10 attorneys), we are seeing new capacity entering, especially through fronts/hybrid fronts. Many existing non-admitted carriers are now also entering the admitted market. There is also extreme price sensitivity, with a 2% to 5% renewal rate increase the highest likely attainable before an account will shop.

The market for mid-size firms (11-100 attorneys) is experiencing reinvigorated competition, with markets stretching appetites and guidelines to gain access to more opportunities. Facing year-end production pressure, many underwriters are quoting under expiring premium on new business submissions and are more willing to quote the entire $5M primary layer to secure 100% of the quoted premium.

For law firms with 100+ attorneys, the market is experiencing rate adjustments that fall between zero to +5% on a per-attorney rate basis for accounts with good loss experience. For accounts with claims, especially severity-driven, rate increases are in excess of 7.5%, although underwriters are willing to soften rate increases with larger self-insured retentions. There are fewer carriers that will consider offering primary capacity in this segment. Carriers that are quoting this business are providing capacity between $7.5M and $10M, usually with the capacity split between primary and excess.

Underwriters for all sized law firms continue to be concerned with firms that have large trust and estate practices because of the amount of work being done for an aging baby boomer generation. They have also expressed concern over the use of AI due to the potential for inaccuracies, although it is too soon to say what impact AI may have on claims experience.

Media Liability

Market conditions are stable in media liability. There are some new markets that have launched and created new capacity in the last year, offering both occurrence-based and claims-made forms. However, with the recent SAG and WGA strikes, overall submission flow for individual video and film producer E&O policies is down, while smaller, non-union “indie” films are still coming through the pipeline.

There are also some recent court cases worth noting for their potential impact on the market. First, in the wake of the Dominion Voting Systems vs. Fox News Network settlement, coupled with the upcoming 2024 election, we have seen an influx of submissions related to coverage for “political” content, with anything related to politics being scrutinized by insurance underwriters. Second, following two separate and unrelated trademark-related court judgments involving Jack Daniel’s (Spirits Manfucturer) in one case and Andy Warhol Foundation in another, reliance on “fair use” as a defense against claims going forward will be affected.

London & Bermuda

Softening of the D&O market has continued in the London and Bermuda markets as well. Capacity remains plentiful and, in an effort to capture market share, the newer entrants continue to aggressively price risks and broaden coverage in some areas. These are largely excess players, but we are seeing some rolling out primary forms. Lack of activity in the IPO, SPAC, De-SPAC arena has caused certain markets to chase opportunities further downstream than where they had been focused in the past 12 months.

Within the primary layer, we are seeing most carriers offering decreases from 5% to 20%, unless there are exposure-based reasons for maintaining rate. While London is not seeing any major changes to policy exclusions, the steady number of claims that are in the pipeline could be a factor in how the market develops over the next few years.

Cyber

See special section of this report.

Select image to view larger

Insight provided by:

- D&O –

- Seth Brickman, CPCU, RPLU, Managing Director, Business Risk Partners

- Michael Gautreaux, VP, Amwins Brokerage

- EPL –

- Joe Robuck, EVP, Amwins Brokerage

- Lilit Jragatsbanian, AVP, Amwins Brokerage

- Kirsty Mitchell, Divisional Director, Amwins Global Risks

- Lawyers –

- Bill Schmitt, SVP, Amwins Brokerage

- David Collins, Esq., SVP, Amwins Program Underwriters

- Matt Glasgow, Amwins Global Risks

- Media Liability –

- Jeremy Huang, SVP, Amwins Brokerage

- London & Bermuda –

- Oliver Doran, Divisional Director, Amwins Global Risks

Reinsurance

Property

While there have been no dramatic market changes since our last report, there has been some overall moderation in treaty reinsurance renewals and facultative buying. Rate increases have continued in property, but there are signs that the market may be softening in some specific classes and geographies.

Treaty renewals from July 1, 2023, were less contentious than previous cycles, and most accounts could be completed with available capacity, except for higher limits that are no longer available at discount prices. July 1 renewals were also much more organized and orderly, with fewer private placements and improved timing and concurrence around terms and conditions. Additionally, we have seen new capacity come into the market from London and, particularly, Bermuda, seeking opportunity in the current rate environment.

Facultative buying remains at unprecedented levels, with reinsurers offering capacity as long as pricing parameters are met. The “rightsizing” of portfolios is almost complete, and there should be some semblance of stability going into 2024.

Carrier retentions have increased, and most E&S carriers are deploying relatively small limits on most accounts, both to manage catastrophe (CAT) exposures and to protect balance sheets in an environment of extreme uncertainty. Despite the rate increases of the last four years, most reinsurers still view the current pricing on CAT property risks as insufficient, but additional increases going forward will likely be in the 10% to 20% range with exceptions noted in areas of greater exposure.

Facultative reinsurance premium volume has increased substantially, creating aggregate issues for several larger reinsurers, and leading them to be more particular on risk selection. This is especially related to exposures in Florida, the Gulf Coast and areas of serious convective storm potential.

Be on the Lookout:

Rather than accepting unfavorable terms, buyers are often electing to retain more risk—either through higher attachment points or retentions—particularly where lower-layer capacity is highly constrained and very expensive. As a result, primary markets will have results volatility in 2023 and 2024, likely necessitating further capital infusion.

Casualty

Capacity is available for casualty risks as new carriers and MGAs have entered the space. Reinsurers have pulled back slightly on GL due to the steep pricing declines of prior years; however, products liability remains soft as there has been an expansion of underwriting appetite. The question is, given the long-tail nature of this segment, how long new entrants can sustain their aggressive pricing. For now, it continues to be a buyers’ market.

In auto liability, primary rates have increased and excess layers that had been dropping off too quickly are beginning to firm. The tightening is very evident on tractor fleets and large commercial schedules. Accounts with deteriorating loss experience are also seeing double-digit rate increases and/or pullbacks.

Insight provided by:

- Rich DiClemente – President, Amwins Re

- Tim Graff – EVP, Amwins Access

- Lee Jon Ellis – Director, Binders, Amwins Global Risks

Construction

Overall Segment Trends

Across the construction industry, building is still going strong. However, we are starting to see some red flags. Clients are more cautious on new projects given the overall state of the economy and its impact on obtaining loans and meeting lender requirements and impacting the absorption rates on for-sale housing, resulting in construction slowing slightly as the segment assesses how interest rates will continue to progress. On the other hand, we still have not seen the full impact of the Infrastructure Investment and Jobs Act and Bipartisan Infrastructure Law, which may spur road, bridge and other infrastructure projects in the months ahead.

Inflation has impacted this space significantly by increasing overall project values, making it harder to find full capacity in an already difficult property market. Supply chain issues are still delaying projects, as are continued difficulties in obtaining certificates of occupation (COs) from municipalities. Brokers should consider the likelihood that an extension of terms may be needed in their market placement.

Builder’s Risk

Capacity and Pricing

There have been a few new entrants in the last nine to 12 months that are offering more competitive terms and conditions. While MGAs are being more selective on where this capacity is deployed, there is stabilization in All Other Peril (AOP) rates with ample capacity. For buyers, catastrophe (CAT) rates continue to see wide fluctuation depending on project nature and location.

CAT capacity, specifically in Florida, is much harder to come by post-Hurricane Ian. New York is difficult as well. There are still many markets unwilling to deploy their full capacity for Tier 1, so many projects have a sublimit for Named Windstorm (NWS), something we haven’t seen much of in the past. Cost will still be a driving factor in a client’s decision to buy full NWS limits or even place full limits without excess on top.

Wildfire business continues to see limited market capacity as well as higher rates and deductibles. Prequalification of wildfire-exposed projects before marketing will help, as will detailed wildfire mitigation plans. Renovation projects remain difficult, especially when existing structure values exceed the new work values.

Be careful of project length: projects exceeding 36-month terms with multiple carriers are typically seeing one or two markets not able to extend. Replacing capacity midterm is not easy, and new markets will often demand to begin rating back to the inception of the project. A 60-day pro-rata extension will save a lot of heartburn if an extension is needed down the line.

In the London market, pricing has been fairly flat. However, we are keeping an eye on how projected new capacity coming into the market in Q1 2024 will impact pricing, terms and conditions.

Be on the Lookout:

Sublimited NWS and higher water damage deductibles are becoming more commonplace and there are very few true project-specific markets. We have also seen some markets try to limit rectification coverage on certain types of insureds, albeit with limited success.

The economy and inflation will still be a factor in 2024, with construction spending projected to level out over the coming year and construction funding more difficult to obtain. There is also a significant amount of commercial office space available and, with large amounts of debt coming due on those properties in the next two years, owners will be faced with difficult decisions regarding those properties.

Casualty

Capacity and Pricing

There is ample capacity in both primary and excess for everything but the toughest risks (primarily demolition, curtain wall, foundation and scaffolding, and excess capacity on frame for-sale residential construction in CD states). In the primary GL and lead $5M excess space, clients will likely not see a big difference in renewal rates and pricing.

There is increased competition for excess layers between $5M and $10M, and towers of $50M or more should at worst see flat premiums. Even in New York, we are seeing stability on GL renewals and general competitiveness on the excess, with only New Jersey seeing developing losses lead to higher increases.

One potential area of future concern relates to increased jury awards for New York Labor Law claims. Clients should consider safety as priority number one to help keep their costs lower than their competition.

Another area of interest as we close out 2023 is the crane rental insurance market, which has traditionally been dominated by programs for Primary Casualty & Excess coverage. Now, with most programs operating as MGAs with limited exceptions, we anticipate continuous hardening of rates, further coverage limitations and reduced excess capacity in the coming year.

This constriction in the market has resulted in GL and auto rate increases of 8% to 10%. Excess markets are seeing increases of 15% to 18%, with only a few taking opportunistic positions higher up in the excess tower.

At the same time, inflation continues to impact underwriting and claims expenses, while social inflation is driving large verdicts across Texas, Florida, California, New York and Washington – all resulting in additional rate pressure.

Limitations and Exclusions

In this competitive market, few new limitations or exclusions are being applied. The exception is exclusionary language for per and polyfluoroalkyl substances (PFAS), which is becoming a common exclusion across several lines of business. It can also be challenging to secure project business extensions and damage to your project during the course of construction coverage but, in this competitive market, both can generally be obtained from a broker with strong market access and underwriting relationships.

Be on the Lookout:

The trend towards aberration verdicts (nuclear verdicts of more than $10M) continues, as well as an uptick in overall claims frequency. Therefore, GL pricing could certainly see some firming in 2024, and the current softening environment in excess could be shorter-lived than hoped.

Insight provided by:

Property

- Tina LaRocca – EVP, Amwins Brokerage

- Brooke Ledbetter – VP, Amwins Brokerage

- Kerry Pecora – Senior Underwriter, Amwins Specialty Risk Underwriters

Casualty

- Gary Ricker – EVP, Amwins Brokerage

- Jett Abramson – EVP, Amwins Brokerage

- Scott Jensen – EVP, Amwins Brokerage

- Chris Bradley – RPLU, VP, Amwins Brokerage

Professional Risk

- Kevin Healey – MBA, SVP, Amwins Brokerage

London

- Gary Keenan – Managing Director, Construction, Amwins Global Risks

Energy

Overall Segment Trends

This summer, news of extended production cuts by Saudi Arabia and Russia, as well as an attack on key Russian oil export hubs by Ukraine and ongoing sanctions against Russia, kept oil prices high. Combined with a growing backlash against green energy and overall losses within the sector tied to costs of energy transition, it’s not surprising that U.S. pricing trends continue to push upward.

Pricing and Capacity

Downstream

Attritional losses have continued to increase as a result of higher mechanical losses from higher utilization rates, while extensive outages caused by supply chain issues and higher business interruption exposure resulted in shock losses across the U.S. In Texas, severe convective storm events have resulted in losses of more than $180M.

Inflation and supply chain issues continue to impact the industry due to higher payrolls, with loss settlements reported at above value for both physical damage and business interruption. Most insureds are facing rate increase of 5% to 10%, combined with continued pressure to increase values depending on timing of past valuations.

Premium increases for non-loss/non-cat accounts are running from 7.5% to 12.5%, while loss affected accounts are seeing increases of at least 10% to 30%, combined with coverage and deductible changes.

Natural catastrophe reinsurance saw the most change this year, with reported increases in retentions and rate increases of 30% to 60%. This severe change in the amount and cost of capacity adds to the overall cost of premiums and insurers continue to pass along these costs and reduce natural catastrophe limits.

Mid-Stream

Every sector of the energy market is being impacted by social inflation, with claims costs and verdict awards increasing exponentially. The median jury award from 2010-2019 was $24.6M.

For mid-stream energy, however, the biggest impact on the market has been the uptick in claims – most coming from liquid pipe incidents. A recent pipe run release claim came in at $35M while a case against an insured for an explosion resulting in a fatality will likely be settled for close to $100M. As a result, we are seeing most master service agreements (MSAs) include requirements for subcontractors to carry higher amounts of coverage.

Capacity remains available, with new entrants looking to make a splash in the sector. However, this additional capacity has not impacted rates favorably. Accounts with no losses are seeing increases of at least 10% while insureds with minimal claims exposure are facing increases of up to 20%.

Upstream

There has been a slow progression of rate increases in the upstream sector over the past several years. While it’s still too early to tell what the next six to 12 months hold, underwriters have begun to talk about narrowing coverage and moving away from bespoke wordings – both potential signs of a hard market.

Insureds are facing intense underwriting scrutiny overall, with underwriters looking for integrated loss prevention measures and increasing their use of modeling to establish limits. Quotes that used to come in days can now take weeks and are often accompanied by multiple requests for information, site visits and adequate valuations. With no recent major departures from the upstream market, capacity is still available with some carriers looking to grow their upstream business. At the same time, we continue to see new MGAs enter the casualty space. The upstream market for casualty has become very difficult.

London

Inflation remains a concern and is impacting the market in multiple ways. The cost to repair or replace items has only increased, making claims more expensive to pay across all classes, and the rise in aberration verdicts (awards of more than $10 million) is impacting casualty rates. Most first-party upstream accounts are seeing rate increases in the single digits with higher exposure accounts receiving increases that are slightly greater. The casualty market continues to broadly see rates approximately 10% higher, while downstream rates are still rising but averaging anywhere from 5% to 15%.

London capacity remains stable and isn’t expected to fluctuate greatly in the near future, although we expect to see modest expansion as new players enter the market. Conversely, we have begun to see market leaders walk away from individual accounts where risk management standards have slipped or have not been maintained at a respectable level and, as a result of treaty restrictions, there is less natural catastrophe capacity available than there was 12 months ago.

PFAS, or forever chemicals, and climate change exclusions have become the norm within the London casualty market over the past 12 months. Underwriters are also now including an Excluded Territories Clause (Russia, Ukraine and Belarus). ESG, however, has not had a measurable impact on the market to date. While many companies have voiced their commitment to reducing carbon emissions and are intent to serve as stewards of the environment, there has not been a major shift away from the use of oil and gas. Until there is, we don’t expect ESG to affect market outcomes greatly. Overall, the market continues to recover from the tightening we saw four years ago.

Be on the Lookout:

Underwriters continue to emphasize the importance of providing precise asset valuations, especially in light of the current global inflation rates. Markets will continue to push rates higher to keep pace with loss trends. Valuations should increase from the previous years and result in increased premiums, potentially easing the need for rate increases. However, markets will continue to keep pace with loss trends.

You can learn more about general market conditions, trends and risks in our recent State of the Market: A Focus on the Energy Market.

Insight provided by:

- Ben Abernathy – VP, Amwins Brokerage

- Rob Battenfield – EVP, Amwins Brokerage

- Craig Dunn – EVP, Amwins Brokerage

- Johnny Hilliard – Divisional Director, Amwins Global Risks

- Samuel Outram – Divisional Director, Amwins Global Risks

Environmental

Overall Segment Trends

Business written with environmental carriers continues to grow at 25+% annually due to a combination of factors. There is increasing awareness of environmental exposures, driven by media coverage of pollution accidents, PFAS (per and polyfluoroalkyl substances) lawsuits and EPA enforcement. Additionally, companies are dealing with more contractual clauses requiring environmental coverage, including Contractors’ Pollution Liability (CPL) and Owner’s Protective Professional Indemnity (OPPI) as well as Pollution Legal Liability (PLL) or what is commonly referred to as Site Pollution.

Some of the big growth classes are renewable/alternative energy, energy-related contracting, and manufacturing/distribution. We have also seen growth for most commercial contractors and some residential contactors. Combined with increased buyer interest in the coverage, there continues to be expansion of appetite from environmental carriers writing combined form GL/CPL into additional market classes. Historically, the marketplace would only offer combined form for environmental contractors or consultants.

Coal remains a difficult class to insure as many markets have stopped writing it due to environmental, social and governance (ESG) concerns. Within oil and gas there have been several high-profile losses that have constrained appetites in certain classes as well. However, coverage is still available in these segments through brokers with market access and underwriting relationships.

Capacity and Pricing

Environmental is seeing different renewal pricing conditions depending on line of business and/or industry sector. PLL and CPL have both been flat, while primary layers in combined form GL/Pollution have been flat to +5%. In contrast, excess layers have seen a 5% to 15% increase, with the higher end applying to auto fleets with pollution exposure.

There have been several new entrants into the marketplace, with a few more gearing up to write business in Q4 2023 and beyond. Currently, there are more than 40 environmental insurance divisions in the U.S. market, with capacity exceeding $300M. London can also provide additional capacity, which can bring total limits to $500M depending on operations/class of business.

Three segments are worth noting for a significant expansion of underwriting appetite. In energy-related contracting, many environmental markets will now offer unsupported excess over primary forms that offer GL with sudden and accidental pollution. In manufacturing/distribution, the environmental market historically would write a combined form offering GL, Products Pollution, PLL and Transportation Pollution for chemical manufacturers and tank manufacturers; however, the appetite for this product has expanded tremendously to offer a competitive combined from on almost any type of operation. And in construction, the combined form marketplace has changed tremendously over the last few years, now offering a combined GL/CPL form for most contracting classes, along with follow-form excess.

In London, there has been one new entrant into the market this year providing extremely competitive rates. However, overall, the London environmental market remains stable both from a capacity standpoint and pricing on new business. Renewal pricing is also stable, with carriers looking for mainly inflationary increases.

Limitations and Exclusions

PFAS exclusions are becoming the new standard for risks that have any exposure, with more than 6,400 lawsuits against manufacturers that used PFAS in their products filed to date. If an insured can show they don’t have exposure to PFAS, coverage is still available.

There are creative ways to encapsulate known exposure for companies that used PFAS in their product, and a few markets are willing to offer multiyear products coverage for historical PFAS exposure. However, coverage is expensive. For example, we have seen a carrier write a three-year policy with a $5M limit, 1M retention and guaranteed one-year extension if there were no claims. The premium was $1.2M, with $900K for the additional year.

Be on the Lookout:

The EPA is still working to define acceptable levels of PFAS and once finalized, this will lead to required cleanup efforts that will boost business in the environmental consulting/contracting industry.

Social factors continue to impact the environmental market as well. The EPA has continued to push for cleanups in low income/disadvantaged communities via its Environmental Justice initiative, leading to fines and scrutiny of industries in these communities. And non-governmental organizations (NGOs)—often supported by litigation funding—are filing more and more lawsuits against alleged “polluters.”

Insight provided by:

- Daniel Drennan – VP, Amwins Brokerage

- Tom Graham – Director, Casualty, Amwins Global Risks

Healthcare

The healthcare market remains in a state of flux with some pockets seeing softening, while others face a hard market.

With a blurring of lines between some risk retention groups (RRGs) and commercial lines carriers, as well as a trend to define standard coverage vs. E&S, the healthcare marketplace has become difficult to navigate.

Overall Market Trends – Capacity and Pricing

For hospitals and health systems, 2022 was marked by rising operating expenses including increased labor costs (salaries and benefits) and coupled with inflation. In 2023, overall conditions appear to be stabilizing despite hospital operating margins remaining below historical levels.

Capacity remains available across the industry, both in the U.S. and in London, but carriers are being judicious and even cutting back in some areas like umbrella coverage. At the same time, underwriting focus has become more regional. Geographic areas that were once considered favorable venues are now seeing large jury verdicts. Underwriters have become more challenged as the litigation landscape has transformed in many states.

Social inflation has hit healthcare particularly hard (what was once a $150,000 claim has now doubled). Rates increases also vary by healthcare segment. For example, most allied health sectors are seeing flat or single-digit rate increases, while healthcare classes such as correctional facilities and foster care/adoption are facing much larger rates increases.

Notable Trends in Specific Segments

Long-Term Care and Senior Living Facilities

Long-term care and senior living facilities continue to face rising labor costs and staffing shortages, as well as an ongoing surge in professional liability claims as new employees are trained and experienced team members are stretched thin. The average claim is now approximately $250,000.

However, after significant rate increases in the past few years, we expect there will be some downward pressure in 2024 as carriers compete for more favorable business. Where double-digit increases were once the norm, entities with low loss ratios are now seeing single-digit increases (5% to 10%) and even decreases for those with no losses.

Attachments for these more attractive classes are also trending lower. What was a $100,000 retention last year, is now $50,000. Underwriting remains tight, however, and we expect it will stay that way as the cases filed during the past three years work their way through the court system. The full impact of the COVID-19 pandemic on loss runs has yet to be seen.

Facilities with less favorable loss ratios can continue to expect high attachment points, with an aggregate deductible or higher retention. And, regionally, we expect to see increased rates – up to 50% in some venues – to address the hard property market, especially in Southeast Florida and California.

Long-term care and senior living facilities should be prepared for higher property deductibles and coinsurance, particularly when they are wood frame construction and/or located in CAT prone areas. Proper valuations are a must for underwriters as material costs remain high.

Despite cash infusions from private equity companies, elder care and nursing homes remain a challenging industry. While capital improvements can immediately improve technology, operations and patient care, the fundamental question of prioritizing patients over profits is a cause for concern. Aggressive financial tactics used by PE firms may involve cutting services or staff to reduce expenses and increase profitability, which may lead to D&O and EPL claims. And, as a result, we have seen increased underwriting scrutiny of this class.

Non-emergency Medical Transport

In an effort to control non-emergency medical transport exposure (NEMT), carriers continue to limit specialty auto coverage. Monoline coverage is particularly difficult to obtain, especially when it comes to senior care, while Medicare and Medicaid-focused transportation options remain a particular challenge for home health care agencies.

The increased cost to repair vehicles has impacted the entire industry. And while claims history will always be a factor, it matters now more than ever. Carriers are being very selective about risk, so time is of the essence.

Submissions should be made 90 days in advance and insureds should be ready to answer questions about best practices and any existing or potential programs that may be implemented within the policy term that would alleviate potential for loss.

Be on the Lookout:

The economy continues to impact the market overall. In the past 12 months, we’ve seen a rise in the number of small healthcare entities that have gone out of business, resulting in an increase in the number of tail endorsements being written.

For more information on market trends and what to expect in the coming year, please see our recent State of the Market: A Focus on Healthcare.

Insight provided by:

- Philip Chester, CPCU, EVP, Amwins Brokerage

- Jordan Connelly, EVP, Amwins Brokerage

- Matt Glasgow, Divisional Director, Amwins Global Risks

- Iain Jeens, Associate Director, Amwins Global Risks

- Don Tejeski, EVP, Amwins Brokerage

- Yajaira Villegas, SVP, Amwins Program Underwriters

- Tim Walter, SVP, Amwins Specialty Casualty Solutions

- Matthew Wasta, FCAS, VP, Amwins Program Underwriters

Public Entity

Property Trends and Pricing

Public entities remain one of the more challenged classes when it comes to property coverage. We expect rates will continue to rise on primary coverage and markets will remain unwilling to quote or offer full capacity without significant deductible increases. Reinsurance treaty renewals are expected to be difficult as well. Underwriting will be thorough, with underwriters focused on adequate valuation rather than simply indexing values year over year. Risk managers must be able to detail the valuation process or be prepared for a margin clause.

There is limited excess capacity for severe convective storm exposures, which is of concern for this sector as public entities often have significant exposures in a small geographical area. Excess carriers are either seeking higher attachment points, requiring significant rate increases or both. For named windstorm (NWS) aggregates, we are seeing significant upward pricing pressure from markets, which will likely force public entities to purchase less NWS limit then they have in previous years. While a deceleration of rate increases in 2024 is hoped for, the extent to which that will happen—if at all—will be driven by geography and historical loss history.

Be on the Lookout:

It is becoming increasingly challenging to secure coverage in convective storm-prone areas, especially for higher layers. What used to be considered “sleep” insurance is now often the most difficult layer to complete, often requiring several additional markets, which creates added cost to a program.

Casualty Trends and Pricing

Public entity markets continue to effect limit compression to mitigate loss and overall portfolio volatility. Mature insurer and reinsurer participants are actively monitoring both venue and coverage-specific claim outcomes to inform capacity positions on offer alongside the firming of rates, albeit at a decelerated cadence compared to the prior two years. Structured solution alternatives are building momentum as middle ground offerings between risk transfer and self-insurance.

From a coverage perspective, Law Enforcement Liability remains a focal point in the underwriting process for municipalities due to heightened media attention and civil unrest statistics.

Cyber Liability continues to be a troublesome area for public entities, especially for higher education and healthcare related risks, although clients that have spent the last year improving cyber hygiene and cyber security are usually rewarded with flat renewal rates and increased sublimits. Watch for full cyber exclusions being pushed by some carriers in the excess and London markets.

For Public Officials Liability, Educators Legal Liability and Employment Practices Liability, capacity is available, and rates have remained fairly stable. However, retentions and pricing levels are significantly higher than in the private sector. Crime coverage with a Faithful Performance of Duty extension is becoming more difficult to secure as fewer carriers are willing to provide it.

Be on the Lookout:

Public entity risk managers and pool administrators can differentiate themselves by using strategies to control adverse loss outcomes through employment of data scientists, elevated claims communication and litigation management, deployment of technology tools in police departments aimed at identifying officers with a predisposition towards violating conduct standards, as well as legislative efforts to mitigate loss variability in non-tort protected venues.

London

London, European and International markets continue to look at Public Entity business as a core/long-term portion of its book. Amwins Global Risks’ growth in the sector over the last three years has doubled (the team now places $3.5B of aggregate in Public Entity space). Top markets have also seen growth in Public Entity business and continue to support this occupancy as key accounts.

We expect to see a consistent approach from underwriters when pricing these accounts in 2024. Rate increases during the last few quarters are likely to be greatly moderated for accounts with a favorable loss history. Accounts based in Florida could see a marginally higher increase (depending on the outcome of the upcoming treaty renewals).

With limited new capacity entering the London market, we expect existing syndicates will enter the occupancy while rates and deductible levels are favorable. At the same time, some current markets are looking to expand their lines moving into 2024.

Valuations are still very much in the spotlight and markets will be looking for clients to be able to demonstrate a consistent methodology on how they value their assets.

Bermuda

The appetite for public entity business remains strong in Bermuda and we expect that to continue into 2024. With an increasing number of markets willing to deploy limits lower in the tower, Bermuda has become a source of much needed capacity for this class, especially in cases where gaps in the tower need to be filled. Rate increases should also stabilize, but each case will be taken on its own merits.

Underwriters continue to be hawkish about exposures such as sexual abuse/misconduct and law enforcement liability, but will entertain these exposures if they are able to fully underwrite them, which is typically a function of the quality of the submission data – especially loss and exposure data.

Aggregation of limits continues to be an issue with markets increasingly looking to limit their downside. A single aggregate limit is preferred, although markets in Bermuda will offer multiple aggregates depending on the circumstances and quality of account and submission data.

Be on the Lookout:

Markets will seek the opportunity to meet with insureds to develop a better understanding of how the individuals at the “coal face” are managing these exposures. Underwriters are also increasingly looking to gain in-depth information on claims handling and the use of panel counsel.

Insight provided by:

- Brian Frost, EVP and National Public Entity Casualty Practice Leader

- Ed Fussell, Casualty Broker, Amwins Global Risks

- Ali Hoefle, AVP, Amwins Brokerage

- Darron Johnston, EVP and National Public Entity Property Practice Leader

- Stacy Kaplan, Chief Operating Officer, Amwins Specialty Casualty Solutions

- Stephen Knight, Head of Open Market, Amwins Global Risks

- Tom Whitehead, Director, Worldwide Property

- Dave Weller, EVP, Amwins Brokerage

- Alan Mooney, CEO, Amwins Bermuda

Real Estate

Property Segment Trends and Pricing

Given the 2023 hurricane season has concluded with no significant hurricane activity in the United States for the past three months and January 1, 2024 reinsurance renewals are generally anticipated to be much smoother as compared to January 1, 2023 reinsurance renewals, talk of rate increase moderation for 2024 has gained momentum with our carrier partners.

Each of the following additional factors below also point to rate increases of a smaller magnitude in many cases for 2024 when compared to the substantial rate increases experienced by so many insureds in 2023.

- Numerous new markets/MGAs have recently entered or will soon enter the space, representing increased capacity supply.

- Several of our carrier partners anticipate controlled line sizes increases in 2024, representing increased capacity supply.

- Over the past 60 days, we’ve begun to see over-subscription return to many midsize and large TIV accounts. With this comes placement leverage and cost improvement, as compared to instances when over-subscription does not exist.

- Over the past 60 days, we’ve noticed many carriers are engaging in more negotiation, rather than utilizing a “take-it-or-leave-it” approach.

- The overall stamp capacity of Lloyd’s syndicates will be 8% greater in 2024 as compared to 2023.

- Many MGAs are anticipating more PML available for deployment in 2024 as compared to what they had available in 2023.

- Many carriers have shifted from loss to profitability as evidenced by recent quarterly and annual results.

- Rate increase fatigue is at an all-time high as buyers have now experienced rate increases for four to five consecutive years.

Combined with an inflation rate that is still well above the Federal Reserve’s target, the highest Federal Funds rate in 22 years, large swaths of real estate debt maturing over the next two years that will be subject to refinance at much larger rates, a substantial amount of new apartment units recently hitting the market and flattening apartment rents as a result, and a mountain of investor/opportunistic cash waiting on the sidelines for interest rates to stabilize or as prices to decrease, the real estate industry overall is likely to remain fluid for the foreseeable future.

Carriers in general, and reinsurers behind the scenes, continue to be heavily focused on ensuring that proper valuation has been reported by each insured. Proper valuation of course is a continuously moving target, as is inflation, with many carriers/reinsurers stating that they will require upward valuation adjustments again in 2024 to account for inflation trends. Blanket limits will continue to be reserved for well valued accounts, while margin clauses, scheduled limits, coinsurance and/or actual cash value valuation should be anticipated for insured’s utilizing valuations which haven’t kept pace with carrier valuation requirements.

Casualty Trends and Pricing

Shock verdicts have gained traction in the last decade, with the median payouts

increasing by almost 28%. Up until this year, when the

Florida tort reform was enacted, the last big legislative change to make a similar impact was the Landowner Protection Act, introduced in Mississippi in 2019.

Governor Brian Kemp in Georgia has proposed similar legislative changes following Florida’s ruling in an effort to level the playing field in the courtrooms and cut insurance premiums. And while we don’t expect it will take another five years for real change, we do expect to see a rush of lawsuit filings ahead of any new legislation being passed.

Professional Lines Trends and Pricing

In the last three years, we have seen the market soften and that trend appears as if it won’t be changing any time soon. Average (and minimum) premiums are down year over year, with retentions reaching historic lows, and it is an opportunistic time for first time buyers or insureds with general partnership exposure who continue to purchase traditional private D&O policies.

Current market conditions have been driven in part by property investments performing relatively well (no doubt helped by the low interest environment we saw prior to the first Fed rate hike in March 2022), which in turn has resulted in fewer losses. At the same time, we have seen new carriers entering the market looking to write attractive business, but also creating an oversupply of limit capacity in the real estate-oriented management liability marketplace.

For now, the laws of supply and demand seem to suggest the soft market is here to stay. But with interest rates continuing to rise and large chunks of real estate debt maturing in the next two years, the loss picture could change the marketplace materially and in turn influence market conditions.

London

While London is still a strong player in the primary market, there has been a considerable increase in appetite for the excess space with a 55% GWP increase year on year. Heading into 2024, we expect to see a consistent approach from underwriters when pricing these accounts.

Rate increases seen during last few quarters are likely to be greatly moderated for accounts with a favorable loss history. Accounts based in Florida could see a marginally higher increase (depending on the outcome of the upcoming treaty renewals).

With limited new capacity entering the London market, we are seeing existing syndicates enter the occupancy while rates and deductible levels are favorable. At the same time, some current markets are looking to expand their lines moving into 2024.

Valuations are still very much in spotlight and markets will be looking for clients to be able to demonstrate a consistent methodology on how they value their assets.

Be on the Lookout:

Property insurance pricing for real estate accounts has reached a point where certain sophisticated insureds (either with strong balance sheets or unincumbered assets) have chosen to self-insure portions of primary or buffer layers (via captives generally), have moved to a named storm sublimit (from full limits), or have chosen to exclude named storm coverage altogether.

For accounts that receive non-renewals from their incumbent admitted/standard market and when an alternative admitted/standard market solution isn’t available, upward rate movement may be substantial while at the same time the combination of deductibles, terms and conditions are likely to tighten.

The potential impact of insurer and reinsurer implementation of RMS 23 remains to be seen. According to the reinsurance marketplace, RMS 23 is taking portfolios into account and looking at the geographic spread of risk within that portfolio. However, there have been reports of meaningful PML increases specific to certain Florida and Texas exposures. The percentage of said increases is still unknown and will ultimately vary by carrier based on their book of business.

You can learn more about general market conditions, trends and risks in our recent State of the Market Report: Real Estate.

Insight Provided By

- Bob Black, EVP and National Real Estate Practice Leader Amwins Brokerage

- Corey Allison, EVP and National Real Estate Practice Leader Amwins Brokerage

- Craig Dunn, EVP Amwins Brokerage

- Warren Hills, Director Amwins Global Risks

- Richard Minor, VP Amwins Brokerage

- Mel Seamster, VP Amwins Special Risk Underwriters

- Matt Sheehan, EVP Amwins Brokerage

- Johnny Tolland, EVP and Florida Property Practice Leader Amwins Brokerage

Transportation

Overall Segment Trends

Transportation is a segment under pressure, squeezed by high input prices and lower freight rates. As a result of economic stress points, some trucking companies are downsizing while others are selling to competitors or ceasing operations altogether. Meanwhile, there has been significant disruption in the insurance market over the last few months, including in the waste hauler and restaurant delivery spaces, with several carriers dropping out or tightening underwriting.

Overall, the segment remains unprofitable for insurers despite several cycles of rate hikes. As we head into 2024, retailers need to continue to educate their clients on underlying economics of why they will likely continue to see rate increases.

Primary Auto

There is good news in this market for accounts with favorable experience, where primary auto renewal pricing is typically flat to a 5% increase on renewal, in contrast to larger jumps in past renewal cycles. Primary insurers are also taking an increasingly proactive approach to underwriting, looking to partner with insureds that want to prevent claims, rather than simply defend them. Distressed risks, however, are likely to see double-digit rate increases. An exception to that trend comes from new entries into the distressed market that are offering aggressive pricing to target what they perceive to be the low-hanging fruit in this segment.

As insurance carriers deal with claims involving passengers in the cab, expect more stringent review of driver policies. Insurers are also adding PFAS (per and polyfluoroalkyl substances) exclusions. More markets are leveraging telematics technology during the policy period, and retailers can expect to field inquiries from clients around both obtaining and deploying this technology. Markets are also using electronic logging device (ELD) information to make sure the insured is rated properly and to better assess the risk based on drivers’ habits and routes.

Excess Auto

Capacity is in flux in the excess space, with notable exits and changes in appetite creating potential gaps in capacity. Carriers are requesting higher attachment points, offering lower limits and charging higher premiums. Some additional capacity has come in from new markets in small/mid-size fleet and on a lead basis, as well as in the high excess ($30M+) arena. In response to the challenging excess market, motor

carriers with financial stability are self-insuring layers and accepting higher deductibles while brokers are engaging new markets and structures to replace exiting capacity.

Auto Physical Damage

In the Auto Physical Damage space, there are fewer monoline players than in prior years. Those that are still writing the coverage continue to seek higher rates and tighter terms. Inflation is having a significant impact on physical damage claims, affecting the repair and replacement costs for vehicles (and the value of cargo). One bright spot for clients is that fleet values are coming down as supply chain issues that had caused delays in parts and equipment have lessened.

Motor Truck Cargo

In the Motor Truck Cargo space, capacity is strong, with a few new entrants into the market. However, Trailer Interchange is being scrutinized closely given high losses. We are seeing more requests for Employee Dishonesty coverage to be included, as well as requests for towing coverage under Motor Truck Cargo to supplement towing costs when there is a trailer interchange claim.

London

London is seeing more distressed commodity classes, while admitted markets continue to write cleaner accounts. Although physical damage costs continue to climb, at present London underwriters are still not increasing their premiums to reflect these increased costs.

A point of complexity in the London market involves the driver criteria endorsement. The form was initially intended to provide a safety coverage for drivers that were not included within the initial policy. Unfortunately, may different versions within London exist, all with a similar premise, but each with subtle differences that often lead to confusion. Review these forms carefully and attempt to remove the driver criteria completely if possible.

Be on the Lookout:

There are many factors that will continue to evolve over 2024 that retailers should be prepared for. The market is going to be continually asked for harder-to-place commodities such as auto, boat and mobile home haulers.

The transportation industry is also becoming more vulnerable to the threat of cyber-attacks, and retailers will succeed in areas where they can help protect clients from any breaches or attacks on their data.

- Matt Andrews, Managing Director, Amwins Program Underwriters

- Dave Brost, AVP, Amwins Brokerage

- Stephen Carter, Associate Director, Amwins Global Risks

- Tanya Holman, TRS, EVP, Amwins Transportation Underwriters

- Lauren Kleppetsch, VP, Amwins Brokerage

- Sean Oliver, Director, Amwins Global Risks

- Bryan Touchstone, EVP, Amwins Brokerage

Special Features

Cannabis

Overall Trends

The cannabis insurance market has undergone notable transformations and shifts in recent years. As the sector continues to develop, insurance providers are refining their offerings to meet the unique needs and challenges being presented.

One of the newer developments within the cannabis market is the availability of true product recall coverage. Up until now, many cannabis liability and MGA package markets only offered a small sublimit of product recall expense coverage, leaving cannabis businesses exposed. This new coverage is a meaningful enhancement available on a monoline basis. It extends coverage for a broad list of event triggers and covered losses, helping cannabis businesses looking to protect their bottom line as well as any potential reputational risk associated with a recall of defective products.

With more states opening up, carriers have become more competitive in the cannabis space. As a result, underwriters are loosening their appetites for specific classes and offering more flexible terms and limits. Price compression remains and continues to affect the oldest and most established markets in the West. There has been increased submission activity from the northeast corner of the country in states like New York and New Jersey, but Massachusetts being the oldest recreational market in the East continues to struggle with the likes of California, Washington, Oregon and Colorado. With all these new markets, pricing in the cannabis industry can still be primarily attributed to oversupply.

Many carriers continue to exclude cannabis synthetics (of which delta-8 is considered) from policies due to how these compounds are manufactured. From an insurance standpoint, brokers should understand the difference between delta-8, CBD and other Farm Bill compliant cannabinoids. Doing so ensures they are offering the right coverage, as the regulatory oversight and stringent testing that should be taking place in the industry often is not.

Capacity and Pricing

Overall, we expect cannabis property rates to level off and slowly decline over the next few years – except in California where taxation rate remains an issue and, in turn, is keeping the illicit market more relevant and driving up rates.

From a general capacity standpoint, more carriers are entering the cannabis space – however, many remain unwilling to write monoline property or excess. As a result, newer MGAs are targeting small to mid-sized operators in a more standard and transactional underwriting style that has begun eroding pricing for larger operators that are struggling for capacity on property.

Currently, most major cannabis programs offer at least $20 to $25 million per location. A select few have secured reinsurance over time and can offer $40 to $45 million; however, there may be tradeoffs with these higher coverage limits, such as gaps in coverage or unfavorable coverages elsewhere.

Protective Safeguard Endorsements

Extraction and cultivation claims have increased due to indoor lighting losses, resulting in more carriers tightening their underwriting terms in an effort to push for 100% LED lighting. Accounts operating with volatile lighting such as high-pressure sodium (HPS) and metal halide grow lights will experience higher rates and potential exclusion of loss or damage caused by smoke or fire.

At the same time, most markets are also requiring protective safeguards endorsements be included in policies to protect carriers in the event of a fire claim. For example, some carriers are requiring hardwired smoke detectors and automatic fire suppression systems – without them, coverage is excluded.

Property

Wildfire and other extreme weather-related events continue to threaten cannabis operations. This has underwriters reexamining their property protection class codes and making changes based on the increased risk exposure.

Crime also continues to be an issue of concern for underwriters, with cannabis operations located in high crime-exposed areas seeing an increase in rates and additional protective safeguards warranty exclusions, including requirements for automatic burglar alarms and security services that patrol the premises hourly when not in operation.

Be on the Lookout:

Cannabis-specific insurers continue to struggle with the lack of strict state laws surrounding protections or legality in terms of hemp derived cannabinoids, leaving them open to tougher claim scenarios. At the same time, product liability claims and large lawsuits have increased, due primarily to false or misleading product labels.

As states continue to make the decision to legalize cannabis, the market will continue to grow and face many new challenges as the industry establishes itself.

You can learn more about general market conditions, trends and risks in our recent State of the Market Report: A Focus on the Cannabis Market.

Insight provided by:

- Norman Ives, EVP, Amwins Brokerage

- Morgan Moore, EVP, Amwins Brokerage

- Brian Savitch, EVP, Amwins Brokerage

- Jeff Katz, VP, Amwins Brokerage

- John Deneen, Program Manager, Amwins Program Underwriters

- Pierre Cabrera, AV,P Amwins Program Underwriters

- Chris Brown, Senior Associate Broker, Amwins Brokerage

Cyber

Overall Segment Trends

Cyber placements continue to become more competitive, challenging incumbents and rewarding insureds that have increased their security posture with multifactor authentication (MFA), endpoint detection and response (EDR), and segregated backups.

With that said, we have seen an increase in threat actors, particularly those that take advantage of business email compromise and ransomware. We’ve also seen an increased number of attacks based on either a group trying to further their own social agenda or a group trying to fight the agenda of a policy or group they don't agree with. And, because of the number of different motivating factors for these attacks, they can be harder to protect against.

Despite the improvement in controls overall, threat actors are continuing to find more innovative techniques to get around them. Human error is particularly one exposure that will never go away, as we saw in the recent MGM breach. Allegedly, all it took was a 15-minute call and a quick LinkedIn search for the attackers to gain access to the organization’s help desk.

You can read more about current market trends in our recent report: Competitive Cyber Market Expected to Continue.

Pricing and Capacity

The cyber market remains very competitive – a stark contrast from the hard market conditions of 2020 to late 2022. We have seen a steady recovery with new entrants increasing capacity and existing carriers displaying a willingness to deploy limit – the majority of underwriters are capping capacity at $10M.

Renewal rates have decreased significantly, and some companies are eliminating sublimits and coinsurance on ransomware coverage which was common on cyber policies during the hard market cycle. This softer rate environment sees markets looking to make up that business with increased market share.

Insureds have seen decreases in premiums of 30% or more (especially in the larger space), as well as enhancements to coverage for social engineering. Where before most markets limited this coverage to $250,000, $500,000 to $1M sublimits are no longer as rare.

That being said, the underwriting community has indicated that these rate decreases will not continue in the long term. Ransomware losses are increasing, social engineering losses never stopped and emerging perils like Pixel claims are driving new losses. There are many signs that the floor is rapidly approaching.

Ransomware Attacks

After a brief reprieve in attacks, we have seen a surge in ransomware claims as well as an uptick in payments. Chainanlysis recently reported that victims paid ransomware groups $449M in the first six months of 2023. 1 We have also seen an increase in “double extortion” attacks wherein threat actors exfiltrate data in addition to extorting access to a network, causing more companies to pay the ransom in order to prevent data from being released.

Underwriters are continuing to look for effective environment monitoring and threat detection, combined with a good business continuity process. MFA and EDR continue to be a sticking point. And we expect to see most limitations and exclusions relate to specific infrastructure events and cyber terrorism, both of which are generally viewed as rare occurrences.

Challenges

There is growing concern around systemic risk or catastrophic risk within the cyber sector. While there have been some major incidents affecting insureds worldwide, from a full market perspective many believe we have not yet seen a “one-in-a-hundred” year event. These types of events – such as major hurricanes or tsunamis – have defined the property market and capacity over decades; but with cyber as a relatively nascent coverage in comparison, many speculators feel that while an event of such magnitude has not yet occurred, one could be on the horizon.

Rising geopolitical tensions, ongoing wars/armed conflicts, and continued reliance on technology create scary potential for a systemic cyber event affecting companies worldwide. The eventual size and scope of such an event is still being debated, with some naysayers suggesting a global outage of a major cloud service being unlikely due to the vast number of data centers globally. Others are citing the fact that cyber incidents can be mitigated or fought in real-time, potentially minimizing damage in a more impactful way. Nevertheless, underwriters are looking to policy language to ensure the stability of their books should such an event occur.

Similarly, insurers are concerned about the growing potential for cyber incidents as a result of cyber warfare. As a result, many believe there is a need to compartmentalize and potentially exclude coverage for risk arising out of direct, warlike conflict and/or outright war. The Lloyd’s Market Association was one of the first to share suggested war exclusion wording for cyber policies, but we are now seeing many domestic U.S. insurers follow suit.