Hail can fall just about anywhere, at any time throughout our country – although it is more prominent in "Hail Alley," where Colorado, Nebraska, and Wyoming meet. Unless 100% of an auto dealer’s inventory is stored indoors, it is susceptible to hail-related loss. With 17,000 franchised auto dealers and 45,000 independent used-car dealerships in the U.S., that’s a great deal of assets vulnerable to the elements.

Most automotive analysts are cautiously optimistic that U.S. vehicle sales will return to some form of normalcy in 2021. While demand and pricing remain high, shortages in computer chips have curtailed much of the expected growth in 2021. This forecast means that it is even more important that your auto dealer clients are versed in how to protect their lots from hailstorms and the necessary steps to ensure an efficient claims process. Timely settlements and the ability to quickly repair or sell damaged or partially repaired units has become critical to dealers.

Three Hot Topics Circulating the Dealers Open Lot (DOL) Market

The DOL market is constantly evolving. Deductibles and aggregates that were available a few years ago are no longer in play. With more “skin in the game,” how can auto dealers effectively mitigate weather losses, including hail? Below are some hot topics as it relates to hail coverage.

1. Several regional carriers and direct writers of hail coverage are exiting the market.

Claims payments based on archaic adjustments often exceed the actual loss sustained by several hundred percent. Many insureds have said “Enough!” The solution lies in accurate adjustments. The remaining insurance programs and carriers understand and have adopted new adjusting processes.

2. Aggregate deductibles on large exposures are becoming increasingly harder to find.

Ten years ago, an auto dealer could secure deductibles of $1,000 per unit capped at $25,000 almost anywhere in the United States. Today, CAT-prone states command deductibles of $2,500 per unit without an aggregate in most cases.

3. While rates have somewhat settled in early 2021, terms may vary so read carefully.

It is important to understand the terms of coverage in any policy, as well as who will be adjusting for losses. As fewer and fewer providers are willing to write hail coverage, those that remain are much less likely to offer the low deductibles and aggregates that prevailed even five years ago. Most include reductions when paintless dent repair is utilized in an effort to get closer to the actual loss sustained. It is prudent to know if the insurance provider adjusts their own losses or uses a third party and what, if any, hail matrix they utilize.

Preparation Is Key to Help Mitigate Potential Loss

Projecting where hailstorms will hit

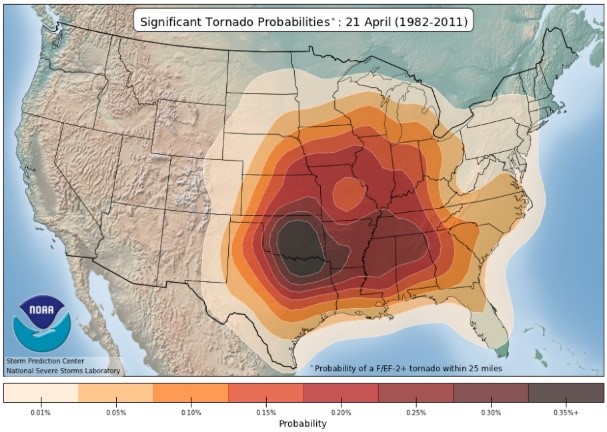

The National Oceanic and Atmospheric Administration’s (NOAA) National Storms Laboratory estimates the probability of hailstorms based on severe weather data collected over a 30-year period. The map below depicts the probability of hail ≥ .75” within a 25-mile radius. The NOAA Storm Prediction Center offers up to the date predictions on their website ( www.spc.noaa.gov).

Source: https://www.spc.noaa.gov/

Evaluating hail size

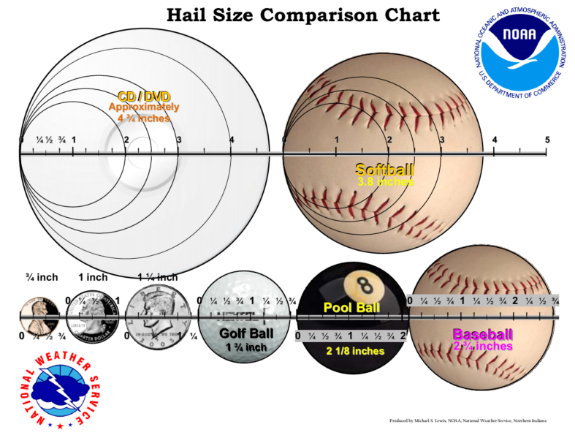

The NOAA’s hail size comparison chart shown below gives you a better frame of reference for evaluating hail size and its potential to do damage to your client’s inventory. Hail size is commonly measured with a ruler or compared to a common object. Many of us that experience a hailstorm tend to resort to the old “golf ball sized” comparison; however, it is important to the claims process to accurately report hail size.

Summary

Do not wait until a loss occurs to equip your clients with the resources needed to properly report a claim. Preparing your clients with tools to protect their assets and placing a keen eye on their policy language as it relates to hail-related damage is important during this time of year. Providing preparation checklists to your auto dealer clients will promote smooth claims reporting and ease the headaches for both parties. Consider sharing the NOAA’s Storm Prediction Center website ( www.spc.noaa.gov) with your insureds as a helpful resource.

Amwins Program Underwriters’ DealerGuard insurance program proactively offers its retail clients and their insureds loss-control recommendations and tools aimed at mitigating loss frequency and severity. By using the latest technology, DealerGuard alerts brokers in real-time when significant hail has fallen on one of their auto dealer accounts. As the only MGA in the space with over 30 years of internal claims handling experience, they have seen it all. Providing your insureds with checklists to prepare themselves pre- and post-hailstorm season can help protect their assets and ensure a smooth claims process should loss occur.