Amwins experts offer tips to obtain hard-to-get insurance coverage

Historically, wildfires have been considered a California-centric risk exposure and with good reason as the top 10 costliest wildfires in the United States have occurred in the state—eight within just the past five years, according to the Insurance Information Institute.

Wildfire risk exposure, however, is not limited to California. Forty-five of the 50 states have regions and counties that are subject to wildfires and states east of the Rockies such as Florida, Georgia, and Oklahoma are, perhaps surprisingly, at risk.

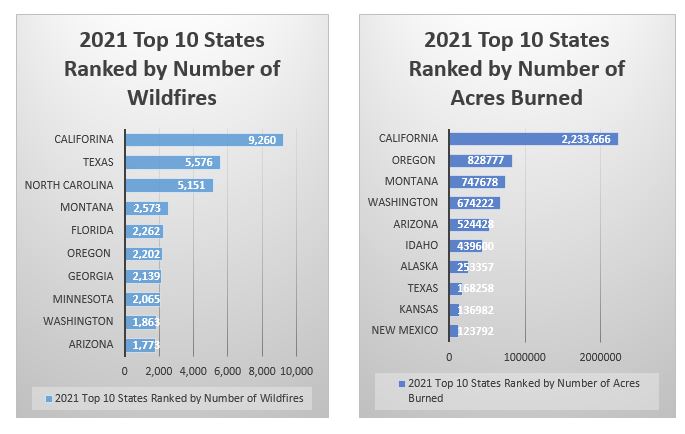

In 2021, more than 58,000 wildfires burned more than 7.1 million acres across the U.S., according to the National Interagency Fire Center (NIFC), and while California tops the lists for both number of fires and acres burned, it still only accounts for 15% of U.S. fires and 32% of acres lost, making wildfires an issue for insureds across the country.

Retail agents and brokers should set appropriate expectations with insureds about the current wildfire market and work with clients on risk management strategies, including fire prevention efforts, to help insureds get the coverage they need.

Current Wildfire Market

As climate change progressively alters the weather and human infrastructure increasingly encroaches on wildlife areas, the frequency and severity of wildfires are expected to rise—as are the costs of insuring property in the geographic regions with the highest risk exposures.

For three of the last four years, insured losses from wildfires in the U.S. have exceeded $13 billion, according to the National Centers for Environmental Information at the National Oceanic and Atmospheric Administration (NOAA).

As insurance losses mount exponentially for weather and climate disasters, insurers and reinsurers are re-evaluating their risk exposures in certain catastrophe prone markets and are limiting their capital deployment in those areas. This trend in reduced capacity is making it even more challenging to secure adequate wildfire coverage for insureds.

A large volume of wildfire exposed risks—everything from a single location to large shared and layered programs—are falling out of the standard market. Most markets that will consider wildfire risk have implemented wildfire risk score maximums, property limit maximums, and restrictions or exclusions on building or exposure type.

Many markets are offering as little as $1 million in property limits and most are capped at $2.5 million. Very few markets are offering more than $5 million property limits at any one location, and some markets can’t layer business. Insureds are likely to find it difficult to buy the same limits as their expiring policies, and in some zones, rates could be five to ten times what they were.

What Retail Agents and Brokers Can Do to Help

The best thing you can do for insureds in a market like this is to understand their specific and unique risks so you can present their submissions in the best possible light to underwriters. The following are tips from Amwins wildfire experts:

Use a wildfire score to understand the specific wildfire risk.

- Scoring tools are used to determine the likelihood that a fire will occur in a specific location, the likely fire behavior (intensity) and the potential damage a fire might cause.

- Generally, the measurements involved in scoring include information like distance from a fire hydrant or fire station, the elevation of the property (the steeper the slope, the faster the fire can spread and hotter it will be), the nearby vegetation that could serve as fuel (type of vegetation, density, distance from property) and the ease of access to and from the property for emergency vehicles.

- Because the measurements are static, make sure the score is pinpointed on a precise location. Wildfire scores can change significantly within a short range.

If available to you, use enhanced wildfire modeling.

- In the past few years, companies like AIR Worldwide (now Verisk) and Risk Management Solutions (RMS) have begun offering more comprehensive wildfire modeling that, in addition to traditional scoring factors, examines variables that impact fire ignition and spread, such as weather conditions, moisture levels, ember contribution and fire suppression.

- Amwins brokers can provide access to AIR models that estimate potential losses to both individual policies and entire portfolios of properties.

Consider standard fire suppression and mitigation tactics.

- Determine if the buildings are constructed with fire-resistant material.

- For buildings that are high risk, insureds should create defensible space in accordance with the guidelines from the National Fire Protection Association (NFPA). Proper vegetation management, including the removal of dead and dying trees and brush, is one of the most effective risk-management technique for combatting fires.

- Note the relationship with local fire authorities, how close the station is and how they work together on wildfire mitigation.

- Wherever available, recommend that homeowners apply to be part of a Firewise Community. These designated communities have official fire mitigation strategies applied collaboratively by neighbors.

Provide wildfire mitigation plans with submission.

- Include details about a risk mitigation plan and documented proof (i.e., photos) with a submission to help show underwriters that the wildfire risk is managed and, thus, lower than the scoring indicates.

Get creative about capacity.

- Break up coverages into different markets (example: cover stock with a stock throughput policy). Even if rates are similar, seeking coverage in a different market increases available capacity.

- Examine on a line-item basis what clients are obligated to insure. For example, they previously covered streets and sidewalks, but maybe this coverage isn’t necessary this year. Have this conversation early.

- If the insureds are eligible for a Fair Access to Insurance Requirements (FAIR) plan, they should apply for coverage. FAIR plans are unique to each state and provide basic fire insurance coverage for high-risk properties when traditional insurance companies will not. Currently, only five states that have wildfire exposures—California, New Mexico, Oregon, Texas and Washington—have a FAIR plan. This coverage can be used as an underlying layer before placing excess fire coverage.

- For multi-location schedules, consider putting the smaller buildings in the FAIR plan and placing the remaining risk elsewhere.

Takeaway

As the frequency and severity of natural disasters and severe weather increases, the ability to insure property in geographic regions with the highest risk exposures will likely continue to shrink.

To help insureds get the coverage they need, retail agents and brokers need to work collaboratively with their clients to understand their unique risk exposures and consider how mitigation and suppression strategies might make submissions more attractive to insurance underwriters.

Amwins expert brokers are your partners in providing insurance that best meets clients’ needs. Contact your broker today with questions about wildfire modeling and obtaining coverage for insureds in high-risk areas.