Intellectual Property - Q&A with Ellie Webb, Senior Underwriter at Tokio Marine Kiln, and Cam Meakin, Amwins Global Risks.

Helping our clients understand the need for coverage is a vital role we have as brokers; and one of the big questions around Intellectual Property insurance is why do we need it? The below Q&A explores some of the basics around Intellectual Property insurance and should help provide clarity to our clients when faced with uncertainty.

What does intellectual property mean to Tokio Marine Kiln?

The intellectual property ecosystem is vast, varied, complex and growing. However, put simply, IP rights confer immense economic value and are crucial to development worldwide.

They have fast become the most valuable asset for many businesses; 40 years ago, 83% of a typical S&P 500 company balance sheet would have been tangible assets, whereas in 2019 this figure was reported to be at only 12%, with the clear majority now intangible. In addition, a study of global supply chains a few years ago concluded that “intangible capital”, which included assets such as technology, designs, and branding, provides for 1/3 of value in all manufactured products, equating to roughly USD 5.7 trillion. Intellectual Property is fundamental to today’s world, and its importance is set to continue on an upwards trajectory.

What does your policy offer? And are there any limitations?

TMK’s IP insurance policy can provide businesses with the ability to withstand and defend itself against IP disputes, providing financial peace of mind and expertise in managing complex incidents. Policyholders can be indemnified for costs including:

- Legal fees and expenses – IP lawyers are very specialist and command high fees. Costs can rack up even if a dispute never makes it to court.

- Damages – Liability or damages can be significant should a court find the policyholder to be infringing third party IP rights.

- Product withdrawal - The cost of withdrawing any products from sale or the distribution chain, recovering possession and/or destruction.

What is the importance of a stand-alone IP policy as opposed to other insurance policies with silent or sub limited cover?

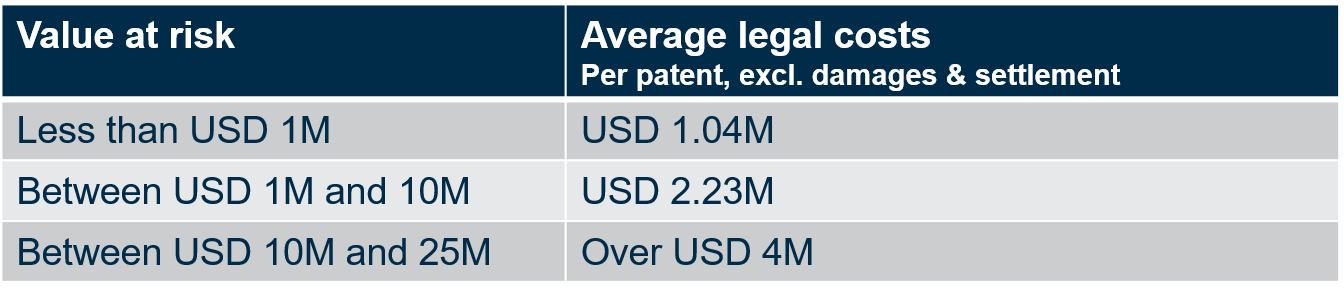

A degree of cover can sometimes be found under other insurance policies, but it is not sufficient and is increasingly being stripped out by carriers once the costs associated with IP litigation are realised. The below table highlights this; the statistics are from the AIPLA and are only for defence costs calculated per individual IP right, but bear in mind it is not uncommon for parties to bring entire portfolios of patents against defendants and that any settlement/damages will be in addition.

Key differences are that a standalone policy can provide cover for patent and trade secret disputes, which are often excluded under other policies but can be the most expensive and complex. Standalone policies also offer higher limits and are likely to have a much wider trigger/coverage. For example, a CGL may provide some cover for copyright and trademark claims, but in the US it will tend to only be related to advertising activities and not the products themselves.

Are you seeing any market trends that our clients should be aware of?

Across all industries we are seeing a growing recognition of IP responsibilities in the supply chain. This is leading to parties including strong requirements in respect of IP disputes in their contracts, demanding that suppliers provide indemnities should any of the goods be alleged to infringe third party IP rights. Clients should be thinking about how to quantify and monitor this type of contractual exposure that could be aggregating, and ensure it is managed effectively.

How has Covid-19 had an effect on intellectual property disputes? Here is a recent article which is relevant to the effects of Covid-19: IP Insurance Demand & Covid.

In an expected response to economic disruption caused by Covid-19, patent and intellectual property asset holders are being innovative and strategically utilizing their IP. Patent trolls have taken the opportunity to aggressively licence their portfolios, seeking quick settlement deals from companies that are already under financial and operational stress. Covid-19 also lifted competitor litigation, with a greater push to monetise assets and to settle the disputes early to avoid the additional financial burden of litigation. Recent reports support this, finding that the volume of US patent disputes is set to increase year on year from 2019, to 2020 and into 2021.

What are patent trolls? And why should our clients be wary of them?

Patent trolls, also known as non-practicing entities (NPEs) or patent assertion entities (PAEs), are organisations that purchase patents and generate revenue by enforcing or licensing their portfolio rather than producing their own products or services.

Clients should be wary as they are known to aggressively litigate their often extensive IP rights and threaten lawsuits that, even if groundless, demand too much resource to fight. Poor investment returns are also funnelling funding to patent trolls, as litigation financing opportunities arise and look increasingly appealing.

What is needed from our clients to underwrite the risk?

For a very rough indication – company name, website and revenues is all we need! For quote terms, it is likely we will also require information including a proposal form, a list of IP rights and details of any previous IP disputes.

What limits are you able to offer? And what are your minimum premiums?

Maximum line is USD25M. Minimum premiums of USD15K.

View more information about our professional and financial risk expertise.