Silent Cyber Umbrella Policy

Silent Cyber Umbrella Policy

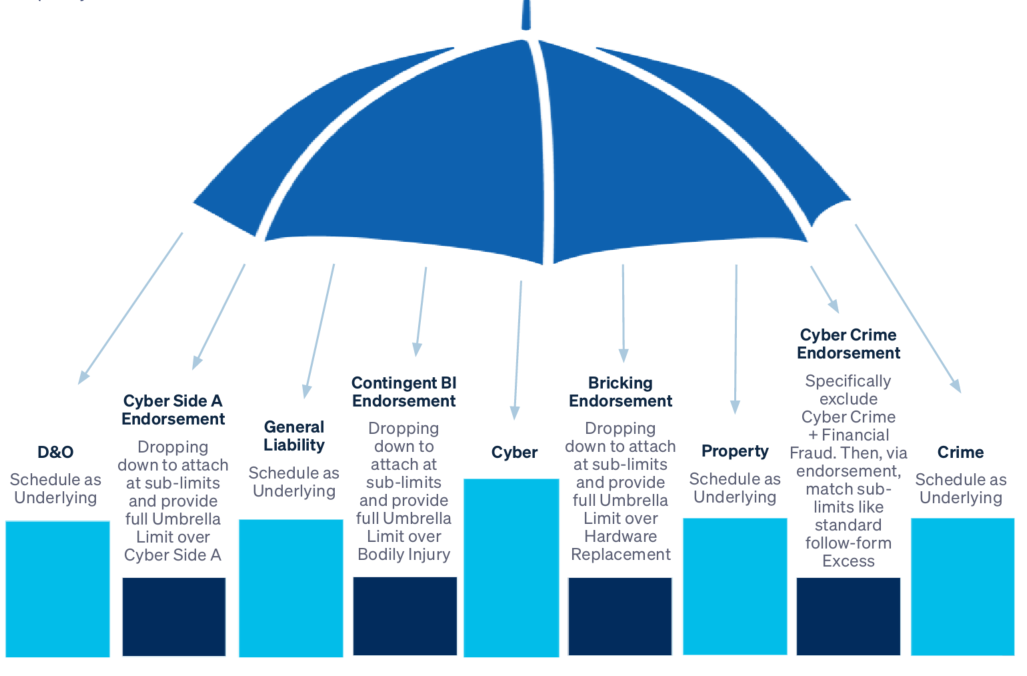

Silent cyber is the latest cyber security threat making noise across our industry. Available exclusively through Amwins and in partnership with an “A XIII” rated insurance carrier, CyberUP is designed to affirmatively protect insureds against silent cyber incidents by dropping down, not overlapping, existing policies across multiple lines of coverage.

CyberUP was named the 2021 Cyber Risk Disrupter of the Year at Advisen's Cyber Risk Awards. This award recognizes a force of change – an innovation that made a significant impact in how the cyber market approaches this evolving risk.

CyberUP / Silent Cyber Insurance Coverage Features

- Simplifies the carrier response which expedites claims resolution and payment

- Focused on middle market accounts

- True umbrella form with full drop-down capabilities

- Typically lead umbrella over primary, scheduling all “sensible” policies as underlying

- Follow-form excess endorsement for certain functions (i.e., cybercrime matching sub-limit)

- Only triggered by a cyber-related event

- Limits up to $10M

Submission Requirements

- Primary cyber application (CyberUP is first excess) and schedule of the non-cyber policies that CyberUP should follow

Select image to view larger

What is silent cyber?

Is your insured at risk for silent cyber?

TAKE THE SILENT CYBER EXPOSURE EVALUATION

Contact Us

Learn More

Resources + articles

Stay up-to-date on emerging industry trends and topics.