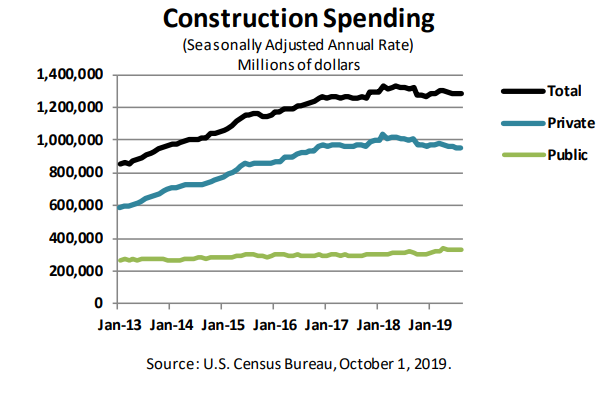

Construction spending continues to reach historic heights. According to the U.S. Census Bureau, approximately $1.3 trillion is spent each year on domestic construction projects.

The increased spending correlates with an increase in the number of construction projects being executed. This ultimately translates to greater exposure and bottom-line risk for all companies involved in the supply chain within the construction sector. These companies include but are not limited to consultants, construction and project managers, design professionals, and builders.

(Click chart for larger view or tap chart to view on your mobile device)

Expanded Roles of Contractors Leads to Increased Exposure

While it’s clear that the inherent risk of bodily injury and property damage exists each time a contractor begins a project, the economic loss exposures are not always as apparent. However, their inconspicuous nature does not align with the frequency with which they occur or the extraordinary impact they can have on a company’s profit and reputation.

The role of contractors in this space continues to evolve. While contractors and design and engineering firms have traditionally held apparent and bifurcated roles within construction projects, developers and other project owners are now placing more responsibility on their contractors regarding construction management, design supervision and delegation, and hiring of subcontractors, as well as other more ambiguous obligations. These expectations affect the burden of responsibility (and ultimately liability) when something goes wrong.

While traditional Contractors General Liability (CGL) products have addressed the brick and mortar exposures of the construction industry for decades, there is now significant demand for coverage for the less tangible exposures, especially economic (monetary) loss suffered as a result of construction services. Additionally, there is a need for policies with language robust enough to address the evolving exposures faced by construction and contracting firms.

Risks in Action – Claims Scenarios

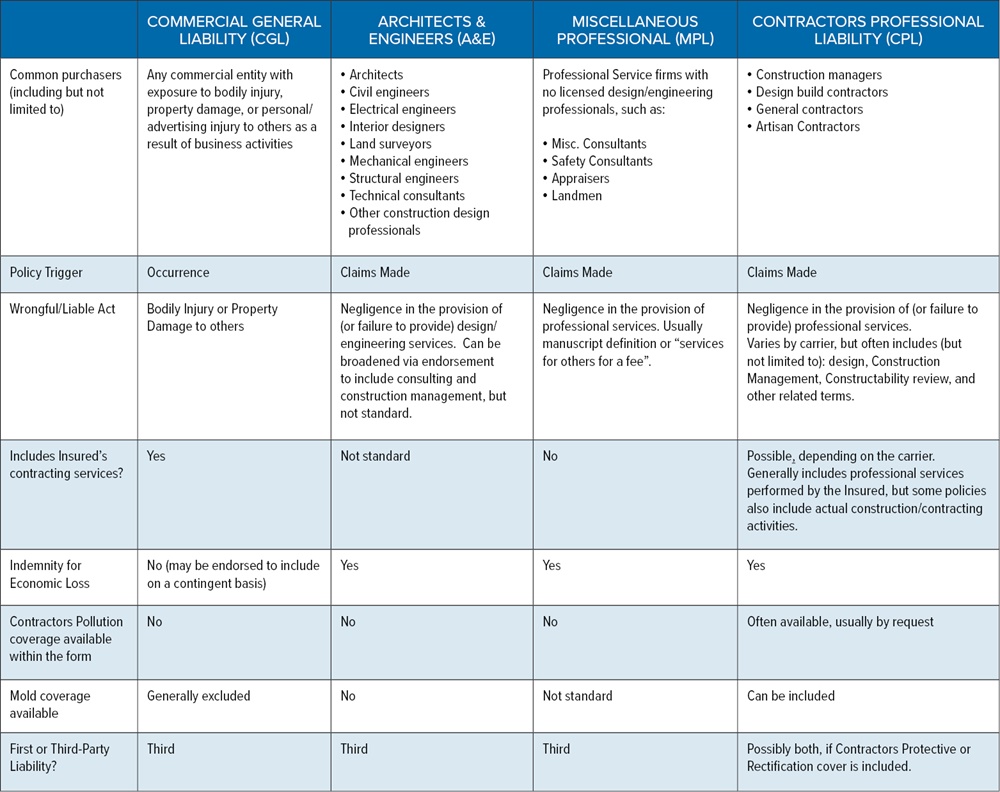

In the insurance world, these new roles have implications for a variety of firms, including General Contractors, Design-Build Contractors, Construction Managers (At-Risk & Agency), and Special Trade Contractors. Each of these firms may choose to insure using a CGL, Architects & Engineers (A&E), Miscellaneous E&O (MPL), and/or Contractors Professional Liability (CPL) policy, all of which have advantages and disadvantages.

A standard CGL policy stipulates that bodily injury and/or property damage must be present for the policy to respond; as a result, pure economic loss (financial loss) is not covered. Conversely, CPL policies are built specifically to respond to such claims and can extend beyond the scope of a traditional A&E or MPL policy.

To illustrate, below are some examples of Professional Liability claims and how each policy might respond.

Negligent Construction Management: The contractor is sued by the project owner on a large school project for negligent construction management. Allegations include failure to schedule and coordinate work properly, which results in significant costs being added to the project that subcontractors did not expect to incur. As a result, they bring suit to recover those costs.

-

CGL: Not covered. There is no bodily injury or property damage.

-

A&E: Not covered. Claim is not a result of negligent design/engineering activities for third parties.

-

MPL: Potentially covered. Generally, the base language is not broad enough to encompass construction management activities. If specifically endorsed for such activities, there is a chance the policy could apply.

-

Contractors Professional: Covered. Construction management activities are generally covered.

Project Delays: The subcontractor sues the primary general contractor for increased costs as a result of project delays allegedly caused by the general contractor’s failure to respond timely to requests for approval across various stages of the project.

-

CGL: Not covered. There is no bodily injury or property damage

-

A&E: Not covered. Claim is not a result of negligent design/engineering activities for third parties.

-

MPL: Potentially covered. Generally, the base language is not broad enough to encompass contracting activities. Can be subject to exclusions on occasion.

-

Contractors Professional: Covered. Construction management activities are generally covered.

Re-work/Installation: An HVAC contractor incorrectly installs ductwork for a heating system which prevents the building owner from installing the appropriate ceiling for the project. The incorrect installation results in inadequate headroom and loss of otherwise habitable space within the building. As a result, the system must be removed and reinstalled in the correct manner. The building owner sues for costs incurred as a result of the error.

-

CGL: Potentially covered. May respond in limited capacity depending on endorsements.

-

A&E: Not covered. The claim is arising as a result of incorrect installation rather than negligent design/engineering activities for third parties.

-

MPL: Not covered. Broad Bodily Injury and Property Damage exclusions are often present within base MPL forms and costs for correcting or re-performing work are often excluded, as well – issues which would prove problematic in this scenario.

-

Contractors Professional: Covered, assuming the definition of covered services includes contracting services and/or mitigation coverage.

Protective Claim: A major structural design flaw is discovered at a multi-story apartment project. The engineer has only $2M in Professional Liability coverage available, yet over $5M in costs were incurred.

-

CGL: Not covered. The loss is a result of professional services, so the CGL would not respond appropriately.

-

A&E: Not covered. The A&E policy for the engineer would respond to policy limits of $2M – which are inadequate to cover the costs incurred.

-

MPL: Not covered. MPL policies are not designed to provide coverage for licensed professional activities such as engineering and would not provide first-party costs.

-

Contractors Professional: Covered. A Contractors Professional policy including Protective cover would provide coverage for the $3M deficit left uncovered by the engineer’s policy.

The Nuts & Bolts of Coverage

To specifically address unique risks, the policy forms for contractors vary from what you might find for an architectural firm, and both differ greatly compared to General Liability and MPL. Though Professional Liability forms are not standardized like CGL, there are some basic tenets present within many of these forms which would affect firms within the construction industry.

The chart below provides some basic points to note. (Click chart for larger view or tap chart to view on your mobile device)

The above chart represents standard and widely used/accepted policy wordings. It is provided for illustrative purposes only. Please remember that A&E and Contractors policies are non-standard and vary by carrier. Availability of coverage is dictated by the merits of each individual risk.

Conclusion

The increase in the number of construction projects in the U.S., coupled with the expanding roles and responsibilities of contractors, has created a perfect storm of exposure to economic losses for contractors in a variety of firms within the construction sector. It is important for agents to understand the types of policies and coverage available and to determine the appropriate option for the type of work their contractor clients are engaged in.

AmWINS’ Construction Practice has more than 400 professionals that specialize in residential and commercial exposure across the country. We also offer a numerous in-house products and programs tailored to the specific needs of contractors, including Contractors Blueprint which fills the gap in protection left by traditional commercial combined packages and includes coverage for Professional Liability (Contractors E&O), Pollution Liability, Cyber & Media Liability, and Employment Practice Liability.

About the Author

This article was authored by Megan North, Assistant Vice President with AmWINS Brokerage in Seattle, WA and a member of AmWINS’ Professional Lines practice group.