One of your jobs as an insurance agent is understanding the intricacies of professional and management liability insurance for healthcare providers. Professionals in the healthcare industry will face many challenges and risks requiring specialized insurance coverage. We will dig into the importance of this coverage and how Amwins can assist insurance agents in meeting their client’s needs effectively.

Professional Liability in Healthcare

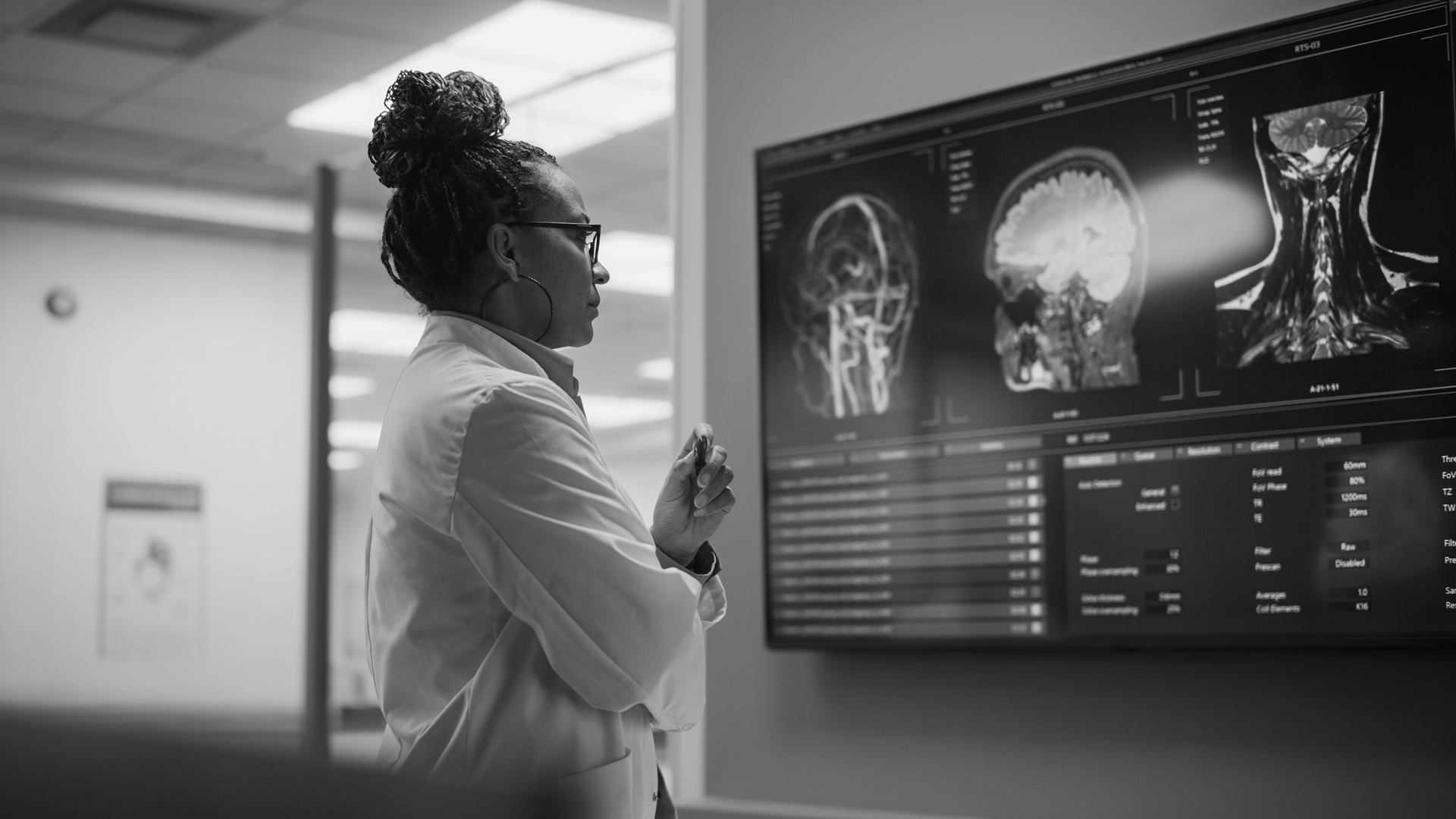

Healthcare professionals have the full trust of their patients. However, mistakes can happen despite their best intentions and expertise, leading to unfavorable patient outcomes. Professional liability insurance, also called medical malpractice insurance, protects against claims arising from negligence or errors in patient care.

Amwins understands the unique risks healthcare professionals face. They offer tailored professional liability insurance that covers healthcare providers, including hospitals, clinics, individual practitioners, and allied health professionals. Their comprehensive policies address the evolving legal landscape and help mitigate the financial repercussions of malpractice claims.

Coverage for Management Liability

Healthcare providers not only face professional risks but also encounter a variety of management-related liabilities. These include employment practices liability, directors and officers liability, cyber liability, and regulatory compliance issues. Failing to address these risks adequately can lead to devastating consequences for healthcare organizations.

Amwins offers management liability insurance specifically designed for the healthcare industry. Their policies safeguard healthcare organizations and their leadership from various management-related risks. This coverage provides financial protection in lawsuits, investigations, and regulatory penalties, helping healthcare providers focus on delivering quality care.

Tailored Solutions for Insurance Agents

Insurance agents are crucial in connecting healthcare providers with the proper coverage. Amwins understands the importance of strong partnerships with agents and provides comprehensive support to help them effectively serve their clients.

- Expertise and Guidance: Amwins employs a team of knowledgeable professionals specializing in healthcare liability insurance. They can provide agents with expert advice, guidance, and resources to navigate the complexities of this unique market.

- Customized Coverage: Every healthcare provider has special needs and risks. Amwins recognizes this and offers customized coverage solutions tailored to individual clients. They understand the intricacies of the healthcare industry and can assist agents in developing policies that meet their client’s specific requirements.

- Claims Support: Dealing with claims can be a challenging process, both emotionally and financially. Amwins offers exceptional claims support to help healthcare providers navigate the claims process smoothly. Their dedicated claims team works tirelessly to ensure timely resolution and fair outcomes for all parties involved.

- Risk Management Tools: Prevention is essential when it comes to mitigating liabilities. Amwins provides valuable risk management tools and resources to help healthcare providers identify potential risks, implement best practices, and minimize the likelihood of claims.

Conclusion

Professional and management liability insurance is essential for healthcare providers, offering financial protection against risks inherent in their industry. As an insurance agent, understanding the unique needs of healthcare professionals and organizations is paramount. Amwins specializes in providing comprehensive coverage for healthcare providers and offers services to support insurance agents in effectively meeting their client’s needs. Insurance agents can help clients find the necessary peace by partnering with Amwins.