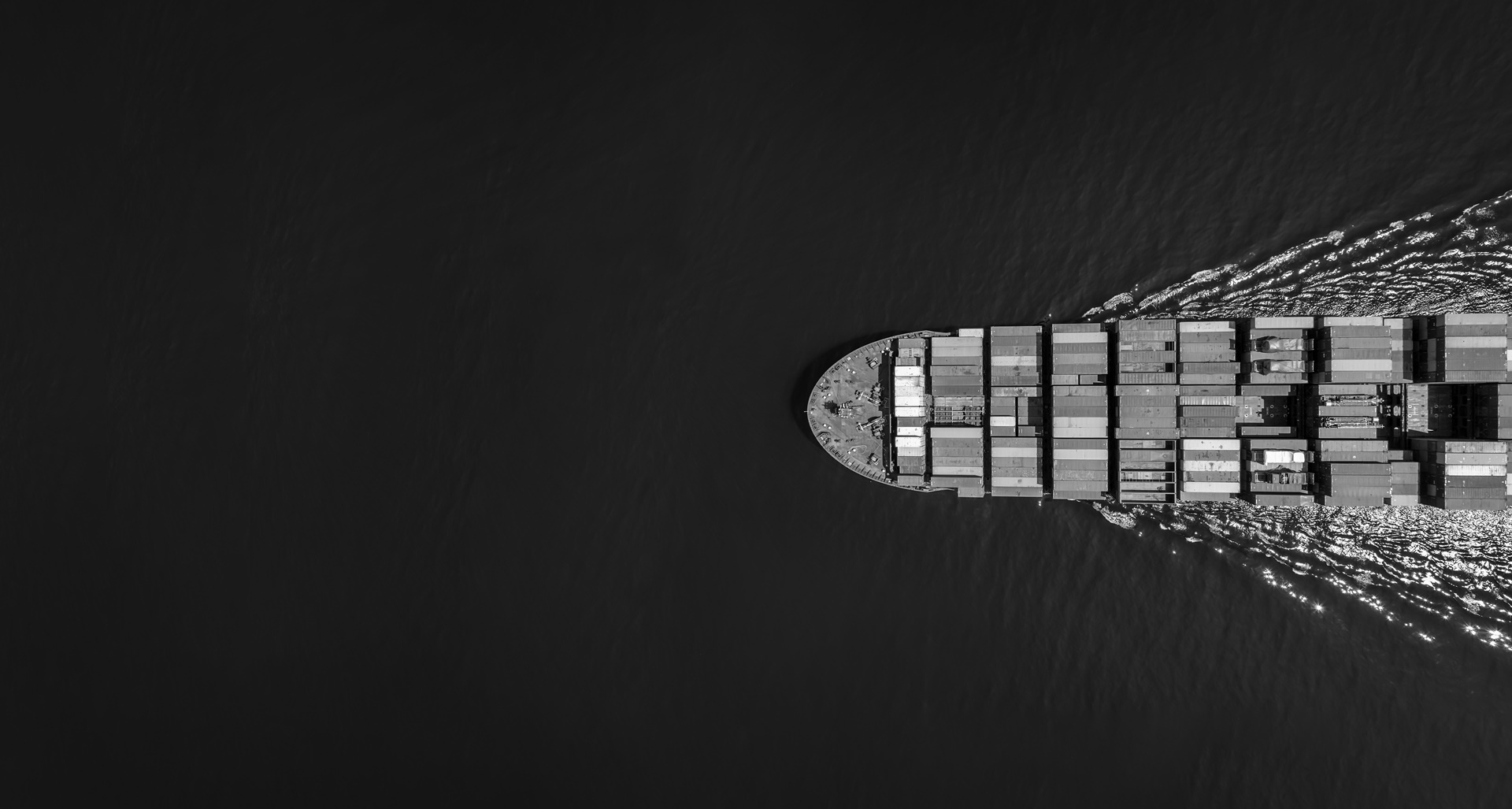

Every day there are hundreds of thousands of ships on the open seas. Vessels trading internationally face a complex web of risk in regions plagued by conflict, piracy or political unrest – and the stakes are high. 90%+ of goods are moved over water and all parts of the globe are accessed.

Troubled waters

Shipping channels are crucial for global trade, offering reliable, efficient and secure routes for maritime transportation. One of the most densely packed shipping channels is the Red Sea. Just south of the Suez Canal, it accounts for 10% to 15% of world trade and is situated between Africa and the Arabian Peninsula. It serves as a crucial route connecting Europe, Asia and the Middle East.

Houthi rebels have been targeting passing ships sailing through the straight where the Red Sea narrows at the southern end between Djibouti and Yemen. Recently, a cargo ship carrying fertilizer was struck by a missile and whilst the crew was able to escape to safety, the ship began taking on water, later sinking.

In situations like this the presumption is often that these rebels’ targets have political allegiances to certain countries. That isn’t always the case. There are many possibilities as to how a ship could end up in the rebels’ crosshairs – making it important to have proper marine war insurance. Without it, the shipowner could bear the full financial burden of any damage, loss or liability incurred, including costs for repairs, salvage operations, legal expenses and compensation for third-party claims. Moreover, the lack of marine war insurance may impede the vessel's ability to obtain necessary permits or clearance to navigate through certain high-risk areas, potentially leading to delays, rerouting or even a complete halt to operations.

Perils of war

As global commerce continues to expand, the need for comprehensive marine war risk insurance has become increasingly important for ships venturing into high-risk or restricted areas. Depending on the region, it's not only attacks or piracy affecting cargo ships at sea. Other perils associated with war and political instability include armed conflicts, acts of terrorism, sabotage and the presence of mines or other military hazards.

Without specialized marine war risk coverage a vessel and its cargo could be exposed to significant financial and operational risks. Similarly, without this crucial insurance coverage, the ship and its stakeholders are left dangerously exposed to the unpredictable and volatile realities of conflict zones at sea.

Blocking and trapping

A cover granted within marine war insurance policies is coverage for a vessel that has been blocked or trapped in a port with no way out. In these situations, having a marine war insurance policy in place is vital since political situations are constantly evolving.

For example, when Russia invaded the Ukraine, the ports were closed and vessels in port were unable to leave, becoming trapped. Some vessels are still stuck there today. Many of these ships arrived before the invasion when Ukraine wasn’t considered a high-risk area.

A marine war policy would have helped protect the owner in this real-world example because many policies often stipulate if the ship is stuck for 12 or more months it is then considered lost and the covered entity will receive payout in full.

How is coverage determined

The amount of coverage your client needs will depend on where an insured is voyaging. For example, if they are transiting the Gulf of Aden, a two- or three-day voyage, the policy will likely be written for seven days to account for possible delays. Other options exist, for example, if your client has multiple ports of call in the Black Sea then they may need 21 days of coverage to help ensure coverage as the ship makes its way through the entire restricted zone.

Length of coverage can also be determined by pulling data from previous cases. It’s important to keep in mind that sometimes delays can occur from backed-up waterways. The intent is always to ensure the client is covered for the entire voyage so it’s important that the policy provides for the possibility of a delay happening. As an added bonus, rates are often more competitive on longer policies.

Marine Hull Underwriter Committee

The Lloyd's Marine Hull Underwriters Committee convenes quarterly to deliberate on navigating the perilous expanses of the world's waterways. Comprised of seasoned Lloyd's marine hull underwriters, these gatherings address the unique challenges of insuring maritime risks, which constantly traverse international borders and maritime territories. High-Risk Areas (HRAs) are globally identified and allow insight on the degree of risk so that rates can be set accordingly.

Similar to the need for heightened coverage in high-risk scenarios this committee analyzes regions with these heightened risks, such as areas historically plagued by piracy. By way of example, the reduction in piracy risk in West Africa has resulted in a noticeable decrease in insurance costs for vessels sailing these waters, while regions subjected to sanctions need additional scrutiny and checks.

The committee also grapples with the complex task of insuring ships that are voyaging in and out of conflict areas. Ukraine, for example, currently presents the persistent threat of mines amid the ongoing conflict with Russia.

And then there’s the weather

While marine war insurance is generally used for wartime or high-risk area purposes, it may be apt to mention that similar cover is also available for areas marked as high-risk because of weather elements. For example, your client may sail into areas considered high-risk due to ice. With a hull and machinery policy, there may be coverage for damage resulting from such events.

We help you win

The London marine insurance market is thriving. With current uncertainties and resultant questions surrounding maritime law, the Amwins Global Risks’ team of marine brokers are able to provide valuable insight and guide you based on their extensive experience.

Amwins is more than an insurance provider, we aim to be an all-encompassing resource for clients and serve as a direct extension of your team. And as your strategic partner, we are committed to simplifying the insurance journey for businesses of all sizes.

The expertise, global reach and personalized service offered by the team can help to ensure your clients are insured for the proper risks for the appropriate amount of time. We provide you with comprehensive solutions that make us a trusted partner when it comes to navigating the intricacies of marine hull and war insurance.

As a leader in specialty insurance distribution, we've seen our retail partners through many experiences — and continue to deliver the coverage solutions that meet insureds' evolving needs. Contact your Amwins broker or underwriter today or learn more about our Marine Hull and War Industry specialists here and here.