Insurance Carriers Re-Evaluate Risks Where Call-For-Aid Systems Are Used

In the U.S. we have a variety of living accommodations designed to cater to the various needs of our aging population. The options can range from 24-hour skilled nursing homes to assisted living quarters to independent senior living apartments. The level of support offered depends on the type of facility and residents’ needs.

One of the selling points these living arrangements have in common, however, is the promise of easy access to assistance in an emergency. As such, many properties have call-for-aid systems (aka pull cords) that residents can trigger to notify staff when they need help.

But what happens if that call goes unanswered and the resident sustains extensive injuries or dies? Who is held responsible in that scenario? And at what cost?

These aren’t new questions—pull cords aren’t new technology—but a consistently hard market has put additional pressure on insurance underwriters to scrutinize potential risk exposures.

As a result, some carries have begun to deny coverage for properties where pull cords are installed and other carriers are following suit, leaving retailers scrambling to find coverage for their clients.

This article will address how underwriters analyze the risks associated with pull cords, and what you can do to help your insureds find coverage for properties where pull cords are installed.

Pull Cords—Evaluating Risk

The U.S. Department of Housing and Urban Development (HUD) does not require properties to install call-for-aid or emergency response systems.

The choice to install them is at the property owner’s discretion—as is the type of equipment used and the type of response to the call.

If a property owner chooses to install a system, HUD does, however, require the system to meet certain requirements:

"An emergency response system, including mobile response devices, in elderly multifamily properties, shall be deemed acceptable if the following are true.

- The system registers an alarm call at a central supervised location; OR

- The system provides an intercommunication system that connects to a continuously monitored switchboard (24 hours a day); OR

- The system sounds an alarm in the immediate corridor and actuates a visual signal at the living unit entrance; AND

- The system is available in each bathroom and one bedroom-location in each living unit."

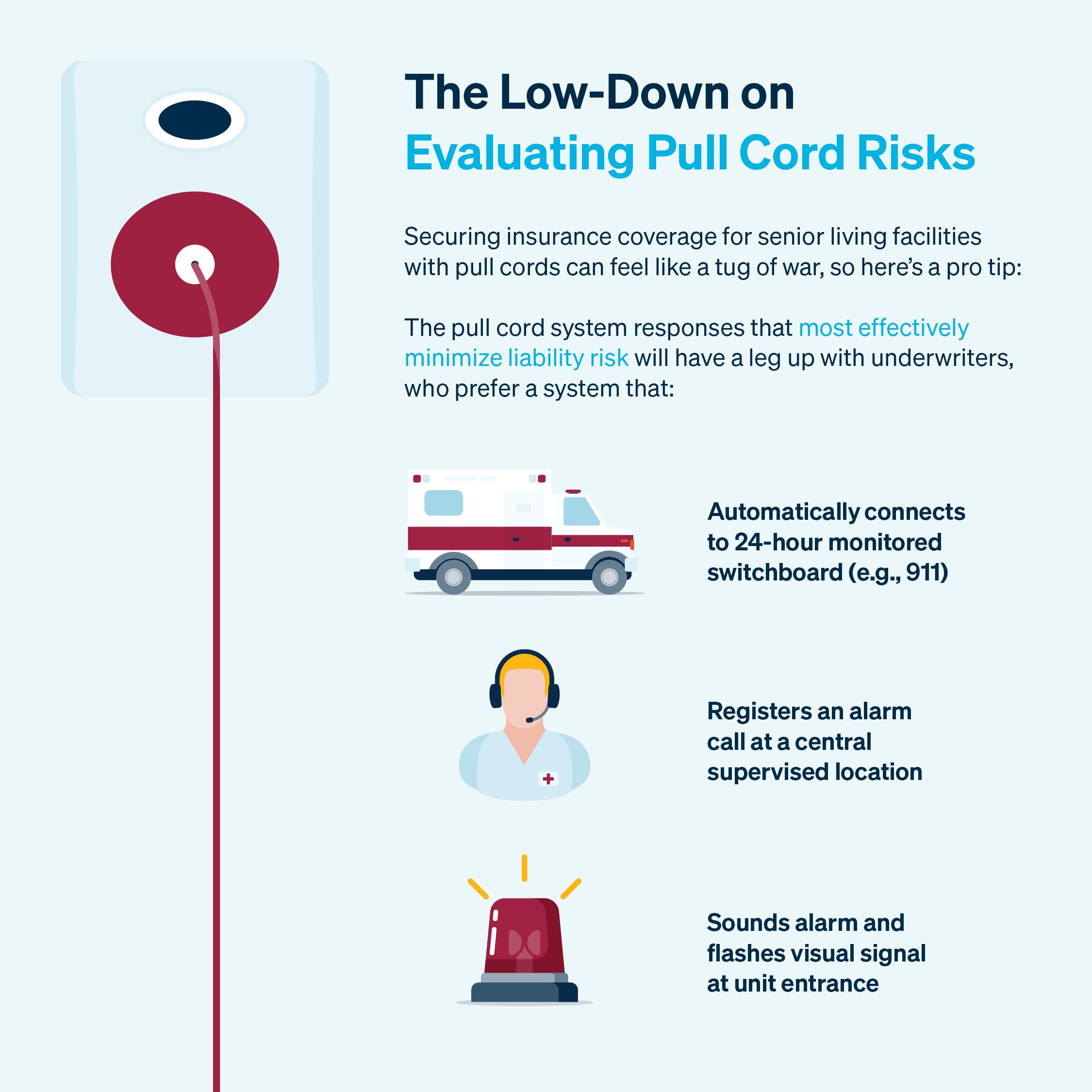

While choosing any of these response options will satisfy U.S. regulations, the responses are not viewed equally to insurance carriers who associate different levels of liability risk (e.g., likelihood the notification could go unnoticed, slow response time, etc.) to the type of response.

In order from most to least favorable, underwriters prefer a system that:

- Automatically connects to a 24-hour monitored switchboard (preferably emergency services, 911).

- Registers an alarm call at a central supervised location.

- Sounds an alarm and flashes visual signal at the living unit entrance.

The best option would be to have a system that does all three simultaneously, further reducing risk of liability with built-in redundancies.

What You Can Do to Help

As a retail agent or broker, you are always in a better position to advise clients when you are fully informed about their specific business practices and risk exposures. If you have clients who are insuring senior living properties, make sure you ask if they have emergency response systems in place and what the response procedures are.

While some carriers will not entertain covering properties with pull cords, others are more open to discussing coverage options when you are transparent about the system in place and any associated risk mitigation strategies the client employs.

You can also seek insurance programs specifically designed to address the unique liability risks of senior living facilities. Amwins has two such programs available which provide coverage for facilities with pull cords.

Amwins Program Underwriters' Long-term Care Facilities Insurance Program provides comprehensive liability coverage for skilled nursing, assisted living, independent living and continuing care facilities with at least 20 beds. Minimum account premium is $20,000.

Amwins Specialty Casualty Solutions Long-term Care Facilities Risk Retention Group (RRG) provides a customizable professional and general liability program for skilled nursing, assisted living, independent living and residential care facilities. Minimum account premium is $50,000.

Contact your Amwins broker for more information on policy features and coverage details.