Partnerships with program administrators are essential for retailers looking to tap into the fast-growing program business market.

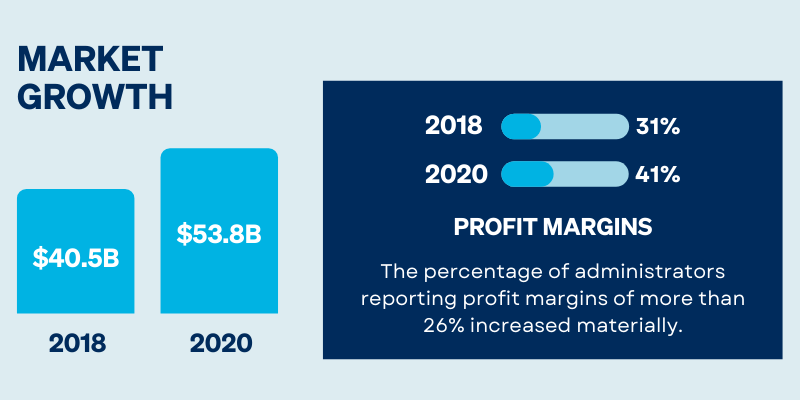

Program business is one of the fastest growing sectors of the insurance marketplace. According to a recent study from the Target Markets Program Administrators Association (TMPAA), from 2018-2020, the industry saw a 33 percent increase in premium administered, with 2020 ending at $53.8 billion in written premium. During that timeframe, the percentage of administrators reporting profit margins of more than 26% increased materially.

For retailers looking to capitalize on this growth, success requires combining a wide range of knowledge about various classes of business with a high level of specialization, which program administrators are uniquely positioned to provide. Retailers should also look for PAs with proven underwriting skills, profitable return on investment, actuarial expertise, and effective supporting technology that can scale with increases in business.

PAs also serve as valuable front-line underwriting for time-strapped and profit-focused carrier partners. “There is a real focus on underwriting profitability now, and the whole program space has become very data-driven as a result,” says Bob Petrilli, President, Amwins Underwriting. “When you look to start up new programs, it’s essential you have valid loss history to be able to model several years of data. That’s quite different than in the past, when it had been more about getting premium in the door.”

Carriers, especially those with limited knowledge on niche industries, also look to PAs for their vertical expertise. “In the past, carriers didn’t want to give up the pen—they wanted to go after business themselves,” says Ben Francavilla, President, Amwins Program Underwriters. “We saw an unprecedented amount of interest in our underwriting programs at this year’s Target Markets Summit. The industry knows Amwins has a strong reputation of developing long-term relationships with carrier partners, delivering positive underwriting returns, and employing specialized underwriters that are exceptional at what they do.”

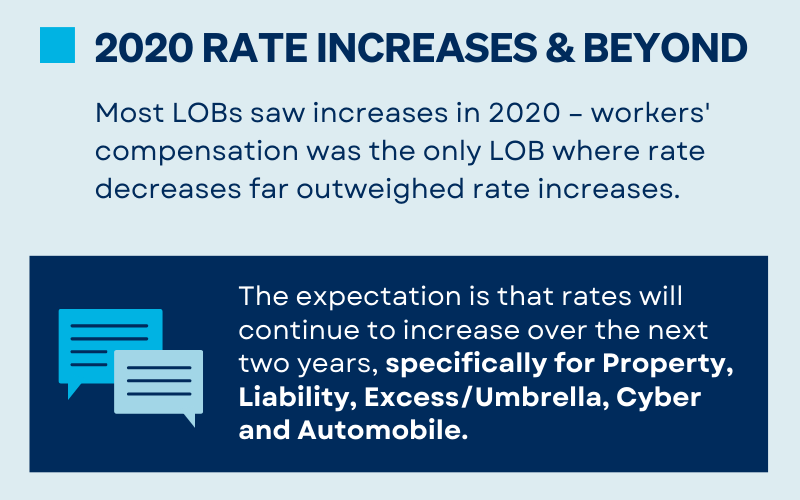

Pricing Trends

Across nearly every sector of program business, pricing conditions mirror those of the property-casualty sector overall. Increases are being seen across all lines with the exception of workers’ compensation. The expectation is that rates will continue to increase over the next two years, specifically for property, liability, excess/umbrella, cyber, and auto. Since the 2019 poll, workers’ comp prices have flattened due to increased premiums in the second quarter of 2020.

In a hardening market, quality of underwriting has become more important. “If you’re a successful program manager, and especially if you’re thriving in a market like senior care or auto-heavy programs, you’ve done a good job of underwriting risk. Nevertheless, you still need to prepare your clients for significant rate increases because the market has firmed,” says Francavilla.

Program administrators reported lower growth in premiums administered and a slight decline in renewal rates in 2020. According to the study, 71% of PAs reported increases in gross revenue in 2020, compared to 75% in 2018. Despite the decline and challenging market, the industry remains optimistic for the future.

Another area of pullback is in Lloyds-backed programs. “If you have a program backed by London capacity, it is tough—there’s a lot of pressure on the distribution cost. Lloyds used a very broad brush when it painted what lines of business were favorable, and now underwriters are being challenged to maintain their capacity,” Petrilli says.

Continued Opportunity

There are a few potential threats to program business growth, including continued consolidation through mergers and acquisition, as well as alternative capital and non-traditional insurance companies entering the space. However, despite these factors, expectations are that program business overall should continue to gain momentum and attract a larger share of the commercial insurance market. In fact, 83 percent of PAs and an overwhelming percentage of carriers surveyed anticipate adding programs and increasing premiums written in the next two years.

For retailers, the program marketplace offers versatility through its business model of providing tailored coverages and bringing new products online faster and more efficiently. To capitalize on this opportunity, retailers should partner with a PA that has a proven track record in the program marketplace.

“There’s a real benefit in choosing a program administrator that has expertise and has shown profitability over time to their carrier partners,” Francavilla says. “For retailers, aligning with PAs is a very efficient, effective way to find insurance solutions for high-hazard risks in niche industries.”

Source: The TMPAA State of Program Business Study 2021.