Looking ahead to 2026, understanding the complexities of our dynamic market continues to be demanding. Some sectors are experiencing favorable rate movement and improved underwriting results, while others still face tougher challenges.

This State of the Market report features expert insights from Amwins professionals into the elements influencing these trends. It examines rate movements, capacity and evolving coverage across various industries, business lines and risk specialties in the United States, London and Bermuda.

Rather than simply forecasting trends, we aim to maintain our promise to you. With over $45 billion in premium placements, more than 100 underwriting programs and global reach, our skilled teams of brokers and underwriters have the full support and resources of our firm to give you a clear advantage.

We remain dedicated to delivering outstanding placement and service in any market environment, helping you successfully navigate both current and emerging industry challenges.

We help you win!

![]()

Property

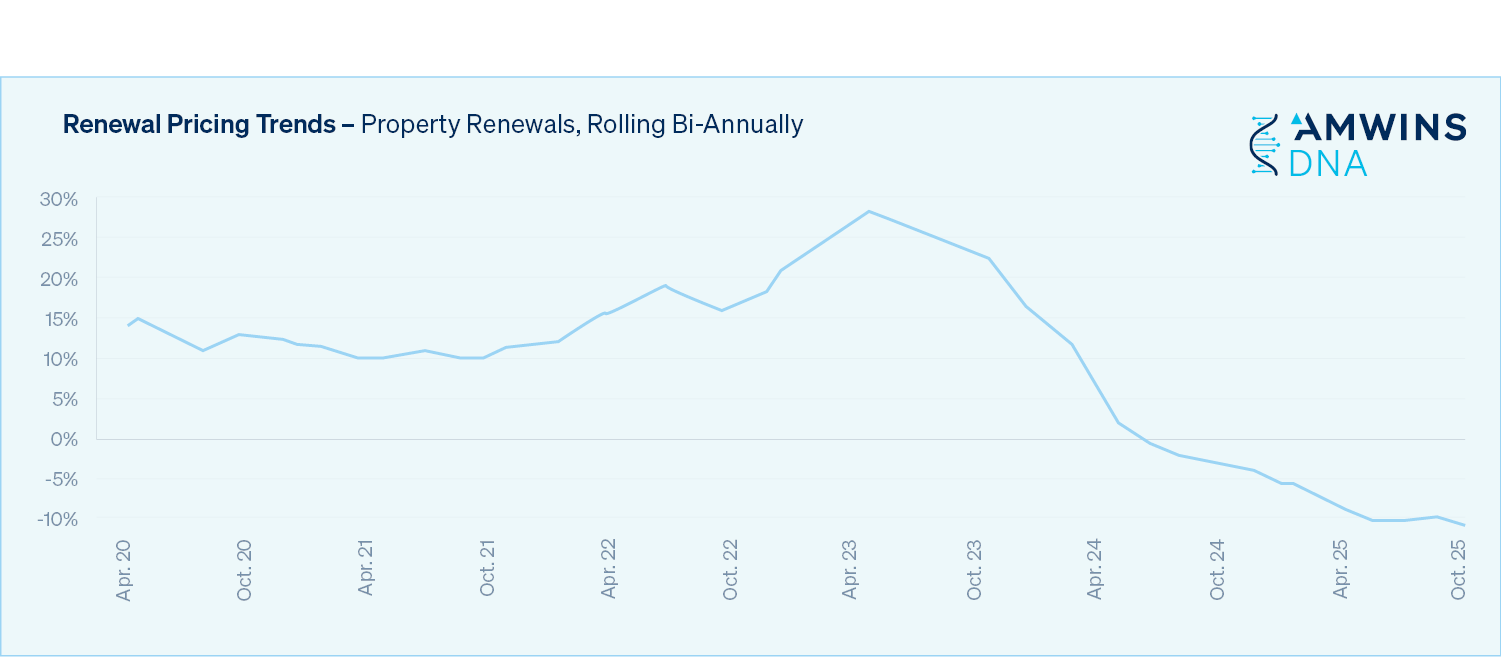

The property marketplace remains extremely competitive heading into 2026 for a variety of reasons, including but not limited to the following:

- Record availability of capacity from existing carriers, MGAs and syndicates, as well as a near continuous flow of new entrants, provides an ongoing opportunity for knowledgeable brokers to achieve rate reduction and coverage improvements. (Increased capacity is directly proportional to increased competition.)

- Rate reductions in 2025 commonly ranged from high single digits to 25%+, depending on account specifics.

- Coverage improvements may include reduced deductibles, improved terms and conditions, a broader policy form, minimization of non-concurrencies, removal or loosening of restrictive wording and warranties, etc.

- No less than six new domestic property carriers/MGAs are slated to open in 2026, in addition to seven new syndicates within Lloyd’s and six new Bermuda property operations.

- In 2026, Lloyd’s aggregate stamp capacity is projected to increase by 4%.

- Line size expansion from the majority of domestic carriers and MGAs, as well as Lloyd’s of London is also expected.

- Substantial oversubscription within layered/shared placements is commonplace, applying downward pricing pressure on all layers within a placement. For single carrier placements, incumbent carriers are often challenged by non-incumbents.

- Carriers and MGAs are highly focused on account retention and generating premium growth as most management teams have budgeted for growth rather than shrinkage.

- Despite the devastating Los Angeles wildfires in January 2025, as well as other meaningful losses throughout the year, overall property losses in 2025 were very manageable given overall carrier capitalization.

- Nearly all carriers, MGAs and syndicates are likely to be profitable in 2025, making it a three consecutive year run of profitability.

- Double-digit cost reductions are projected for 2026 treaty reinsurance renewals, with the possibility of select carriers securing lower attachment points from their treaty reinsurers.

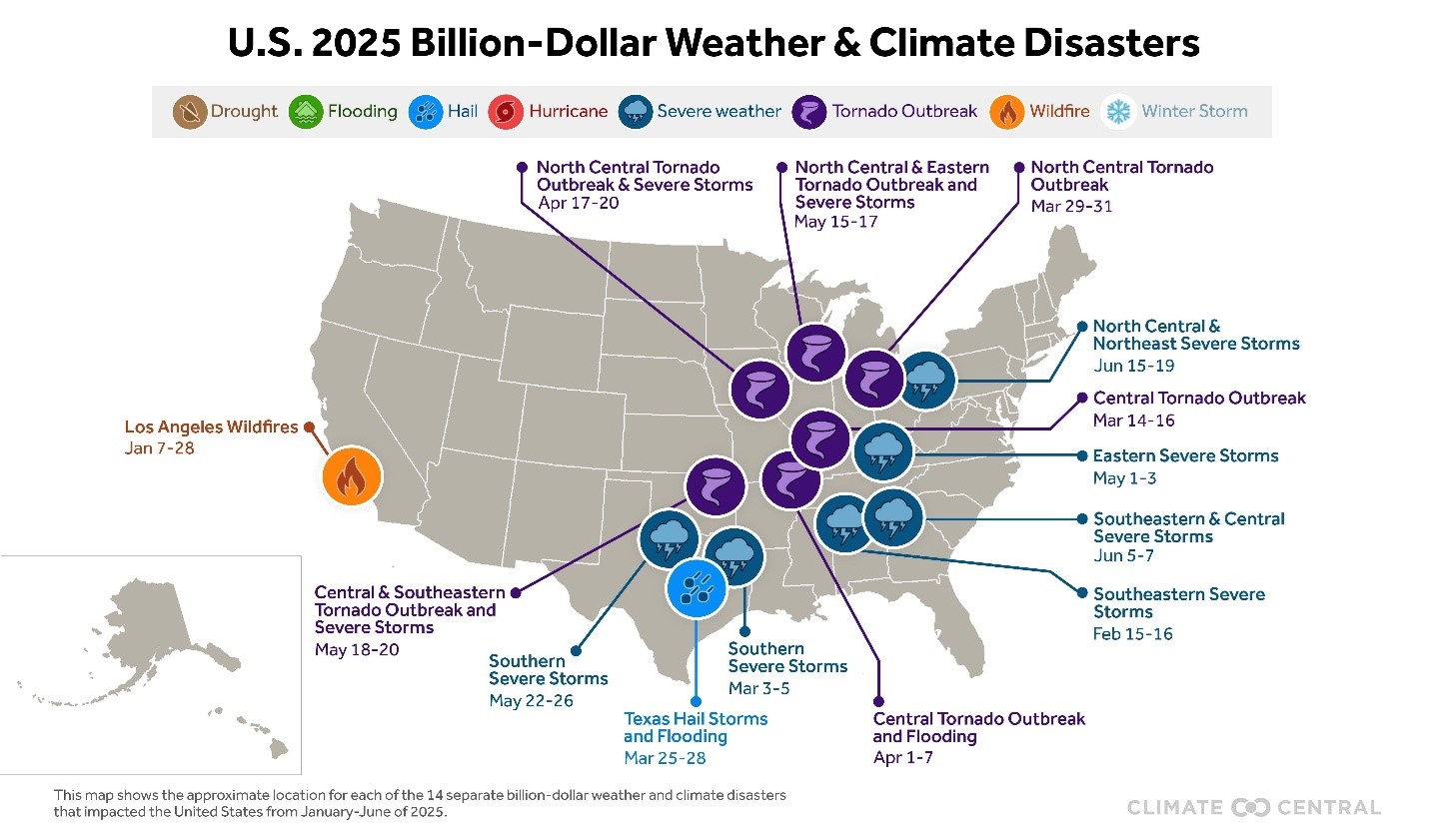

Billion-dollar claims and SCS activity

Through June 2025, the U.S. had already endured 14 separate billion-dollar weather and climate disasters, according to Climate Central. Despite the scale of these events, re/insurers took them in stride.

Recent catastrophes have caused only modest ripples in treaty structures. Capacity continues to expand, demand has held steady and for now, the market seems well equipped to absorb losses. However, that balance is delicate. A sudden shift—whether from tightening capacity or rising demand—could quickly magnify the financial impact of future disasters.

For the moment, the numbers tell a story of resilience. The U.S. P&C industry posted a combined ratio of just 89.1% in Q3 2025 (the best result in a decade) driven by strong reserve releases and a relatively mild catastrophe season.

Hurricane

For the first time in a decade, no hurricanes made landfall in the U.S. which was remarkable considering the conditions: sea surface temperatures were warmer than average and with the return of La Niña, meteorologists anticipated another active hurricane season.

The season saw several major storms, including three that reached Category 5 strength (Erin, Humberto and Melissa). Yet, according to a recent Bluesky post, a persistent trough of low pressure created favorable steering currents that pushed the most powerful storms safely out to sea.

The U.S. didn’t emerge entirely unscathed. Heavy rains and storm surge associated with these distant systems caused millions of dollars in localized damage. For most carriers, these losses remained well within acceptable limits. When combined with the relatively moderate impact of the 2024 hurricane season—largely viewed as an “earnings event” rather than a capital event—continued downward pressure on rates has followed.

Severe Convective Storm

By September 2025, insured losses from U.S. severe convective storms (SCS) had already reached an estimated $42B, marking a “new normal” with average per‑event costs roughly 31% higher than the previous decade. Since 2020, SCS losses have surpassed those from hurricanes, forcing insurers to rethink how they measure, price and manage this rapidly evolving risk.

As storm intensity and frequency continue to climb, collaboration between carriers and policyholders is increasingly critical. Encouraging and implementing more effective, sustainable mitigation practices can help reduce both exposure and vulnerability to SCS events. For added balance sheet protection, insurers and insureds alike should consider tools such as deductible buydowns to manage volatility and preserve capital strength.

Wildfire

Before 2015, wildfire-related insured losses represented approximately 1% of all natural catastrophe claims, according to Swiss Re. That share has grown sharply over the past decade, as eight of the 10 costliest wildfire events on record have occurred during this period. Today, wildfire losses account for roughly 7% of total insured catastrophe losses, a clear signal of how much the peril has escalated.

Despite this trend, insurance pricing has remained comparatively steady. Robust capacity from Lloyd’s and the domestic E&S markets has kept competition alive even as exposure increases. E&S carriers have played a crucial role in providing coverage in high-risk states such as California and Nevada, stepping in where admitted markets have tightened capacity or imposed high deductibles.

The result is a market that continues to adapt, balancing mounting risk with new underwriting approaches and an expanded appetite for complex wildfire exposure.

Market dynamics

Larger and larger stretch primary layers have grown in popularity over the past couple of years, sometimes eliminating buffer layers altogether or reducing the number of buffer layers that exist within a placement. In response to this, many carriers and MGAs that were exclusively buffer layer players in the past have adjusted their appetite to include primary layer participation and lower buffer layer attachment points. Similarly, certain excess layer players have adjusted their appetite to allow for lower attachment points and sometimes even primary layer participation.

Other key trends of note include:

- An increasing number of carriers and MGAs have begun to offer capacity in multiple layers, many times ventilated, as compared to offering just a single line.

- Carrier minimum premium, price-per-million and return on capital requirements are each experiencing downward pressure.

- Soft market conditions have led to very few classes of business and individual risk characteristics to be considered auto-declines.

- The percentage of accounts that now qualify for ground-up coverage from a single carrier/MGA is increasing.

Now is the time to work closely with your wholesaler to streamline programs and eliminate as much non-concurrency as possible within any given property placement. For example, many programs were split into pieces for a variety of reasons through 2023 during hard market conditions. The current marketplace may present the opportunity to recombine an insured’s assets into a master program.

Although reducing or meaningfully reducing the number of participants within a large layered/shared placement is achievable and even tempting in certain situations, maintaining continuity with long-standing program supporters, supporters that have paid large losses and supporters that have met with insureds over time is also very important to consider.

As carriers search for ways to grow in a shrinking marketplace, high-performing and well-managed MGAs are likely to receive additional PML for deployment in 2026 from existing panelists and new entrants.

Reinsurance treaties for 2026 are predicted to renew at double-digit rate decreases, pending no major losses for the remainder of the year. Whether it will be possible for reinsurance markets to maintain the higher attachment points they secured in in the past few years is yet to be determined.

As deductibles decrease, and to the extent there are then losses associated with the perils that received deductible decreases, we expect that claims frequency and carrier loss ratios will increase over time. As pricing simultaneously decreases, additional upward loss ratio pressure is experienced.

Should pricing levels dip to a point considered by carriers and MGAs to be below their technical price, carriers, MGAs and capital providers will begin to pass on opportunities and instead identify higher anticipated capital return options elsewhere. However, enough of the marketplace will need to take this step for the property marketplace to stabilize. And until then, or until there are one or more very substantial industry losses, or until carrier profitability no longer exists, the property market will continue in a downhill slide.

Strategic renewal approach

When meeting with insureds to review expiring property policies, plan for the upcoming renewal and review renewal options, it’s recommended to consider each of the following:

- Evaluation of the unique qualities of each opportunity: Every renewal and new business opportunity should be reviewed on its own merits as every account has its own history and unique risk characteristics as well as its own advantages and challenges.

- Up-to-date valuation review: Up-to-date valuations are critical in scheduled limits, margin clause and coinsurance scenarios. They can also help prevent a “double whammy effect” when the marketplace next hardens (i.e., rate increase due to market hardening + required upward valuation adjustment).

- Loss summary: Include detailed explanations of any sizable loss(es), as well as any steps taken to minimize the chances of similar losses going forward.

- High quality submissions: With submission flow at an all-time high, high quality and detailed submissions continue to be very important. Underwriters prioritize and favor detailed and well-organized submissions.

- Carrier meetings: For larger, complex and/or loss affected insureds, consider scheduling meetings with key incumbent carriers as well as potential key new carriers.

- Extensive review of quoted terms and conditions: Considering current market conditions, it’s important to ensure that the renewal program doesn’t contain unreasonable deductibles, sub-limits, exclusions/endorsements or risk mitigation requirements.

Strategic considerations

- As cost savings are achieved for your client, balance sheet protection can often be achieved via the purchase of AOP and/or named storm deductible buydowns, additional policy limits, larger named storm/flood/earthquake sublimits, parametric coverages, etc.

- Savvy clients should consider reinvesting premium savings into building improvements, right-sizing undervalued building valuations, right-sizing outdated business income figures, improved risk management, improved building security, etc.

- For undervalued accounts: While underwriters are still considering such opportunities given current market conditions, many of the most competitive primary layer carriers downwardly manage their line size.

- Well-managed and loss free accounts: These accounts continue to be treated more favorably than accounts with one or more challenges (undervaluation, losses, poor risk management, less desirable risk characteristics, etc.)

- With capacity abundant and oversubscription commonplace, insureds now have the luxury of prioritizing the signing of highly rated carriers with favorable long-term outlooks. However, in times of market softening, it can be tempting to minimize the number of carriers utilized in a carrier panel. Give consideration to maintaining a broad/diverse carrier panel (i.e., carrier loyalty), as this approach will pay dividends when the marketplace once again hardens or as large losses are sustained by an insured.

London

The London property market has seen additional new capacity, adequate margin and possible reinsurance premium relief as we enter 2026 – generating further softening. These changes are being felt across all areas of the market, with both CAT and non-CAT-exposed accounts seeing rate reductions and a softening in terms. Additional key items of note include:

- Rate reductions mimic what we are seeing in the U.S. market with some U.K./European carriers being as aggressive as U.S. markets on business they wish to retain. Continued downward pressure on rates due to bountiful capacity and strong competition will begin to squeeze profitability.

- Increased capacity, including additional Lloyd’s syndicates and company markets offering U.S. style line sizes on larger primary layers (e.g., $50M and $100M primary layers) plus various company markets offering $100M+ line sizes, have meant that requests for additional limit have been received positively.

- Follow/tracker facilities have become increasingly available, which has positively impacted capacity and resulted in increased efficiencies when filling out programs. It is important to consider which follow/tracker facilities are long term, secure players.

- Push for additional benefits from carrier partners including credits for improved risk management systems

- Outside of treaty exclusions (i.e., communicable disease and cyber), controlled flexibility exists specific to terms and conditions.

- Inflation is still a factor and above average in many areas. Insureds should be able to demonstrate confidence in valuations as rising costs can impact material costs.

- The U.K./European market is able to compete with U.S. carriers on smaller/middle market TIV accounts, illustrating that they believe this will be a core component of their portfolio going forward.

- Almost all types of business are still being considered, and there is no indication that new business activity is decreasing. London continues to be enthusiastic about maintaining its presence in the E&S market.

Amwins Global Risks offers two dedicated, exclusive facilities:

- Small business facility: Focused on TIVs less than $100M

- Middle markets facility: Focused on TIVs from $100M to $2B

These facilities are designed to expedite the process of gaining capacity, ensuring that you receive the most competitive pricing, terms and conditions available to your clients.

Bermuda

In 2026, no major shifts in appetite or line sizes are anticipated. The Bermuda property market, similar to the market in the U.S. and Lloyd’s, continues to soften. Terms and conditions continue to ease, with attachment points and deductibles slipping slightly, and carriers offering further rate reductions. There is also an ongoing focus on profitability and long-term partnerships.

Be on the lookout

- Actual treaty reinsurance results for January 1, 2026 renewals will be telling, foreshadowing upcoming 2026 treaty reinsurance renewal results.

- Each carrier and MGA we have spoken with are either in the midst of exploring AI use cases or already utilizing AI to increase efficiency. Submission ingestion and prioritization of opportunities are two commonly discussed potential uses of AI.

- Property accounts that weren’t aggressively marketed in 2025 by a retailer or wholesaler with full market access and true expertise in the space are almost certainly not optimized from a pricing and terms and conditions perspective.

- Accounts that are currently placed in the admitted marketplace may now be better suited for the E&S marketplace.

- Data centers are coming out of the ground at a record pace. Amwins brokers are experts at placing both the builder’s risk and permanent coverage for these unique and continually growing projects.

- In a softening property market, your chances of winning new business are meaningfully increased via careful wholesaler selection. Amwins brokers won a record amount of new business for our retailers in 2025, providing them with true competitive advantage and greater levels of success.

- Full market access is as important to your success as ever. This includes access to all of the following:

- New markets, MGAs, products and programs

- Limited distribution markets, MGAs, products and programs

- Exclusive capacity, products and programs

- London markets

- Bermuda markets

Insight provided by:

- Bob Black, EVP and Amwins National Property Practice Leader

- Kayla Bridgewater, VP, Property, Amwins Bermuda

- Steve Knight, Head of Open Market, North America, Amwins Global Risks

- Harry Tucker, EVP and Amwins National Property Practice Leader

- Jessica Zuiker, VP and Amwins Assistant National Property Practice Leader

![]()

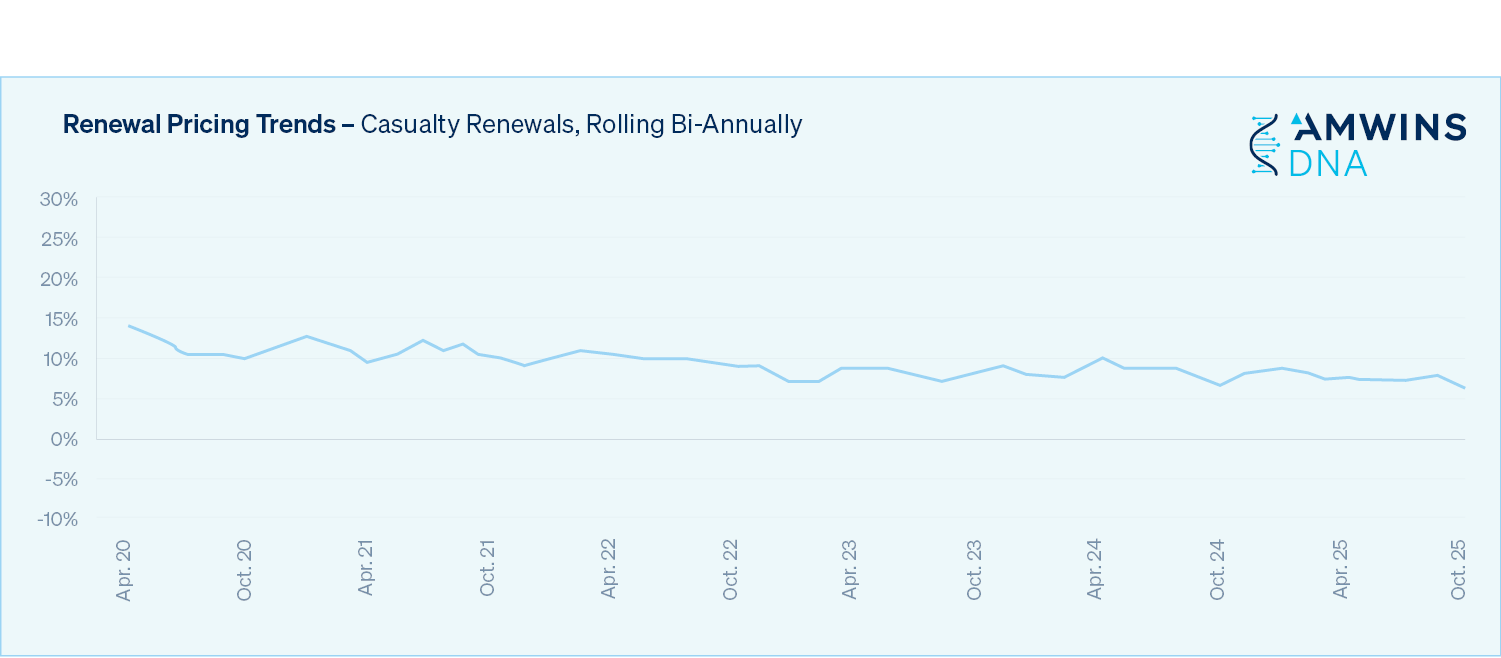

Casualty

The casualty market in 2025 remained strong despite a modest slowdown in the second half of the year, likely due to economic uncertainty. New business growth continues to pace at double digits both in premium and submission volume. Carriers are still working to diversify their portfolios and capture market share – especially those willing to play in the tougher market segments.

Capacity and pricing

Additional capacity has tempered rate growth, with carriers targeting moderate increases in 2026 to keep up with loss trends. Middle market business ($25K to $100K premium) continues to be a focus and we anticipate this segment will remain competitive into the new year.

Many agree that the double-digit rate increases we saw in 2024 have slowed. Most accounts are seeing renewals that are either flat or in the single digits – especially in high excess layers – with the possible exception of large fleet exposures.

Similarly, while we’ve seen growth in primary GL policy count overall, new business (excluding projects/wraps) premium growth has moderated year-to-date. This suggests that insureds are increasingly willing to purchase more restrictive coverage or higher deductibles to lower premium.

Ongoing social inflation and rising claims have led carriers to examine their reserve strategy to help determine if they are well-positioned to meet current loss trends which are holding steady at 12% to 15%. Limits are not expanding, nor are they being cut. However, accounts with certain exposures like auto and SAM, remain challenging. There is continued skepticism that the casualty market has kept up with loss trends for post-2020 accident years.

Market dynamics

Regulatory & litigation trends

State legislatures across the Southeast are advancing tort reform aimed at reducing frivolous litigation, limiting nuclear verdicts and improving transparency around third-party litigation funding. Florida, Georgia and Louisiana have all passed significant legislation impacting bad faith law, premises liability, expert testimony and litigation financing, while South Carolina’s efforts remain under debate. These reforms are expected to reduce legal expenses, stabilize insurance markets and promote fairness, though their long-term impact will take time to measure as new laws are tested in court. You can read our full report on ongoing tort reform efforts here.

Technology & AI

As AI continues to advance, the way we work is changing. Carriers are in various stages of implementing AI into their underwriting workflows which will continue to transform the way in which business is transacted.

Strategic renewal approach

As the market fluctuates, it’s important insureds consider not only price, but a carrier’s financial strength and longevity, as well as their claims handling and long-term track record in the E&S space. Also, be sure to articulate and outline any nuances of certain risks and how they may outperform their peers, especially within tough industry classes.

When looking for additional capacity in a tightening space, considering quota sharing on excess layers is an option. Amwins’ exclusive excess casualty sidecar program offers a collaborative approach, enabling brokers to complete towers while maintaining consistency in terms, conditions and pricing across the shared layer.

London

Overall capacity has increased in London with four new market entrants in 2025. This has led to more business flow and a greater number of bound accounts.

Macro market trends have taken a back seat to industry sector trends. For example, auto and habitational casualty markets are seeing increased rates as capacity continues to retract and restrict terms in those sectors. Conversely, well-performing commercial construction accounts with no losses have begun to see some softening.

The number of MGAs continues to expand, likely a result of capital providers looking to deploy capacity through existing channels and share in the risk. At the same time, fast track/smart follow facilities are also on the rise, providing capital investors not only quick access to market but lower start-up costs.

Bermuda

The Bermuda market continues to provide a strong source of reliable, highly rated casualty capacity. In Q1 2026, there will be 22 casualty insurance markets trading in Bermuda, with two recent new entrants increasing overall capacity. With attachments from as low as $5M, there is now a wider array of capacity in Bermuda than ever before and Bermuda is gradually losing its reputation as a market of last resort.

Rates in Bermuda continue to be robust; we saw average rate increases in the single digit range during 2025. However, there is evidence that these increases are slowing and we expect that trend to continue in 2026. Nevertheless, tough classes such as transportation, public entity, heavy construction, energy and pharma/life sciences, as well as accounts with poor loss experience, can expect to see continued rate increases in the new year.

Markets in Bermuda continue to deploy capacity selectively. Average capacity deployed in 2025 ranged from $5M to $10M and that is expected to remain stable in 2026. Where pricing is very attractive and/or the attachment is high up in the tower, some markets have deployed capacity of $25M or even more. However, these situations tend to be more of an exception than the rule. Aggregate exposure continues to be a big focus and less capacity can be expected where a carrier has a potential exposure to the same loss from multiple clients (e.g., construction risks).

Interest in and demand for captives and other alternative risk transfer solutions, such as structured deals, is growing in Bermuda and is expected to continue – provided rates do not decline in 2026. Many clients have established captives or rent-a-captives as an alternative to guaranteed cost policies or to buy-down increased policy deductibles or fill coverage gaps in their programs. These clients are planning for the longer term where a creative ART solution can be tailored to work in both hard and soft markets.

Be on the lookout

- Many carriers are using AI to increase efficiency in their underwriting processes, utilizing the technology to identify submission opportunities and gather underwriting information prior to completing their review.

Insight provided by:

- Tom Dillon – EVP and Amwins National Casualty Practice Leader

- Tom Graham – Director, Casualty, Amwins Global Risks

- Alan Mooney – CEO, Amwins Bermuda

- Nate Schepers – VP and Amwins Assistant National Casualty Practice Leader

![]()

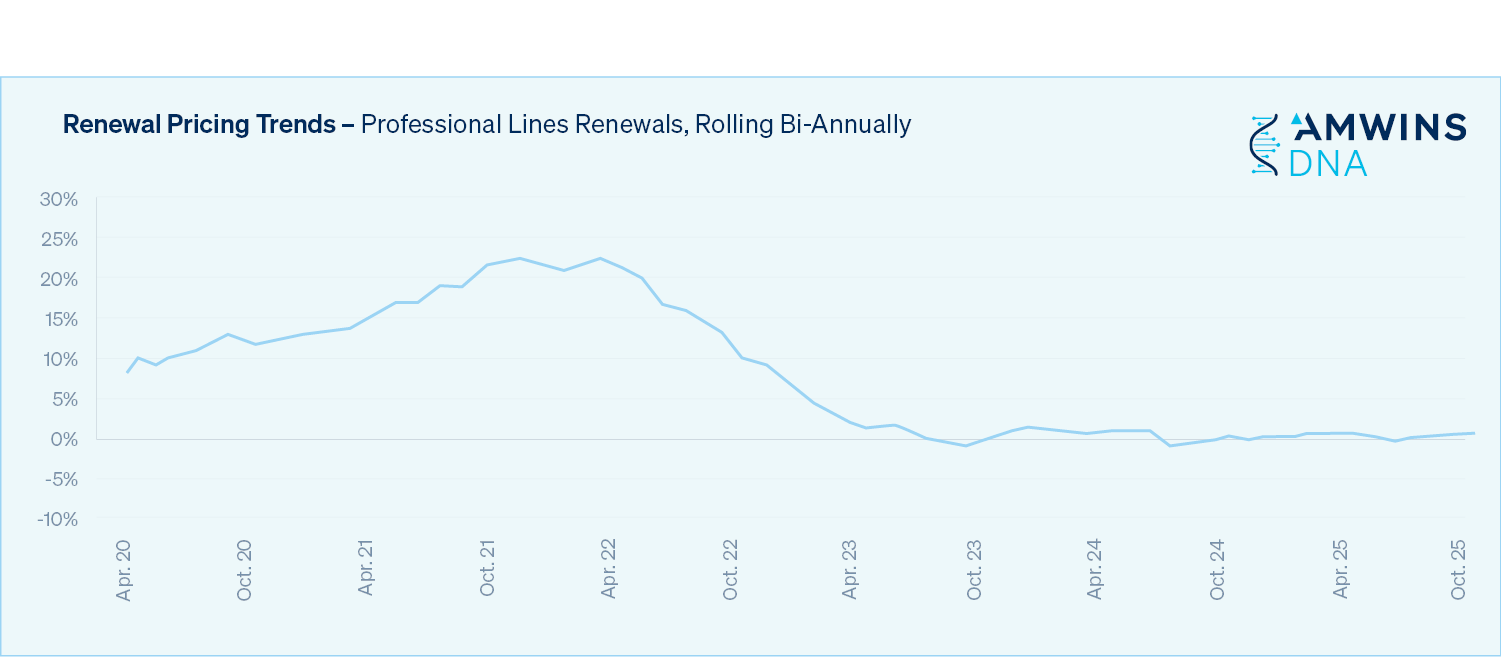

Professional Lines

The professional lines market remains competitive. Policy count is up overall and there are still opportunities to be found. However, it’s important to remember that market cycles and fluctuations affect classes of business differently – and at different times. For example, where the D&O market remains favorable for buyers and is beginning to show early signs of stabilization, capacity remains constrained within the sexual abuse and molestation (SAM) marketplace. When talking to clients, ensure that they know what to expect at renewal.

Broad coverage and ease of doing business are fundamental to meaningful market growth. Carriers continue to stress the importance of relationships – they want to be seen as a long-term viable partner to insureds. And as such, they understand the need for speed in quoting risks and the fact that claims paying experience will factor into an insured’s decision.

Agents/Brokers

The Agents & Brokers E&O market enters 2026 driven by heightened competition and new market entrants. Both traditional carriers and an influx of MGA and insurtech programs are competing aggressively for small to mid-sized accounts, pushing pricing downward and expanding available capacity.

Carriers eager to retain business are offering broader coverage and favorable terms—including defense outside the limits, first-dollar defense, and aggregate retentions without maintenance clauses—often at no additional cost. Excess layers remain active but fragmented, with most carriers still capping participation at $5M due to severity concerns. Larger agents continue to face a limited pool of carriers, with more measured rate decreases.

The most meaningful coverage distinctions in the market continue to center on insolvency exclusions, defense provisions and aggregate retention structures. In certain states, insolvency exclusions are being more tightly scrutinized due to Fair Plan exposures, particularly in California and Florida.

Market dynamics

Regulatory & litigation trends

Despite the soft market, we continue to see claims related to coverage placement errors, clerical mistakes and failure to recommend appropriate coverage. In addition, social inflation and third-party litigation funding continue to elevate claim severity. Extended statutes of limitation for sexual abuse and misconduct claims, particularly against schools, nonprofits and youth organizations, are contributing to unexpected losses. These pressures persist even as rates continue to decline, underscoring the disconnect between pricing and long-tail exposure.

Technology & AI

AI is impacting the agent E&O landscape as carriers, MGAs and program administrators increasingly use AI in customer service, marketing and risk and policy analysis. This creates not only new efficiencies, but also new exposures. Agents employing AI-driven advice tools or outsourcing back-office functions face potential cybersecurity and data privacy risks, expanding what must be covered under an E&O policy.

Strategic renewal approach

Retail agents should start renewals early and engage experienced E&O specialists. With many markets competing on price, expertise and coverage precision matter more than ever. Manuscript forms tailored to an agency’s operations remain essential to avoid unintended gaps, particularly for larger firms.

The London Market has become increasingly active in Agents & Brokers E&O, particularly for excess placements and complex risks. Syndicates are demonstrating renewed appetite for professional liability, often stepping in to fill higher layers where U.S. carriers are conservative. London’s creative underwriting and ability to craft bespoke policy language continue to provide critical capacity, especially for large brokers or retail agencies with unique exposures.

Be on the lookout

- While the current market is characterized by broadening coverage terms and increased competition, carriers are approaching absolute exclusions (i.e., those related to employment practices, ERISA, bodily injury and property damage) differently. These exclusions, when applied without careful modification, can unintentionally narrow coverage for the very professional services that E&O insurance is intended to protect.

Insight provided by:

- Bill Dixon, EVP, Amwins Brokerage

- Sam Little, SVP, Amwins Brokerage

- Karen Lombardo, Managing Director, Business Risk Partners

- Steve Vallone, EVP, Amwins Brokerage

FI/Asset Managers

The asset management insurance sector is experiencing a controlled transition as we look towards 2026. Legal, technological and regulatory factors continue to influence carriers as they focus on expanding into underserved markets, prioritize product innovation and leverage data to optimize underwriting and risk assessment. Elevated loss activity in segments such as private equity is creating isolated pockets of capacity constraint, highlighting the importance of targeted program design.

Capacity and pricing

With strong carrier appetite and a flurry of new entrants—including established markets debuting new primary forms and startup MGAs—the asset management space is benefitting from best-in-class, loss-free accounts and seeing flat or even reduced rates, especially within primary and lower excess layers.

That said, competition is intense, and renewal retention is driving aggressive pricing behavior. Accounts with distressed profiles—defined by adverse loss history or higher-risk strategies (e.g., credit, lending, or crypto)—may face rate increases, tighter terms and higher retentions. Many markets have signaled less flexibility for private equity risks given overall loss trends. Lower limits and higher retentions are increasingly common, and building larger towers has become more challenging and expensive as excess layers increase rate factors.

We anticipate the competitive landscape will continue, particularly for clean accounts, while insurers will likely continue seeking higher retentions and narrower coverage grants for more complex or loss-affected risks, especially within primary placements.

Coverage limitations and underwriting

Despite increasing capacity, underwriting appetites are tightening in certain areas. Carriers are requiring insureds to retain more risk, especially for firms with heightened exposures or unfavorable claims experience. Excess layers remain broadly available, but policy language continues to evolve to address emerging risks such as digital assets, crypto and technology-driven exposures.

Heading into renewals, it’s important to:

- Prepare for potential higher retentions on primary placements, especially for private equity risks.

- Highlight compliance readiness for new regulations (e.g., SEC Private Fund Adviser Rules) to demonstrate how firms have addressed them.

- Focus on program structure improvements beyond price; coverage refinements remain an effective differentiator.

- Recognize that firms with significant crypto exposure still face limited market appetite, often resulting in elevated premiums and retentions.

Market dynamics

Regulatory & litigation trends

Increased regulatory scrutiny, expanded disclosure requirements and an active plaintiff bar are driving claims severity and loss costs. The phase-in of the SEC Private Fund Adviser Rules is expected to trigger additional inquiries and enforcement actions now through 2026, adding to already elevated defense cost trends driven by social inflation.

Industry consolidation & launch activity

The asset management industry is experiencing simultaneous consolidation and expansion. PwC projects 16% of asset and wealth management firms will be acquired or shuttered by the end of 2027, with M&A activity exceeding $5.7B in 2025. At the same time, thousands of new funds and managers launch annually, particularly in alternatives, ETFs and crypto. The U.S. leads in volume, Europe emphasizes private equity and APAC drives growth through retail demand and pension reform.

Technology & AI

Carriers are increasingly adopting AI-driven underwriting and claims tools. For insureds, this raises expectations for data transparency, governance and robust cyber controls. Firms with well-documented systems and model oversight are best positioned for favorable underwriting outcomes.

Emerging risks

As we head into 2026, systemic exposures may intensify. Cyber, ESG and reputational harm continue to be key drivers of loss frequency and severity. Coverage lag in fast-evolving spaces such as crypto, digital assets and AI, where policy language may not fully capture emerging risks, remains a critical area to monitor.

Strategic renewal approach

Success in the 2026 market will hinge on delivering well-documented, transparent and organized submissions. Engage early with incumbent carriers and new entrants, review limits, deductibles and policy language and seek opportunities to enhance program structure. Assessing the claims-paying reliability, financial strength and service track record of emerging carriers will also be key.

Be on the lookout

- Coverage may continue to narrow, particularly in excess placements, as underwriters reassess exposures related to crypto, private equity and ESG.

- Consolidation remains a defining theme, with heightened M&A activity anticipated as subscale firms face pressures from fees, technology requirements and regulatory expectations.

- AI adoption is reshaping underwriting and claims processes, enabling participants to leverage more advanced data capabilities.

- Globally, increased ETF and active fund launches are expected across APAC and Europe, while the U.S. maintains its leadership.

Insight provided by:

- Andrew Pritchard, EVP, Amwins Brokerage

- Jenny Fraser, VP, Amwins Brokerage

D&O

Following several years of aggressive competition and rate erosion, the D&O marketplace remains favorable for buyers but is beginning to show early signs of stabilization. Capacity remains abundant across all segments, drawing new entrants and keeping terms competitive.

While market conditions continue to favor insureds, brokers are turning their attention from price to protection, leveraging the current environment to secure broader terms and maximize value for clients. However, carriers appear increasingly cautious as regulatory scrutiny intensifies and financial pressures mount.

Capacity and pricing

The D&O marketplace is showing signs of stabilization as the prolonged period of rate reductions reaches its floor. While an abundance of capacity continues, particularly across private, nonprofit and smaller public company segments, flat renewals are becoming the norm as carriers attempt to hold firm on pricing.

Despite isolated exits and adjustments from other insurers, new MGAs, insurtechs and carriers continue to enter the space, keeping competition strong and premiums low. Brokers report limits being marketed aggressively, with $10M placements increasingly common, further compressing demand across D&O towers. Many believe the market is approaching an unsustainably low pricing level, suggesting potential for firming if claims activity or regulatory enforcement increases in 2026.

Coverage limitations and underwriting

Coverage remains broad, but underwriting practices are tightening in response to financial stress and increased insolvency risk. Carriers are introducing bankruptcy, insolvency and creditor exclusions for financially challenged insureds, which can be particularly problematic in today’s environment.

Underwriters also continue to show caution on regulatory and antitrust coverage, especially in healthcare, government contracting and dominant market positions. Some are introducing consumer protection or cyber exclusions and employing sublimits in sensitive classes.

On the positive side, competition is still enabling brokers to expand terms, especially for buyers represented by knowledgeable intermediaries who are pushing for coverage enhancements. Amwins’ proprietary solutions, including the Amwins Portco form, continue to stand out in this environment.

Market dynamics

Regulatory & litigation trends

Regulatory oversight continues to evolve, with the SEC and Department of Justice expanding scrutiny around AI-related disclosures, cybersecurity and ESG (or “greenwashing”) claims. Enforcement in these areas is expected to increase into 2026, influencing both underwriting appetite and retention levels.

Agencies, including the Equal Employment Opportunity Commission (EEOC), Department of Labor, National Labor Relations Board (NLRB) and FCC are also shifting enforcement priorities, creating uncertainty for corporate boards and insurers alike.

Third-party litigation funding and social inflation remain key drivers of rising defense and settlement costs, particularly in the public company D&O segment.

Technology & AI

Artificial intelligence is emerging as both a tool and a risk driver. Brokers are seeing increased concern around what many are referring to as “AI washing,” when companies overstate their AI capabilities which could lead to potential misrepresentation claims.

Retailers should ensure that D&O policies do not inadvertently exclude AI-related exposures under technology or cyber exclusions. Coordinating D&O and cyber programs is critical to prevent coverage gaps as these claims develop.

Emerging risks

Macroeconomic pressures, including persistent inflation, tariffs and tightening credit markets, are increasing financial stress across industries and leading to more bankruptcies and restructuring activity. These developments heighten the importance of proactive coverage management, particularly obtaining broad Side A protection early.

Strategic renewal approach

As the market begins to level out, retailers should focus on leveraging competition to enhance coverage, not just lower premiums. Flat or modestly reduced pricing creates opportunities to improve policy breadth, especially around Side A protection, insolvency language and regulatory coverage.

Amwins’ depth of market relationships and proprietary solutions—including its broad Side A DIC form backed by A+ MSIG paper—equip retailers to deliver strong value even as rate decreases slow. Early engagement and collaboration with experienced D&O specialists remain key to navigating distressed accounts and securing optimal protection before financial conditions deteriorate.

Be on the lookout

- The market is showing signs of pricing stabilization, as carriers resist further reductions and flat renewals become the norm.

- Some insureds are beginning to use AI tools to review their D&O policies, often generating inaccurate or misleading interpretations. Retailers should be aware of this trend and engage your broker if clients raise questions or concerns based on AI-generated policy analyses.

Insight provided by:

- Aileen Spiker Berry, EVP, Amwins Brokerage

- Corey Turner, SVP, Amwins Brokerage

- Dom Calcott, Director, Amwins Global Risks

- Jamie Taylor, VP, Amwins Brokerage

- Joe Robuck, EVP, Amwins Brokerage

- Philip Collins, EVP, Amwins Brokerage

- Scott Misson, EVP, Amwins Special Risk Underwriters

- Seth Brickman, Managing Director, Business Risk Partners

EPL

The EPL market remains active and complex, characterized by open capacity and heightened underwriting scrutiny. Navigating the intricacies of technological advancements throughout HR processes, steady claim frequency and social inflation make EPL a line to watch closely through 2026.

Capacity and pricing

Capacity remains generally available, supported by new entrants and competitive pressure. However, carriers are more selective in higher-risk states (CA, NY, IL) and industries such as technology, hospitality and healthcare. Persistent claim frequency, particularly in wage and hour (W&H), DEI, discrimination, harassment and wrongful termination cases, is keeping rates and SIRs relatively flat, despite an abundance of capacity. Some placements require strategically structuring primary and excess layers, offering sublimits on primary policies with dropdown sublimits on excess. Renewals often prompt marketing activity, keeping the marketplace fluid but cautious.

Coverage limitations and underwriting

W&H coverage continues to be heavily restricted, especially in California, with limited and costly options. Markets are tightening exclusions around WARN Act coverage, biometric privacy and pay transparency obligations. An increase in underwriting scrutiny adds an additional challenge, as the focus is primarily on prior EPL claims, HR practices, employee handbooks, training programs and compliance with state-specific employment laws. Employers with multi-state operations may face separate retentions or sublimit structuring to manage risk effectively.

Market dynamics

Regulatory & litigation trends

State and federal legislative changes are reshaping EPL exposures, with notable drivers including wage transparency, pay equity, biometric privacy, AI in hiring and the Pregnant Workers Fairness Act. California’s complex labor laws and high claim payouts continue to challenge carriers while across the country, social inflation and third-party litigation funding are increasing verdict sizes and settlement amounts, often resulting in nuclear verdicts. Mass layoffs, coupled with regulatory change, are also doing their part to contribute to higher risk scrutiny.

AI and emerging workforce risks

The increasing use of AI and automation in hiring, performance management and HR processes introduces new EPL exposures. Algorithmic bias and lack of transparency in automated systems can result in discrimination claims. As a result, some states, including Colorado and Illinois, have required AI bias audits, and the EEOC has flagged algorithmic bias as an enforcement priority.

These technology-driven risks are also having an impact on workforce structures. Hybrid and remote work models may create disparities between employees, raising privacy, equity and compliance concerns. Beyond that, mass layoffs and reliance on AI or automation increase potential claims in W&H, discrimination and wrongful termination. Together, these factors make proactive compliance, monitoring and strategic policy structuring essential to mitigating EPL exposures.

Strategic renewal approach

For upcoming renewals, carriers and brokers should focus on early engagement with clients, clear communication about exposure changes and proactive compliance measures. Key strategies include:

- Reviewing prior claims and HR practices before renewal discussions.

- Monitoring state-specific regulatory changes to anticipate coverage or premium adjustments.

- Considering separate state retentions and primary/excess sublimit structuring.

- Advising clients on proactive risk management, including updated handbooks, AI audits, training programs and documentation of layoffs or employment decisions.

- Providing details of remedial actions significantly increases the chances of receiving competitive terms for clients that have experienced prior claims.

These measures help mitigate surprises at renewal and maintain competitive placement in challenging markets.

Insight provided by:

- Christina Allen, VP, Amwins Bermuda

- Cindy Brandt, SVP, Amwins Brokerage

- Joe Robuck, EVP, Amwins Brokerage

- Kendall Bundy, VP, Amwins Brokerage

- Kirsty Mitchell, Divisional Director, Amwins Global Risks

- Matt Wischnowsky, VP, Amwins Brokerage

Lawyers Professional Liability (LPL)

The lawyers professional liability (LPL) market remains decisively soft, with an abundance of capacity. There are currently more than 60 markets actively writing coverage and new entrants continue to emerge. Carriers are competing aggressively to hit growth targets, often offering lower rates and enhanced limits.

Small firms remain highly competitive. Mid-size firms (25 to 100 attorneys) are seeing small to mid-single-digit rate decreases and expanded admitted options. Large firms (100+ attorneys) are seeing more stable pricing, with most markets looking for some level of inflationary rate increases unless claims experience dictates otherwise. Excess pricing remains favorable, with layers often priced at 35% to 40% of the underlying, and in some cases, deals as low as $2,000 per million.

Coverage limitations and underwriting

We are seeing aggressive underwriting across the market, with carriers offering expanded eligibility and coverage, including coverage for cannabis-related work and even for non-attorney paraprofessionals in certain states. However, most carriers either sublimit or exclude cyber entirely, with a particular focus on excluding coverage for loss of client funds through a breach or social engineering attack. The best practice is for insureds to purchase standalone cyber coverage.

Market dynamics

Regulatory & litigation trends

Social inflation and rising defense costs are pushing claim severity upward, particularly for large firms, with several settlements exceeding $100M in recent years. Litigation funding is also fueling claims that might not otherwise proceed. Meanwhile, regulatory activity creates additional work opportunity for attorneys as businesses navigate continued uncertainty, particularly around tariffs.

Technology & AI

Generative AI (GenAI) represents both opportunity and risk. From contract review to legal research, law firms are adopting AI tools at accelerating rates. However, improper use has led to real-world sanctions and reputational damage (e.g., legal briefs containing “hallucinated” cases).

Emerging risks

Exposures tied to cryptocurrency, Know Your Client/Anti-Money Laundering lapses and vendor contract indemnities are drawing increasing scrutiny. Some tech vendors have even inserted clauses allowing use of client data for AI model training, creating potential confidentiality and professional liability breaches.

London

Overall, competition remains strong across the segment and London continues to play an important role, particularly in large firm and high excess placements. Capacity is tightening modestly on higher layers following a series of large losses; however, there is increased insurer appetite combined with modest premium reductions following several hard-market years.

Be on the lookout

- Cyber exclusions are tightening, and standalone coverage remains essential. However, we are seeing expanded admitted appetites for previously hard-to-place classes (IP, ETP, bankruptcy).

- As ethics opinions evolve, firms must ensure human oversight and stay current with state bar guidance.

- Carriers are not yet routinely asking about AI use, but that will likely change.

- In this soft market, strategic discipline is key. Retailers should focus on preserving coverage continuity and avoiding short-term savings that could lead to long-term exposure gaps.

Insight provided by:

- David W. Collins, Esq., SVP, Amwins Program Underwriters, Inc.

- Bill Schmitt, SVP, Amwins Brokerage

- John Muller, SVP, Risksmith Insurance Services, LLC

![]()

AI

The Ongoing Impact of AI on How We Do Business

Artificial intelligence (AI) is changing the way we all work and is reshaping the insurance ecosystem more rapidly than any innovation in recent memory. From underwriting to claims to customer experience, AI is transforming how risks are evaluated, how brokers work and how insureds expect to be served. For brokers, this shift isn’t just technological, it’s strategic. The firms that embrace AI will operate with more accuracy, more speed and more insight, reshaping the value they deliver to clients.

Driving productivity

AI has the power to process vast amounts of information, recognize patterns and streamline decision-making. These advanced analytics can help organizations make data-driven decisions, anticipate market shifts and create products and services to meet individual customer needs. And as the technology continues to evolve, it will influence how businesses compete and create value.

Amwins understands this opportunity and is committed to investing in not only the technology itself, but the people who use it. We believe that AI enhances our team, making us more productive and efficient, without changing the core of how we do business or the relationships that drive our success.

Amwins’ investment in AI

Amwins has prioritized data and analytics since our founding. It’s part of who we are. Whether it’s Amlink, our enterprise management system used to manage accounts and maintain client information or Amwins IQ, our retailer facing quoting portal that targets small and middle market accounts, we have always invested in technology that strengthens the specialty placement process.

Our ongoing, significant investment into AI builds on this foundation and supports the continued development of these proprietary solutions. Our in-house data scientists are working in partnership with our business leaders to tackle complex, firm-wide opportunities that redefine how we approach wholesale broking and underwriting – operationalizing AI so we can work smarter, not harder, and deliver more value to our clients.

Amwins DNA

The industry’s most in-depth collection of E&S insurance information, Amwins DNA is foundational to how we support our colleagues, retail clients and market partners. It also serves as the backbone to our AI-driven solutions. The sheer volume of data available through Amwins DNA helps us:

- Understand the risk appetite of our market partners for better placement decisions.

- Provide client deliverables, such as coverage benchmarking, to equip our clients with knowledge and tools that their insureds will value.

- Efficiently identify expertise within our firm to help ensure that risks are matched with the right specialists and markets.

Where most companies must look externally to provide the necessary data to help build their infrastructure, Amwins already has it. This strong and stable data ecosystem enables our data scientists to do what they do best: – analyze data, build smarter tools and enhance the user experience for brokers, underwriters and retailers.

It also allows our team to provide unique solutions for your clients. Have a challenging account that needs specific coverage? AI enables us to quickly search millions of policy documents and submissions to find relevant examples and potential solutions for the insured.

Unlike 95% of enterprises that struggle to integrate AI tools in their workflows, Amwins is using AI to bring the collective knowledge of the firm to support a single client, – further differentiating us and you from the competition.

Proprietary AI tools

Amwins provides all our colleagues with access to the best AI tools, resources and processes to take the friction out of our workday. That means faster research, smoother workflows and more time to focus on what matters most.

- AmChat is a proprietary general-purpose AI tool that enables brokers and underwriters to make quote comparisons, extract loss run data and get started using AI quickly and easily. Unlike other enterprise-grade systems that see only about a 5% production rate, our system offers contextual learning and alignment with day-to-day operations.

- Property market selection tools give our brokers the distinct ability to quickly identify markets with aligned risk appetite.

- AI-enabled workflows mean better service for our clients and more capacity for our teams. These workflows operate 37 times faster than manual processes, increasing efficiency and productivity.

Enabling everyday tasks

According to the recent MIT NANDA report, The GENAI Divide, while more than 80% of organizations have explored or piloted tools like ChatGPT and Copilot, only 40% report deployment. Amwins is in that 40%.

Across the organization, Amwins is weaving AI into the routine tasks that shape our daily workflow. From summarizing complex submissions to quickly locating historical account activity to drafting clear, client-ready communications, AI helps our teams work with greater speed and precision.

These enhancements don’t replace expertise, — they amplify it. By removing administrative friction and giving colleagues instant access to insights that once took hours to find, AI allows our brokers and underwriters to stay focused on the strategic, relationship-driven work that defines our value.

Market dynamics

New technology exposes new risks. As a result, many carriers have moved to restrict or exclude AI-related losses. Verisk’s Core Lines Services has developed and submitted standard exclusion policy language across multiple states that will become effective January 1, 2026. It remains to be seen if insurers that have authorized Verisk to make filings on their behalf will adopt this exclusionary language. The same can be said for the insurers that have made similar filings with state insurance departments.

When the potential for broad exclusionary endorsements is combined with the fact that definitions for AI and GenAI can vary and are often inconsistent, companies taking advantage of AI in back-office efficiencies as well as product development will likely be faced with gaps in coverage. In response, a new specialty class of business designed to close these gaps has emerged.

The E&S/wholesale market, – with its greater flexibility to react quickly to new and changing markets, – is offering policies designed to tackle not only liability coverage, but the inherent exposure that comes through third parties as well as misuse and misappropriation of data. It is widely expected that these initial policies will evolve to provide coverage for algorithmic failures, bias in data and autonomous system failures.

London

While the market continues to struggle with just how to address the challenges AI presents overall, we are starting to see some carriers roll out tailored coverages.

Broadly, AI-adjacent risks among insureds providing services such as workflow automation remain difficult to place in London. Because of the significant exposure many professional services companies face, premiums and retentions are high.

More specifically, AI companies themselves are the area most markets shy away from as privacy and intellectual property (IP) exposures can be hard to quantify from an underwriting standpoint. The ongoing uncertainty around who owns the IP in AI-generated outputs also complicates matters.

Be on the lookout

- Demand for AI coverage is clearly growing and underwriters are devoting more resources toward understanding the exposure, taking a more forward-looking stance on coverages.

- Many existing programs still appear to lack the needed substance to provide insureds with the real innovation required by these emerging risks, but we are watching closely and expect to see further developments over the next 12 months.

Insight provided by:

- Michael DeGusta, Chief Technology Officer, Amwins

- Ashley Kaiser, SVP of Strategy, Amwins

- Oche Ojabo, Sr. Broker, Amwins Global Risks

![]()

Economic Overview

The U.S. economy is entering 2026 in a fog of mixed signals. Delayed government data due to the U.S. shutdown, elevated inflation and rising unemployment rates have added uncertainty to the outlook. The Federal Reserve has been lowering interest rates slowly. But with U.S. consumer inflation at 3%, it remains above the Fed’s 2% target (even if it is sharply lower than the 9.1% year-on-year rate in June 2022).

Interest rates are still high by historical standards, and the Fed’s gradual easing is creating uneven outcomes across major sectors. Unless interest rates begin to fall more significantly, the housing market is at growing risk of stagnation.

The labor market remains strong, with unemployment still consistent with near full-employment dynamics. But payroll gains have slowed drastically over the past two years. Elevated borrowing costs and slowing job growth seem likely to keep pressure on home prices and multifamily rents, especially as more supply enters the market.

Policy uncertainty is likely to remain the major theme in the year ahead. Following the uncertainties of 2025, trade, tariffs, immigration rules and geopolitical flashpoints in Cold War Two are poised to continue influencing business decisions. These risks complicate capital planning. However, they are also accelerating long-term structural changes like U.S. reindustrialization for a wartime-ready economy that could support U.S. economic growth, including reshoring, nearshoring and investments in supply chain resilience.

Geopolitical and economic security priorities are reshaping U.S. corporate strategies, with countless companies across sectors building redundancy, regionalizing production and expanding automation and AI use to drive productivity gains.

Overall, the outlook for 2026 is one of cautious optimism. Inflation is moving in the right direction, labor markets remain on a relatively positive footing and gradual Fed interest rate cuts could support some improvements in sentiment. Firms that maintain fiscal discipline, embrace AI and align with emerging industrial policy priorities will likely be best positioned to capture new opportunities in the year ahead.

Insight provided by:

- Jason Schenker, President of Prestige Economics and Chairman of The Futurist Institute

![]()

Reinsurance

The reinsurance market is navigating a period of adjustment following several years of volatility. While competition has intensified amid abundant capacity, the market appears to be finding its footing, with signs that recent rate decreases may begin to level off as renewal season approaches.

Capacity and pricing

Signs of stabilization following a period of notable softening continue with ample capacity available across both traditional and alternative capital sources. Reinsurers are deploying larger line sizes and showing greater flexibility, particularly in high excess layers with limited CAT exposure. This has reduced the need for multiple participants to complete placements, streamlining the process for cedants and brokers alike.

While rate decreases have persisted, they are trending toward moderation. Following the substantial 30% to 40% reductions seen earlier in the cycle, we anticipate that any continued downward movement will likely slow to 10% to 15%, assuming no major global catastrophe events occur. The competitive environment has also encouraged admitted carriers to revisit previously restricted classes, offering larger sublimits and reengaging with risks they had stepped away from, such as food processing and manufacturing exposures.

While reinsurers continue to compete on both price and terms, the pace of softening is expected to ease as treaty renewals approach and market discipline reasserts itself.

Coverage limitations and underwriting

Underwriting standards have loosened modestly, though reinsurers remain cautious in high hazard zones prone to convective storms, wildfires and flooding. Many are employing refined underwriting models and selective deductibles to manage exposure, most notably wildfire and water damage deductibles. The market is also seeing more nuanced valuation approaches, including shifts between replacement cost and actual cash value for roofs and other property elements.

Beyond property, reinsurers maintain a disciplined stance on terms and conditions, with underwriting difficulty still high for risks exposed to secondary perils, now considered primary by many due to loss frequency. Continued emphasis on engineered risk documentation and detailed data remains essential for securing competitive placements.

Market dynamics

An influx of capacity and new market entrants, including MGAs and fronting carriers with lower cost-of-capital models, has intensified competition. This has enabled insureds and brokers to drive placements, reversing the leverage reinsurers held during the hard market period.

In certain regions, capacity withdrawals from admitted markets, particularly in states heavily affected by convective and wildfire losses, have created opportunities for E&S carriers and reinsurance-backed structures to fill the gap. As a result, facultative and treaty reinsurance have become increasingly important tools to support growth and stability in these transitioning segments.

Regulatory & litigation trends

Globally, regulatory changes have had limited direct impact on reinsurance terms to date, though reinsurers are closely watching evolving solvency and capital adequacy requirements that may affect underwriting appetite. In the U.S., litigation funding and social inflation continue to pressure underlying carriers; however, these trends have not yet materially altered reinsurance structures.

Economic conditions remain a key factor. Inflationary pressures and rising tariffs are indirectly influencing claim costs, as material and labor expenses increase the ultimate severity of losses. Should investment returns weaken, reinsurers may reevaluate their portfolios, potentially tightening capacity or reassessing pricing models.

Emerging risks

Global reinsurers remain attuned to evolving exposures across cyber, terrorism and climate-related perils. Cyber and terrorism protections are seeing broader adoption in both mature and developing markets, reflecting heightened awareness of systemic risks and geopolitical volatility.

Additionally, flood risk remains a major concern as climate change alters loss patterns. Increased frequency and severity of convective storms and wildfires that were once considered secondary perils are reshaping portfolio strategies and pricing models. As these risks evolve, reinsurers are deploying sophisticated modeling and diversifying structures to maintain resilience.

Strategic renewal approach

With competition at its peak, the renewal landscape demands a thoughtful and strategic approach. Creativity in structuring, such as layering adjustments, refreshed primaries or introducing new participants to placements can yield significant benefits. Understanding which markets are deploying net versus treaty capacity can also uncover opportunities for improved pricing and efficiency.

The key to success in this environment lies in collaboration. Partnering with Amwins Re and leveraging our wholesale brokerage network enables clients to present a unified front to the market, maximizing leverage, insight and execution power. Engineered, well-documented risks will continue to see the best results, as reinsurers prioritize clarity and completeness in underwriting data.

London

The first half of 2025 presented significant challenges for the London Market. As rates declined more sharply than expected, major reinsurers that are often slower to respond to market fluctuations faced pressure to maintain renewal levels amid intense competition. Many London participants, still focused on higher-margin direct business, were hesitant to deploy reinsurance capacity, tightening available options for cedants early in the year.

Securing new opportunities has proved difficult, as incumbent direct insurers, both in London and the U.S., aggressively cut rates to retain renewals. Unless terms are particularly competitive, new entrants have struggled to establish meaningful shares. In many cases, cedants have opted to retain smaller participations rather than cede them, limiting facultative deal flow.

As the year has progressed, a more pragmatic tone has emerged. Direct insurers are increasingly recognizing the importance of reinsurance flexibility to support both renewal retention and growth. Shorter primary layers and buffer excess layers have become less common, with direct placements stretching to higher limits. This has created opportunities for reinsurers to participate in broader, more attractive layers or for cedants to adopt a “write and buy” approach, using facultative protection to manage net retentions.

As hurricane activity remained subdued through the end of 2025, London’s facultative market may see a stronger close to the year and a more balanced renewal season in 2026, driven by a renewed appetite for both writing and purchasing facultative protection.

Insight provided by:

- Jennifer Keefe, VP Marketing, Amwins Re

- Nigel Fearon, Director, Amwins Global Risks

- Tom Jakob, Director, Amwins Global Risks

![]()

Construction

Builder’s Risk

The builder’s risk insurance market is feeling the effects of evolving risk profiles and significant capacity expansion. Rate softening is widespread and expected to continue, driven by heightened competition and hesitation among developers facing tighter margins and macroeconomic headwinds.

Rates and project activity have been at an all-time high over the past several years, with some carriers seeking to deploy capital through MGAs in a bid to join an attractive market landscape. As a result, carriers are now relying on the specialized underwriting expertise of MGAs and their operational agility to strengthen market presence.

You can read more about the state of the builder’s risk insurance market here.

Market dynamics

Regional trends

Florida has shown meaningful improvement in capacity and deal structure, while markets like Louisiana remain difficult due to legal and litigation-related concerns. The Southeast and Gulf Coast are beginning to see pricing recalibration. In the West, demand remains steady, but high replacement cost valuation and CAT exposure continue to pressure both carriers and insureds. In the Northeast and Midwest, competitive conditions have returned more quickly, though carriers are still prioritizing risk quality and deal structure over volume.

Technology & AI

Loss prevention technology continues to be a key factor in risk assessment. Developers incorporating water flow detection systems, AI-powered security platforms and damage mitigation tools are increasingly viewed as higher-quality risks.

Builder’s risk underwriters are also beginning to consider the implications of digital construction management platforms, smart sensor integration and even early-stage adoption of digital twin technology. These tools offer real-time monitoring, predictive analytics and enhanced transparency—creating opportunities for more proactive risk engineering and claims response.

Emerging risks

Another emerging trend is the growth of modular and prefabricated construction. These approaches can offer cost and time efficiencies but may introduce new risk considerations during transport, assembly or structural integration.

Casualty

The construction casualty market remains firm but fragmented. Primary coverage continues to benefit from consistent capacity and manageable pricing pressure, seeing flat to single-digit rate increases. Excess underwriters, on the other hand, are broadly seeking rate increases between 7% and 15% (with spikes above 20% for distressed risks). Clean accounts can still secure favorable terms, but even these are being priced more conservatively.

Capacity remains available but is being deployed selectively. Carriers are pulling back on limits, tightening per-project aggregates and maintaining a firm stance on exclusions. There is room, however, for negotiation when creative program structures, alternative markets and clear risk mitigation strategies are brought to the table.

Creative program structures are becoming essential with solutions such as quota shares, bifurcated towers and captive layers to help manage costs and ensure adequate coverage. These approaches can improve placement options, increase participation from facultative markets and make it easier to replace capacity when needed.

You can read more about the state of the casualty construction insurance market here.

Market dynamics

Regional and class-specific trends

Commercial construction is seeing ample capacity and competitive pricing, especially for clean, well-managed accounts. Project-specific general liability (GL) programs, including GL-only wrap-ups, are also maintaining traction, particularly in the E&S market.

Conversely, for-sale residential construction in construction defect states (including Florida, California, Colorado, etc.) and auto-heavy civil construction projects continue to see limited appetite and steep pricing. Fleet exposure, especially in markets like Texas, Georgia and California, is a major concern.

Despite anticipated casualty market improvements resulting from tort reform, Florida markets in the for-sale space are either leaving the state completely or pushing rate to levels not seen since 2005/2006 and driving capacity down. Claims during the actual course of construction have also been higher than expected and completed operations claims are still being aggressively litigated by the plaintiff bar.

In New York, there’s stiff competition among retailers looking for creative solutions in what has become an evolving market. Insureds are looking for lower premiums and some direct markets are offering lower pricing on the supported lead umbrella in response. At the same time, some E&S carriers are still looking for rate on clean accounts; however, they are the exception not the norm.

Regulatory & litigation trends

Litigation hotspots are shifting with smaller venues like Cook County, IL drawing concern due to escalating verdicts and litigation trends. Even accounts with clean histories face increased scrutiny based on jurisdiction alone.

Professional lines

The professional lines market remains stable and competitive, with increasing capacity from more traditional E&O carriers and MGAs, as well as more traditional environmental markets that are expanding coverage into the contractors E&O space. Premiums on accounts with typical risks and no claims issues are flat to down slightly. More challenging risks (e.g., geotech, roads/bridges and residential) may see higher rates.

Underwriters in the space are managing capacity on tougher projects and challenging jurisdictions, including New York, Florida and Texas. Difficult classes include condos, New York risks, geotechnical and roads/bridges. Brokers are having to become somewhat creative to get terms in these classes/venues, offering alternative structures to traditional risks (i.e., quota sharing).

Other notable changes include an increasing demand for coverage enhancements and ongoing requests for faulty workmanship and rectification coverages. While we are seeing more carriers offer these grants, it’s important to note that all policy language is not created equal and should be thoroughly vetted rather than taking a simplified checklist approach so as not to mislead and expose the agency to potential E&O claims.

The same can be said when it comes to defining professional services. The definition should be scrutinized and compared to the contract as this coverage is often purchased according to contractual requirements. Many times, the definitions do not line up with the duties and obligations that are strictly required under the contract, resulting in coverage gaps for the general contractor and subcontractors alike.

Social inflation continues to play a key role in the market, as do the economic impacts on the cost of goods. However, if interest rates continue to ease, we expect there will be an uptick in project starts heading into 2026 and beyond.

From our underwriters

Underwriting discipline remains strong. Carriers are becoming increasingly selective, gravitating toward high-quality risks and exercising caution in more challenging geographies and project types. There is an overall reticence on the part of the carrier for total limits, including excess – especially where auto coverage is involved.

There may be instances where underwriters are willing to fight for better term conditions; however, technical underwriting standards are not being relaxed despite the flood of new capacity entrants in the builders’ risk marketplace. And we continue to see some carriers reduce limits in excess.

Builder’s risk coverage is also evolving. Some insurers are offering broader language, especially around exclusions like construction defects, but those provisions often fall short on actual protection. At the same time, thinner project margins and higher interest rates have increased the stakes. As construction timelines stretch, questions around claims handling (particularly during mid-project transitions) are gaining importance.

London

The U.S. construction insurance market has experienced a notable expansion in capacity, largely due to the activity of domestic insurers and MGAs. This development presents challenges for the London Market, which has observed a similar increase in capacity over the past 12 months. When combined with declining premiums and deductibles, as well as relatively low loss activity during the previous year, U.S. carriers have had to reduce their dependence on international markets.

One emerging trend we are seeing is the pressure many carriers are facing to limit exclusions, particularly when it comes to defects coverage on renovation projects involving existing properties. Where it was once standard to quote only the renovated property, expanding protection to the existing structure is becoming increasingly popular.

Given these current market conditions, clients may wish to consider securing period extensions at the time of binding. This strategy could enable them to lock in favorable rates and mitigate the risk of higher costs should market conditions tighten in the future.

Be on the lookout

- Private equity activity continues to shape the casualty market. Roll-up acquisitions have become common, especially in HVAC and plumbing, resulting in large, complex accounts with rapidly growing exposures and limited historical loss data. These insurance programs often require flexible structures and a strong integration strategy to maintain underwriting stability.

- In response to the premium-to-limit imbalance many large accounts face, the market is seeing increased use of structured and fronted programs.

- One notable innovation in the casualty marketplace is the rollout of Amwins’ excess casualty sidecar program. This exclusive product, available only through Amwins brokers, offers follow-form excess liability on a quota-share basis.

Insight provided by:

- Jett Abramson, EVP, Amwins Brokerage

- Matt Andrews, Sr. Managing Director, Amwins Program Underwriters

- Rob Best, Associate Director, Amwins Program Underwriters

- Shannon Campbell, EVP, Amwins Brokerage

- Grant Chiles, EVP, Amwins Brokerage

- TJ Collins, EVP, Amwins Brokerage

- Nick DelVino, EVP, Amwins Brokerage

- David Dow, EVP, Amwins Brokerage

- Brett Fowler, VP, Amwins Program Underwriters

- Liz Goldie, SVP, Amwins Brokerage

- Brooke Jenkins, SVP, Amwins Special Risk Underwriters

- Scott Jensen, EVP, Amwins Brokerage

- Gary Keenan, Managing Director, Amwins Global Risks

- Rachel Lindsey, AVP, Amwins Brokerage

- Kerry Pecora, VP, Amwins Special Risk Underwriters

- Gary Ricker, EVP, Amwins Brokerage

- Ryan Scheinfeld, CEO, Risksmith Insurance Services

![]()

Energy

After two years of turmoil, the energy insurance market enters 2026 with a mix of renewed competition and selective underwriting discipline. Rates are broadly softening across downstream property and professional lines, while casualty markets continue to wrestle with social inflation, nuclear verdicts and rising loss severity. Early 2025 began with notable losses, which temporarily slowed the pace of softening but did not reverse it.

While property markets benefit from abundant capacity and strong competition, casualty lines remain more constrained, with underwriters maintaining discipline on limits and retentions. As the energy sector adapts to rapid technological and operational changes, insureds can expect continued divergence between these two market segments in 2026.

Market dynamics

Downstream energy property sector

On the property side, the downstream energy market continues to soften. After several years of correction, 2025 brought consistent softening as capacity expanded and profitability improved. Despite rate reductions of up to 20% in some cases, the energy property insurance market outlook is relatively optimistic.

Non-CAT losses have already exceeded the total global premium for the downstream sector. Combined with the impact of several large natural catastrophe events, this has prompted close attention to the upcoming 2025/2026 reinsurance treaty renewals and early 2026 placements, which may signal whether the market adopts a more disciplined approach to ratings.

Capacity remains plentiful, with underwriters deploying larger line sizes on well-engineered, loss-free risks. Oversubscription has become commonplace, and maintaining market share is challenging. Soft-market incentives such as long-term agreements and no-claims bonuses have returned; loosening of retention levels and margins on key clauses like Business Interruption Volatility are being considered.

Underwriters are also paying closer attention to contractor performance and oversight, as well as supply chain issues, a key factor in recent loss events. Insureds should anticipate greater scrutiny around safety procedures, vendor qualifications and risk management frameworks at renewal. Despite this, competition remains strong for larger projects.

Power & renewables