The healthcare and human services sectors are facing one of the most challenging liability environments in decades. Abuse and molestation coverage, once widely available and relatively stable, has become increasingly complex, costly and difficult to secure. Carriers are pulling back, exclusions are quietly expanding and insureds are finding themselves uninsured or noncompliant with contractual requirements without even realizing it.

A contracting market

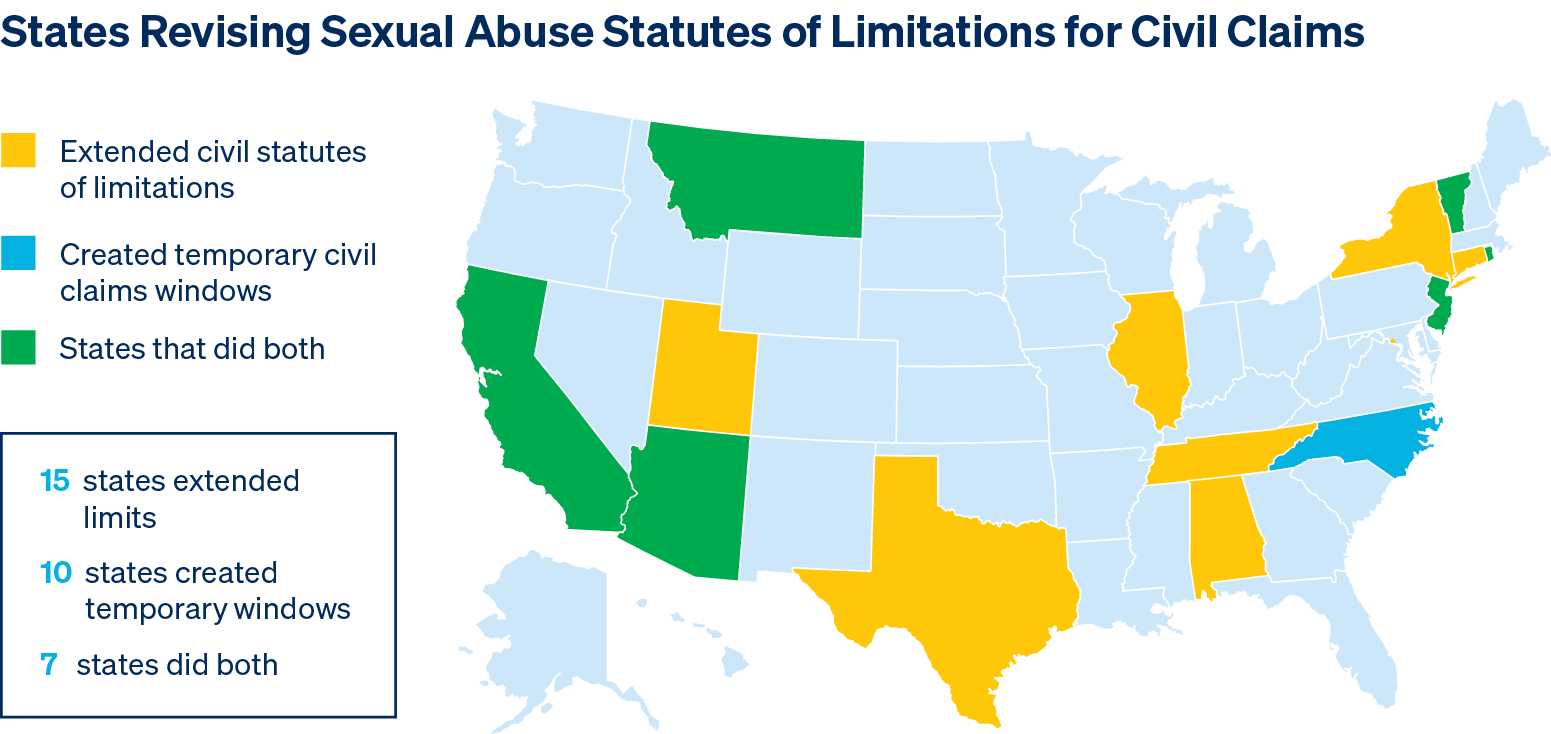

A confluence of factors has led carriers to retreat. Statute of limitations reforms in more than 30 states have significantly extended or even removed filing deadlines for abuse-related claims. In some jurisdictions, incidents dating back decades can now surface in litigation. Because many admitted carriers historically write these policies on an occurrence basis, they are now absorbing losses from claims tied to policies written, in some cases, all the way back to the 1980s. You can learn more about how statute of limitation reforms are affecting the market here.

The result is uncertainty on an unprecedented scale. Actuaries are struggling to project long-tail exposure, and many carriers are opting to exit the space entirely rather than assume unknown risk. For insureds, this means fewer options, higher premiums and an increasing reliance on the E&S marketplace to find adequate protection.

Actuaries are struggling to project long-tail exposure, and many carriers are opting to exit the space entirely rather than assume unknown risk. For insureds, this means fewer options, higher premiums and an increasing reliance on the E&S marketplace to find adequate protection.

The rise of hidden exclusions

As carriers reassess their risk appetite, exclusions are becoming both broader and less transparent. Patient-on-patient abuse, for example, is being carved out quietly and often without clear disclosure. For facilities serving developmentally disabled populations or behavioral health patients, these exclusions can leave multimillion-dollar gaps in coverage.

Similarly, some carriers are now splitting physical and sexual abuse coverage into two separate categories or sub-limiting one category without clearly differentiating between the two. A facility might believe it has comprehensive protection, only to discover that significant exposure exists after a claim is filed. Without careful policy review and guidance from an experienced broker, these gaps can go unnoticed until it’s too late.

Retroactive changes complicating compliance

In addition to reduced capacity, some carriers are making retroactive changes to policy limits, a shift with serious consequences for insureds. A nonprofit that previously carried $1M/$3M limits, for example, may suddenly find its historical coverage capped at $1M/$1M going back several years.

This creates two significant problems:

- Insureds may unknowingly fall out of compliance with contractual requirements that mandate higher limits.

- Prior claims may have already eroded the newly reduced aggregate, leaving no coverage for additional incidents.

For many organizations, the cost of securing supplemental coverage to close these gaps can be substantial, straining already limited budgets.

For many organizations, the cost of securing supplemental coverage to close these gaps can be substantial, straining already limited budgets.

Broader forces at play

While these pressures can be particularly difficult for healthcare and human services, broader legal and societal trends are also reshaping the market. Nuclear verdicts continue to escalate settlement values, with juries awarding increasingly high non-economic damages. Third-party litigation financing has amplified this trend, providing claimants with the resources to pursue costly, prolonged cases.

At the same time, changes to tort laws in several states are raising damage caps, driving up the potential size of claims. Since these trends aren’t expected to shift anytime soon, carriers are becoming more selective, pushing rates higher and tightening underwriting standards.

Takeaway

For healthcare providers and social service organizations, these changes have created a much tougher market to navigate. Coverage that used to be straightforward now takes a closer look, and relying on old assumptions can leave serious gaps in protection.

Capacity is tightening, premiums continue to climb and exclusions are evolving faster than many realize. Staying ahead means being proactive, reviewing policies carefully and exploring creative solutions in the E&S market. Securing the right abuse coverage isn’t as simple as it once was, but with the right expertise, it’s still within reach.

We help you win

Amwins is a leading professional liability insurance broker specializing in financial, professional and management risks. Our experts across the country and around the world collaborate to deliver the right solution for your clients.

Through our commitment to the health and human services sector, we have established strong relationships with top-tier, specialty carriers. Our team of experts can guide you through all the available options to find the best fit for your business or organization. With Amwins on your side, you can help your clients operate with confidence.