Parametric insurance, also known as index insurance, is an innovative solution that functions differently than traditional insurance. As agents and insureds continue to look for ways to enhance their programs and ensure they’ve secured the most effective way to protect their assets and revenues, the parametric landscape has and will continue to play a major role in improving coverage and the recovery experience.

In its simplest form, a parametric solution is an insurance policy that pays an insured based on certain pre-defined thresholds and characteristics of an event (i.e. “triggers”), such as windspeed, ground shake intensity/magnitude of seismic events, rainfall intensity, or lack of rainfall to name a few. Since the coverage is based upon the event, and not specific to physical damage of an asset, these structures can rapidly disperse much needed capital very quickly – at times, in as little as a few days or weeks. Additionally, because a parametric structure covers the impacts of an event and not just losses sustained to an asset, the proceeds of the policy can be used flexibly to cover any expense associated with the triggering event, which may otherwise be excluded from traditional insurance policies. For these reasons, they are often used as complements to traditional coverage, rather than as a replacement for traditional coverage.

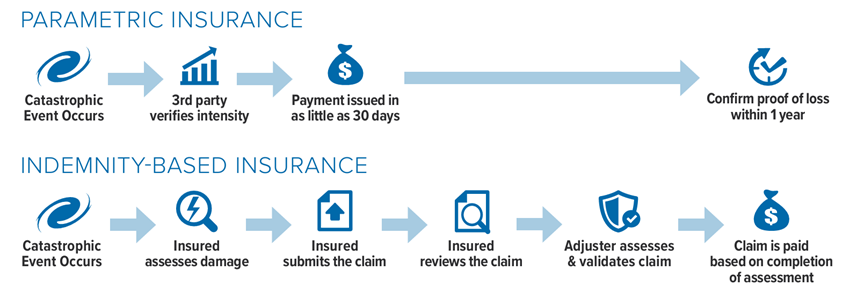

The graphic below compares the sequence of events for claims and payout between parametric insurance and a traditional indemnity-based insurance.

Many types of insureds can benefit from utilizing parametric insurance, including those with exposure to natural perils—such as coastal wind, earthquake, wildfire, drought, flood, excessive rainfall or heavy snow—and those with the potential for business interruption or direct physical loss. It is also beneficial for businesses that value immediate cash flow or public entities that are dependent on revenue sources, such as property and sales taxes.

The flexibility to design the coverage triggers and subject geographies is one of the key advantages offered by parametric solutions. For example, an insured could have exposures in multiple counties close together, across an entire state, or across several states, and the parametric product and its coverage triggers can be designed for bespoke coverage within those areas.

Parametric structures can also provide peril-agnostic applications—it can cover all risks that impact operations. Insureds that are heavily dependent on single sources of revenue can experience significant impacts to operations from a variety of risks, such as a tourism-driven community or business. Therefore, having a solution that focuses on the impact rather than the cause of loss is paramount. For example, a hotel may lose revenue due to a hurricane, a public health crisis, a downturn in consumer spending or a failure of local infrastructure outside of their control.

In this case, an index could be developed using available industry data to cover losses when revenue falls below a certain threshold. Parametric solutions can be applied across nearly all lines of business that have robust and reliable data sources.

Expertise in this segment is very important for agents to ensure the solution is clearly defined and understood by the buyer. The markets in this space are very analytically-driven; therefore, knowledge of modeling and how those figures can and will move, depending upon the slightest adjustments in the structure, is paramount.

Factors in Designing a Tailored Parametric Product

Unlike a traditional insurance policy, there are many levers to pull in designing a specific parametric solution for any one insured’s needs. These levers afford the opportunity and flexibility to provide a menu of options at many different price points, often providing a more competitive solution than is available in the traditional market. Additionally, the flexibility in structuring allows for the mitigation of basis risk, thus limiting downside when compared to a traditional policy.

Parametric solutions aim to complement insurance programs and buyers’ balance sheets in the following areas:

Claims

Since the parameters for coverage are pre-defined, the claims process for parametric products is quick and simplified. In some instances, Insureds complete a simple form notifying the carrier of an event, a calculation is conducted to determine if the pre-agreed trigger was met or exceeded and the limit is deployed to cover direct and indirect financial losses associated with the event. Claims adjusters are not required, so cash flow needs are addressed in a timely manner. This quick cash payout is often not possible with a traditional insurance product.

Triggers

Coverage trigger mechanisms are defined prior to any event, including measurement sources and threshold structure for payout. The specific geography of the subject area is determined based on the unique insured’s needs and can be established using a variety of parameters, including latitude/longitude coordinates, counties, and zip codes.

For example, if heat index, measured rainfall, and hurricane wind speed thresholds meet the pre-agreed trigger measurements within any geographic boundaries set, the coverage is triggered for payout. However, broader boundaries could affect pricing as the probability of loss may increase.

Structuring

Parametric insurance is indemnity-based and functions in the same manner as traditional insurance, in which the insured is indemnified for their loss and no more. However, since the loss is settled on the pre-defined trigger and covers all direct and indirect losses associated with the event, these solutions pay out very quickly and the settlement process is greatly simplified, which is something a traditional insurance product cannot match.

As an example of the differences in structuring options, let’s consider an insured who has an exposure in tri-county Florida. The geographic trigger areas would be designed around these three counties for hurricane exposure. The trigger and payout structure can be designed to pay increasing limits based upon the severity of the event to more closely match the true exposure (i.e. 25% of the full limit for a Cat 2 storm, 50% for Cat 3 and 100% for Cat 4 and above). There are endless permutations of the trigger design process to manage the risk of the Insured and this methodology applies across all perils.

Limits

Limits can be purchased as binary or stair-stepped payouts. The limit that the Insured purchases does not affect the structuring of the product. The pricing is typically Rate on Line (ROL) based on the limit purchased. Therefore, if the limit is increased, the ROL typically doesn’t move. However, the premium spend would increase.

Attachments

Determining the appropriate attachment point for the trigger is a critical step in designing a robust solution. The attachment point should be selected based upon the severity of the event and the concern of the Insured. Using tropical cyclones as an example, an Insured may not be concerned with low severity storms, such as a Category 1 or below. Therefore, the trigger selected would be for events that are Category 2 or higher. Parametrics do not have deductibles in the traditional sense—once triggered, they cover ground-up losses. A zero-dollar deductible is often not available with traditional products.

Case Study

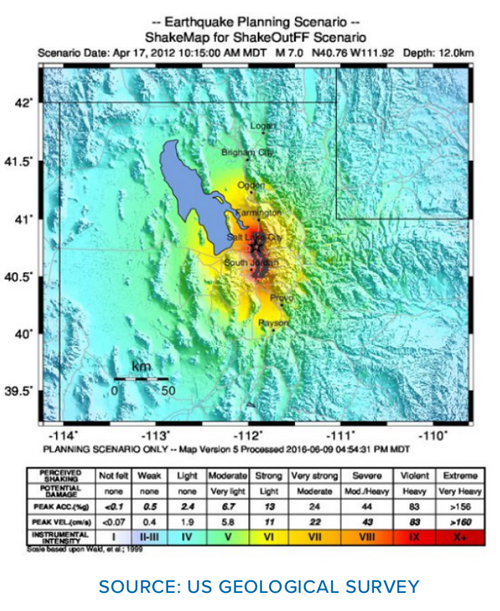

A large Insured in a western state in the U.S. has seismic exposure in areas with the highest concentration of assets. The client has built a robust traditional insurance program, but realized that securing additional capacity and greater flexibility would be an important strategic development. The client’s property program covers the physical assets, but would not cover the secondary economic impacts of a large event. The client procured a parametric insurance policy based on ground shake intensity in the areas of the state with the greatest economic value to complement their traditional policies. The parametric structure could be used to cover deductibles, losses above the traditional program, the cost of debris removal or to offset lost tax revenue and would pay in as little as 30 days.

Conclusion

Access to ever-improving modeling techniques and overall historical data capture has allowed for the growth of parametric solutions. As agents and insureds look for the most efficient and flexible ways to protect their assets and their economic wellbeing, the parametric landscape has increasingly played a major role in risk transfer. The number of carriers—and their willingness to be innovative—has also increased.

The Alternative Risk group at AmWINS continues to explore state-of-the-art options for customers, with a focus on hurricane/wind, earthquake, wildfire, temperature, precipitation variance and non-peril specific revenue protections. Our specialists have extensive reinsurance backgrounds, as well as strong relationships and experience with various types of markets in the space. Our market access and expertise allow us to leverage the best solutions at the best prices.

About the Authors

This article was authored by Alex Kaplan, Holland Walls, Robert Patterson and Kelly Greene, members of the Alternative Risk group at AmWINS.