The Specialty Insurance Provider that Keeps You Ahead of Risks

/ $33B

annual premium placements

/ 37,124

underwriter relationships

/ 30,341

retail agency relationships

/ 7,325

employees worldwide

/ 1,514

employee shareholders

/ 1.7M

submissions received annually

Where market intelligence meets broker expertise

Amwins understands your clients' businesses aren't static — they're complex and evolutionary in nature, and require future-focused insurance solutions that keep you a step ahead of risks. As a leading, global specialty insurance distributor, our unparalleled expertise spans 13 industry and risk specialty practices. Coupled with an extensive partnership network and granular analytics that drive every decision, Amwins uncovers the right insurance solutions for your clients — tackling today's obstacles, and anticipating tomorrow's challenges.

Partnering with Amwins is more than a standard business transaction. Our team of specialists touts a deep bench of niche industry experts, each committed to strategizing and investing in your success. Comprised of five core divisions, 90+ underwriting programs and a worldwide reach, our dedicated practice groups, brokers and underwriters have the expertise, knowledge and relationships of the firm at their fingertips — giving you a distinct advantage. We value all segments and relationships equally, weaving collaboration into the fabric of our organization, within teams and across divisions.

At Amwins, we believe in finding solutions together. Your challenges are our privilege. And when you win, we all win.

Brokerage

As a leading excess and surplus lines specialty insurance broker, Amwins Brokerage handles difficult placements and unique opportunities across all lines. We're more than your partner — we're on your team and in the trenches, working to consistently deliver broad resources and unmatched access to leading insurance markets worldwide. You expect quality specialty insurance service — we're here to deliver it.

Small Accounts

Amwins Access is a nationwide binding platform for small property and casualty businesses, with dedicated areas of focus on E&S binding authority placements for small business, personal lines, and admitted placement services. Armed with dedicated marketing relationships and industry-leading technology, we simplify and accelerate the process of handling small accounts. The result? Our local underwriters focus more closely on your — and your clients' — needs, delivering big solutions for small businesses quickly and with care.

Underwriting

Amwins Underwriting is comprised of specialists who understand the nuances of the markets we support. And we've delivered profitable underwriting results to our carrier partners for decades. Combined with our proprietary, cutting-edge technology, we serve coverage solutions that leverage insightful data and analytics, completely tailored around the unique needs of your clients — because we know not all business risks are created equal.

Global Risks

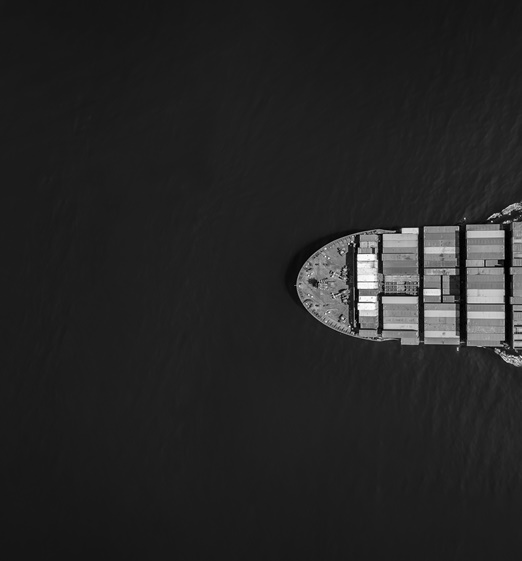

In an increasingly borderless world, global market access matters. Amwins Global Risks division serves clients in over 150 countries to place specialty insurance and reinsurance coverage. Our network and access reaches from our home base in London to the farthest corners of the globe. We tap into these expansive market relationships to secure solutions for your most complex risks.

Group Benefits

Amwins Group Benefits is uniquely focused on providing solutions to assist benefit brokers and consultants as you tackle today's industry challenges. We complement our clients' existing capabilities by helping expand product and service offerings when resources and investments may be focused elsewhere. We do this through three primary capabilities: access to specialty benefit insurance products and services, robust benefit administration and program management.

Explore specialty insurance resources + insights

Stay up-to-date on emerging industry trends and topics

Our global reach, your competitive advantage

In-depth industry expertise

Our specialty practices are comprised of teams focused on specific industries, and the risks that accompany them.

People of Amwins

Collaborators. Experts. Partners.

When you work with Amwins, our team is your team.

Becky Patel

Becky has been instrumental in furthering our mission at Amwins. Throughout her 37-year career, she has been recognized for countless achievements and proven herself as an industry leader. From receiving an Orange County Women in Business award to holding a previous Chairman of the Board position for Delta Dental of California, Patel’s experience and vision for development is evident. Today, Becky brings a signature management style and innovative solutions to over 350 people in her role as CEO of Amwins Connect.