Casualty Insurance

Amwins delivers primary and excess casualty insurance solutions for your clients' most complex risks.

Casualty Insurance

Amwins delivers primary and excess casualty insurance solutions for your clients' most complex risks.

Custom solutions and market clout at your fingertips

With more than 580 dedicated casualty professionals across the country, collaboration is in our DNA. Amwins delivers trusted consultation, market access and creative program structures to place coverage for even the most complex and layered accounts —providing value-added resources, unmatched service and expertise every step of the way.

$9.4B

annual U.S. premium placements

936

dedicated professionals

700

casualty markets we place business with

Casualty areas of specialty

Actuarial services

Licensing robust cutting-edge software, our in-house actuarial team runs account and portfolio-level reports ensure submission details and pricing are as accurate as possible.

Claims advocacy

Custom product development

Casualty resources + insights

Stay up to date on emerging casualty insurance trends and topicsCase Study: Ingredient Manufacturers and Their Product Recall Insurance Risk

The following is a theoretical scenario.

USA Sugar is a processor of sugar. They bring refined sugar into their production plant, where it is transformed into a liquid form and sent to USA Sugar’s customers, who use the liquefied sugar in various food manufacturing applications.

On May 15, 2015 the FDA contacts USA Sugar and notifies them that salmonella was found in beverage products manufactured by two separate companies. Both strains of salmonella have been traced back to USA Sugar’s liquid sugar product. After a series of tests, it is determined that the liquid sugar was in fact the source of the salmonella. It was also determined that the salmonella contamination occurred in the insured’s facility between March 3 and March 17, which was a period of roughly two weeks. On March 17, all production lines were broken down and a thorough cleaning was performed. The products manufactured after the March 17 cleaning appear to be free of salmonella.

As a result of the findings, USA Sugar decides to perform a voluntary recall of all products manufactured between March 3 and March 17. In addition to USA Sugar’s recall, all products containing USA Sugar’s contaminated liquid sugar will need to be recalled. The FDA classifies all related recalls as Class I, meaning consumption could result in serious health problems or death.

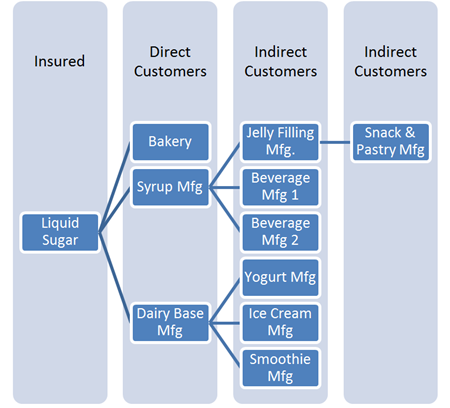

USA Sugar sold the contaminated product to three customers; a bakery, a syrup manufacturer and a dairy base manufacturer. The bakery used the liquid sugar in frosting for various products, all of which were sold at retail locations. The syrup and dairy base manufacturers sold their products to other manufacturers for use as ingredients. In all, 11 companies including USA Sugar recalled products (see chart below).

Product Recall Insurance Implications

Fortunately, USA Sugar carried a Product Contamination policy

(product recall policy for consumable products), which covered

the recall and related costs incurred by the insured as well as other

third parties.

The following coverages were included in USA Sugar’s policy:

- First Party Losses

- Recall Costs

- Replacement Costs

- Loss of Profit

- Brand Rehabilitation

- Third Party Losses

- Recall Costs

- Customer Loss of Profit

The appendix at the end of this article shows a breakout of the costs incurred by each entity and calculations of the total losses. In all, this incident resulted in a total financial loss of $16,245,000, of which $12,640,000 were product recall related losses, and $3,605,000 was GL loss.

GL Loss – Because the GL pays for damage caused to property of others, USA Sugar’s GL policy covered a portion of the damage caused to the products containing the contaminated liquid sugar. The value of the actual sugar in those products was covered by USA Sugar’s Product Contamination policy. The claims adjusters for the GL and Product Contamination policies reviewed the claim and agreed that the GL policy would cover 70% of the damage, and the Product Recall policy will cover the remaining 30%.

Covered Product Recall Loss – The Product Contamination policy covered all of the insured’s losses relating directly to the recall, including recall costs, replacement costs, loss of profit, extra expenses and brand rehabilitation. These losses amounted to $2,500,000. The policy also covered the recall costs and some replacement costs incurred by the insured’s customers. These losses amounted to $3,550,000. In addition, the policy covered loss of profit sustained by the insured’s direct customers. These losses amounted to $2,670,000. In all, the Product Contamination policy paid $8,720,000.

Uncovered Product Recall Losses – Unfortunately, there were some losses that were not covered by the Product Contamination policy. The Product Contamination insurance company provided a quote to USA Sugar, which included an option to purchase either Customer Loss of Profit coverage (CLOP) or Third Party Recall Liability coverage (TPRL). The CLOP coverage was less expensive than the TPRL, so USA Sugar opted to purchase CLOP. They did not realize that CLOP only covers loss of profit incurred by the insured’s direct customer. It does not include loss of profit sustained by indirect customers or other third parties. Therefore, loss of profit sustained by the jelly manufacturer, beverage manufacturer 1, beverage manufacturer 2, yogurt manufacturer, ice cream manufacturer, smoothie manufacturer and snack/pastry manufacturer was not covered.

Furthermore, CLOP only covers their customer’s loss of profit. It does not cover any brand rehabilitation, extra expense or other financial losses incurred by their direct customer. Each of the insured’s customers (direct and indirect) incurred costs to rehabilitate their brand names. In addition, the smoothie manufacturer was forced to shut down their production facility for six days in order to clean their facility. That cost as well as the ongoing cost to maintain their payroll amounted to $150K. In all, there were $3,920,000 worth of uncovered losses, which would have been covered if the insured had spent the extra money to purchase the broader Third Party Recall Liability coverage instead of CLOP.

How Does Customer Loss of Profit Coverage Differ from Third Party Recall Liability?

- Customer Loss of Profit (CLOP) covers loss of profit sustained by the insured’s direct customer only.

- Third Party Recall Liability (TPRL) coverage would cover loss of profit and other financial losses sustained by the insured’s direct customer as well as any other third parties, such as a customer further down the chain of commerce. This is broader because it covers virtually any financial loss sustained by any third party directly resulting from the recall, as opposed to only loss of profit sustained by the direct customer.

Why is Third Party Recall Liability Coverage Important for Ingredient Manufacturers?

Unlike finished product manufacturers, who sell their products on retail store shelves, ingredient manufacturers sell their product to other manufacturers who use that product to make a number of other products, some of which are ingredients themselves. For this reason, recalls of one ingredient can spur recalls of multiple other products. This phenomenon is sometimes referred to as the “multiplier effect.” The finished product manufacturer will only need to replace their retail distributor’s loss of profit, which in most cases is minimal due to quick retail slotting. Grocery stores can fill shelf space quickly with alternate products if necessary. Conversely, the ingredient manufacturer will need to indemnify large financial losses sustained by multiple third parties.

Click here for appendix - recall cost calculations.

This article was authored by Matt Carpenter, a vice president at AmWINS Brokerage in Chicago, IL and a product recall insurance specialist. To learn more about AmWINS’ RecallReady team, click here.

- Casualty

- Product Recall

- Property & Casualty

Filling excess placements despite changes in exposure.

When an insured with five New York City hotels converted operations to COVID-19 shelters for the local homeless population, the change in exposure threw a wrench in the renewal. While the general liability carrier stayed on the account, the excess carrier discontinued coverage. The retail agent contacted Amwins to fill the excess coverage for these locations.

With a local government agency managing and operating these shelters, the insured’s exposure was lessened. However given the venue, occupancy and market conditions, filling out the program was still an uphill climb. Through our market access and industry expertise, we were able to fill the policy with just two layers - securing a big win for our retail client and their insured.