Recent events have changed the trajectory of the E&S marketplace, especially for catastrophe-exposed property accounts. While it looked as though 2023 would bring a deceleration of rate increases, factors including CAT weather events, inflation, valuations, and reinsurance renewals have changed this path and we find ourselves in a continued hard property market for the foreseeable future.

This update will provide an informative look into the factors that are shaping the current market landscape. As we begin to see more defined market trends, we will keep our clients informed through our traditional State of the Market report and help find solutions that achieve the best results possible for your clients.

As always, reach out to your Amwins specialty broker for a review of specific accounts.

2022 Catastrophic Property Events

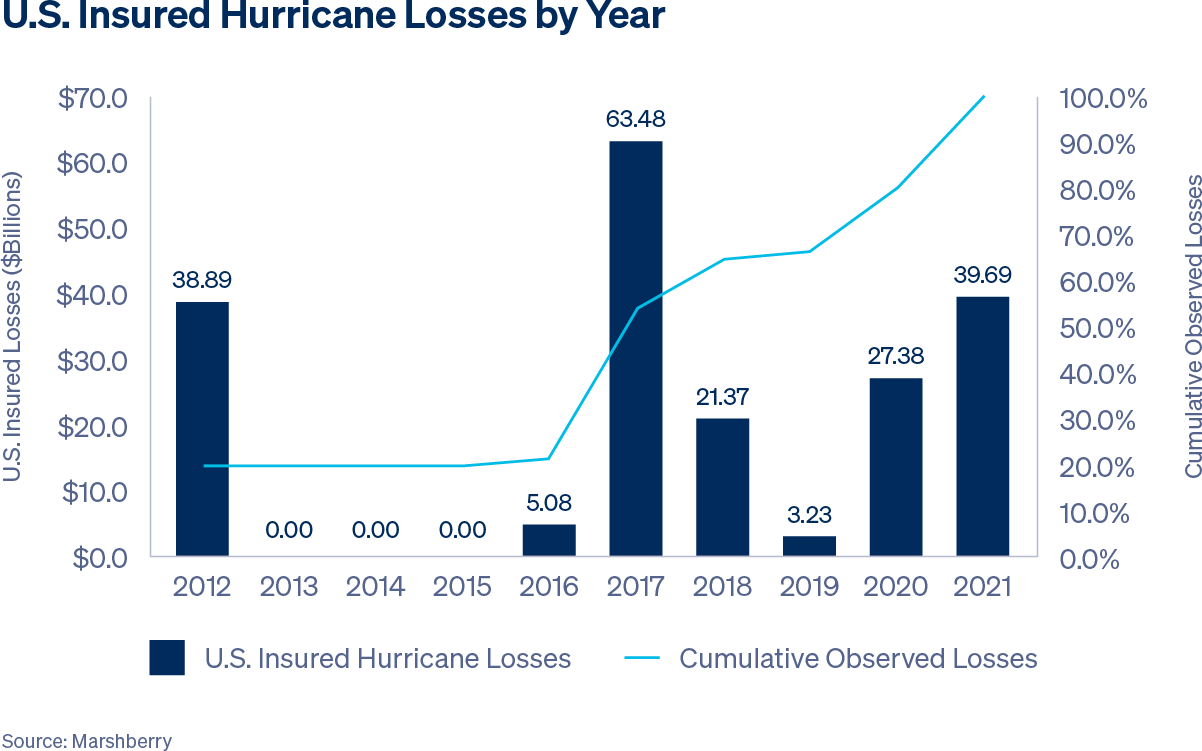

Whether you blame climate change or bad luck, catastrophic weather events have played a major role in shaping the insurance marketplace over the last decade. With a major hurricane making landfall in the U.S. five out of the last six years, is it still accurate to call these events one in 100-year events?

While considered a relatively quiet year for Atlantic hurricane activity, 2022 still saw 14 named wind events, including Hurricanes Ian and Nicole which made landfall.

Source: NOAA Tracking chart.

According to the Insurance Information Institute, Hurricane Ida (2021) was the second costliest hurricane on record, with $36 billion in insured losses. Top of the list is Hurricane Katrina, with approximately a $90 billion insured loss in 2021 dollars. Hurricane Ian is currently estimated to be a $40-60 billion insured loss event.

In addition to hurricanes, wildfires have engulfed hundreds of thousands of acres in the U.S., making historic CAT losses a reality from sea to shining sea. Globally, insured losses from natural catastrophes reached $130 billion in 2021 — 18% higher than 2020. Though there haven’t been any recent notable earthquake losses, the California earthquake market will still be affected by losses from other natural disasters and the global economic environment.

“But wait,” you say, “There’s been other noteworthy natural disasters and hard market cycles in history. How is this different?” Great question.

In previous market cycles, major natural disasters, such as Hurricanes Andrew and Katrina, led to a reduction in market capitalization. However, most of today’s carriers are well capitalized against catastrophic events. The restrictive appetites for CAT-exposed risks we’re seeing are generally implemented to reduce balance sheet volatility from other market factors. Hurricanes Ian and Nicole have acted as catalysts to further harden the market, rather than igniting the fuse.

Additional Factors Impacting the Market

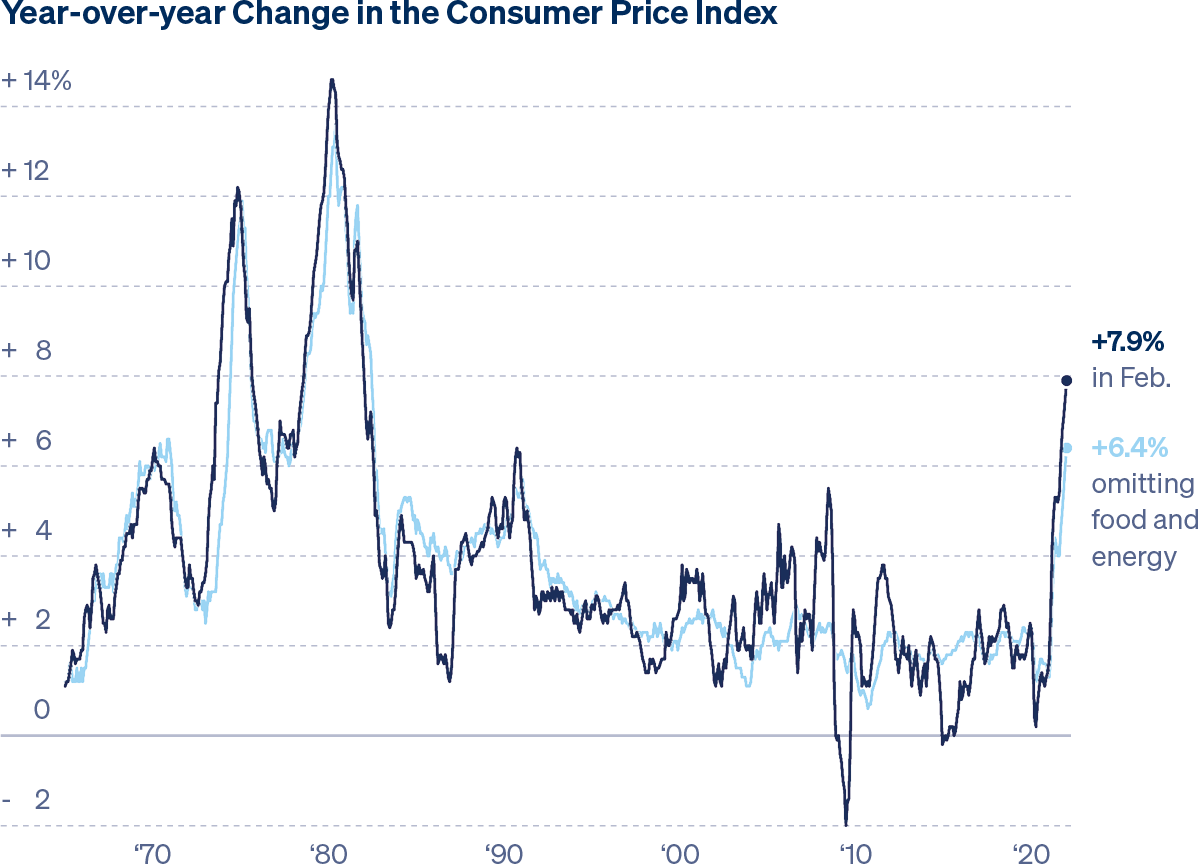

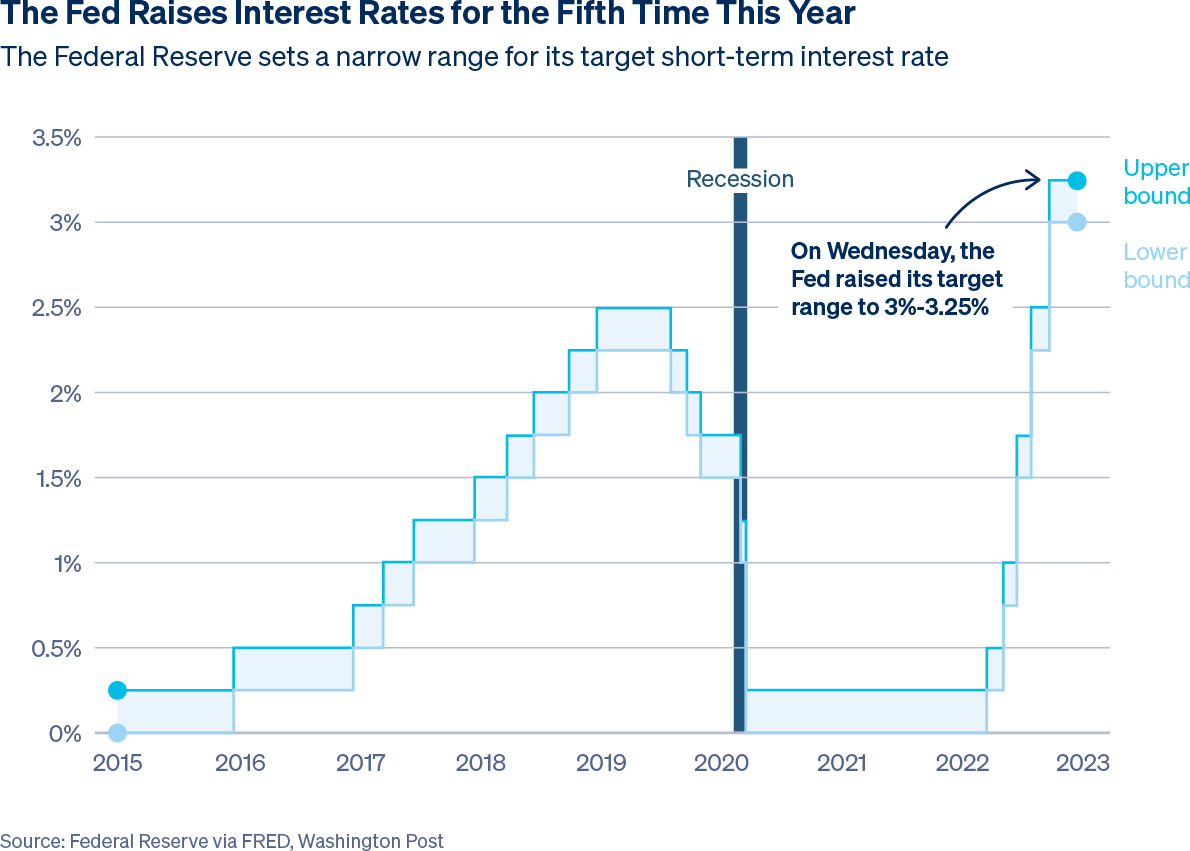

Global inflation as well as financial and economic uncertainty are unmodeled factors causing an increase in the cost of capital. These factors are also putting pressure on rates to rise as markets focus on profitability. The continued hike in interest rates equate to rising capital costs, with investors wanting the best rate of return on their capital. This is creating a lack of alternative capital options available in the market.

Source: NY times

As rates and inflation increase, it becomes more and more important for the insured to revisit reported valuations and increase as necessary to account for true replacement cost and current rent price/business income. Put simply, losses continue to increase in cost.

The days of static/unchanged reported building and rent price/business income valuations from year-to-year are gone, with carriers now penalizing accounts that don’t proactively adjust reported valuations. Carriers say that insurance to value (ITV) is off by 30% or more. The difference in valuation that markets feel is needed varies greatly by region.

The simultaneous combination of the following factors has created a perfect storm of complications in the marketplace:

- Carriers requiring increased valuations (which will generate more modeled AAL/PML than expiring)

- Many carriers set to implement updated wind/quake modeling versions that are anticipated to show more AAL/PML for their portfolios

- CAT MGAs and/or carriers are likely to have less PML/capacity to deploy than in prior years

Additionally, it is important to calculate the unmodeled costs of social inflation, nuclear verdicts, supply chain issues, lasting impacts from the COVID-19 pandemic, and the Russia/Ukraine conflict – all of which continue to compound the cost of losses.

Florida

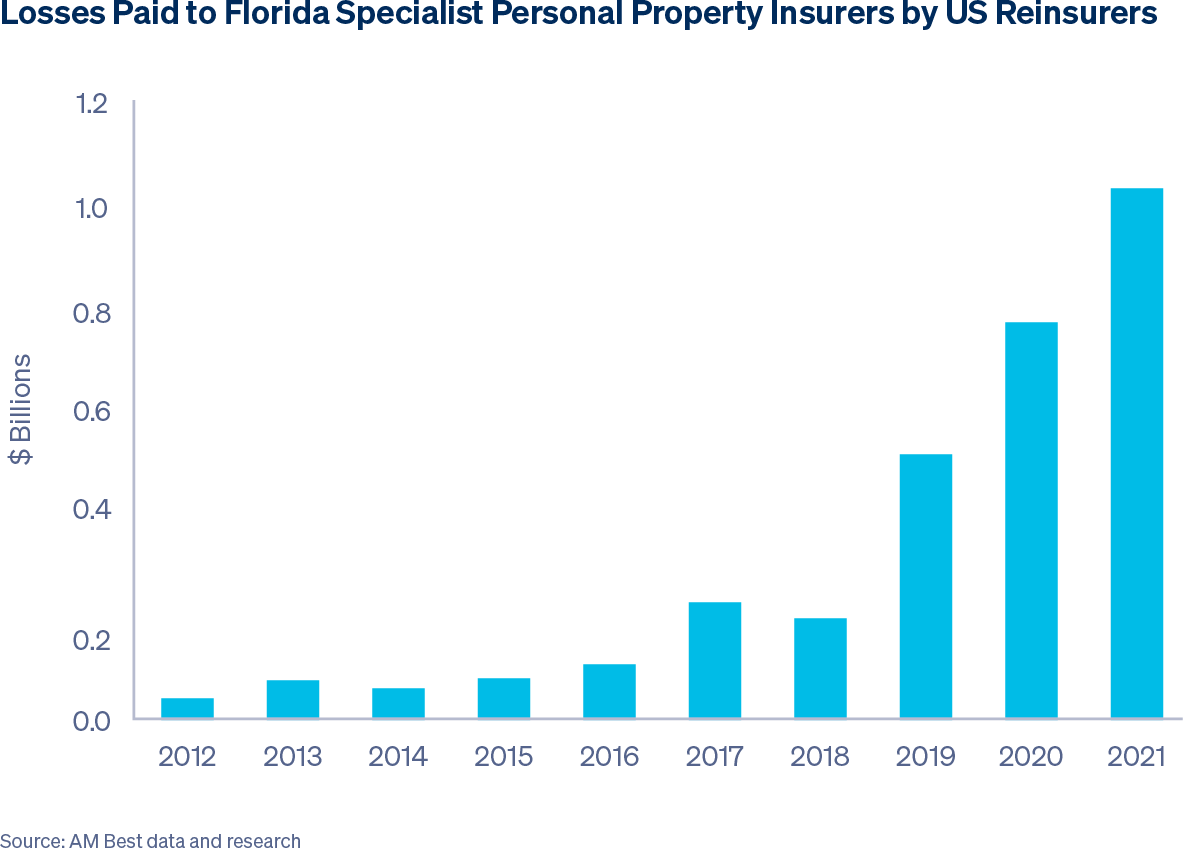

Florida makes up between 30-37.5% of global annual premiums in the CAT reinsurance market. However, it is also responsible for a significant portion of global losses as well.

The 2022 Florida reinsurance renewals did not go smoothly, with an estimated 25% of Florida’s 6/1 reinsurance renewals not being placed by May 30. Additionally, Demotech, the main Florida rating agency, withdrew and decreased ratings for three carriers.

However, as Amwins highlighted in June 2022, there have been some positives with Senate Bills 2D and 4D being passed on May 24, 2022. Key components of legislation include:

- Clarifying options for roof repair and replacement

- Reducing frivolous litigation

- Fund matching grants for home hardening

- Enhancing insurer access to the Florida Hurricane Catastrophe Fund (FHCF)

As of Q3 2022, many of the Florida homeowner's specialist insurers have drastically reduced surpluses. This implies that 2023 will continue to be a tough market and some markets may even struggle to continue to write policies.

Reinsurance (Treaty and Facultative)

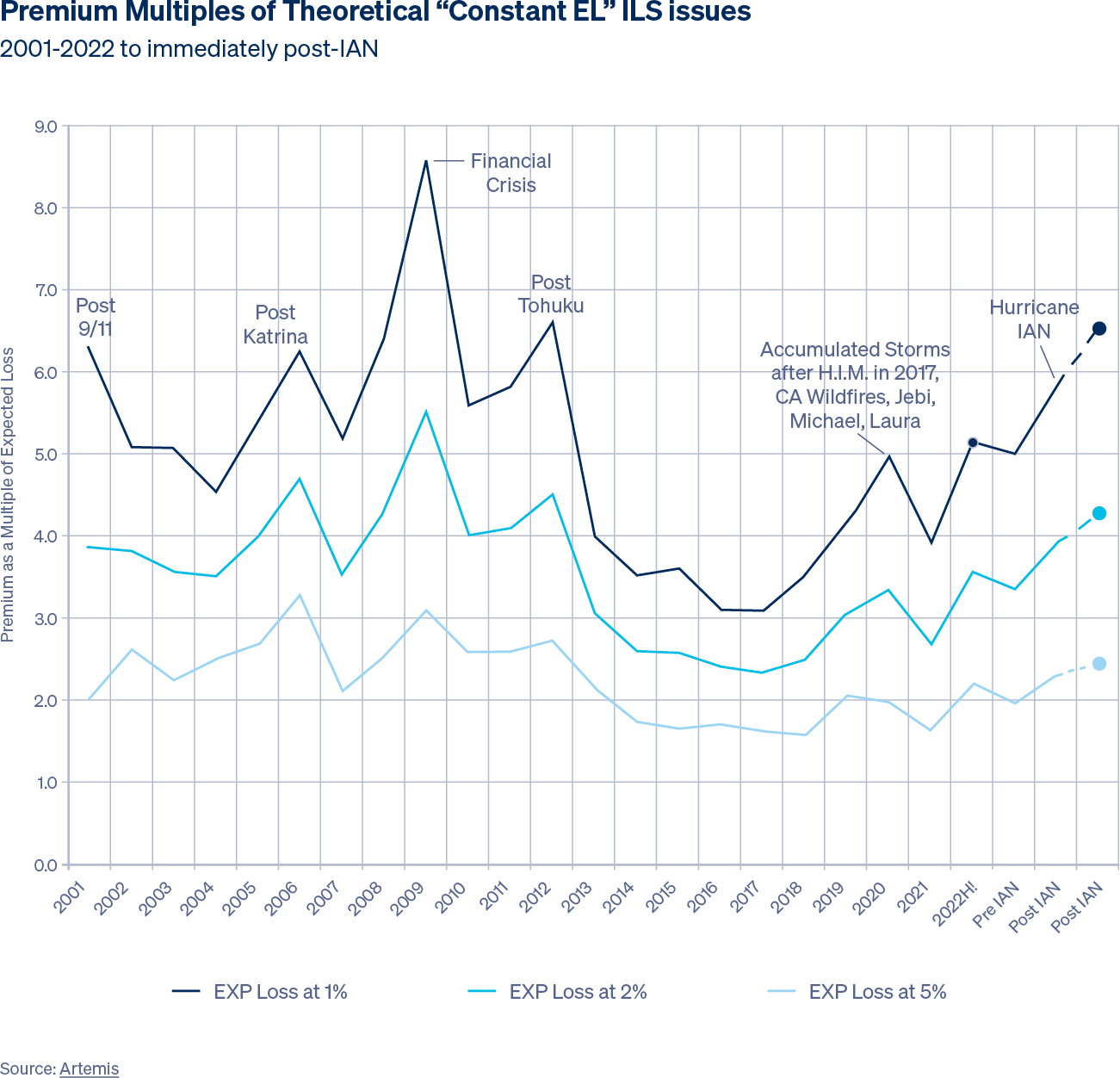

Reinsurance renewals are more difficult than the last cycle. At this time, many firm order terms (FOTs) for 1/1 accounts, which includes most of Lloyd’s and European treaties, have not been issued due to market uncertainty. Larger players in the space have publicly stated that they will be focusing on profitability rather than growth as well as focusing on eliminating ambiguity by red lining all-perils catastrophe coverage.

It is also expected that reinsurers will continue to recalibrate their views of risks individually. Compared to previous years, reinsurers will likely attach higher on most programs and will likely push for their clients to retain more net risk.

Additionally, inflation has eroded some of the rate increases obtained by reinsurers, so it is expected for reinsurers to continue to be bullish on rates.

Due to the above, it is expected for there to be a shortage of capacity available in the market regardless of price, terms and/or conditions offered. It will be the outcome of the 1/1 renewals that will set the tone for 2023.

Facultative reinsurers are holding off quoting early with the assumption that prices will inevitably rise as placements are not completed – with most now quoting within 30 days of binding. There is also a consistent reduction in line sizes as many are “rightsizing” their portfolio. The loss of retro capacity is keeping deployable capacity low, therefore higher prices will come with less capacity to offer.

Trapped Capital

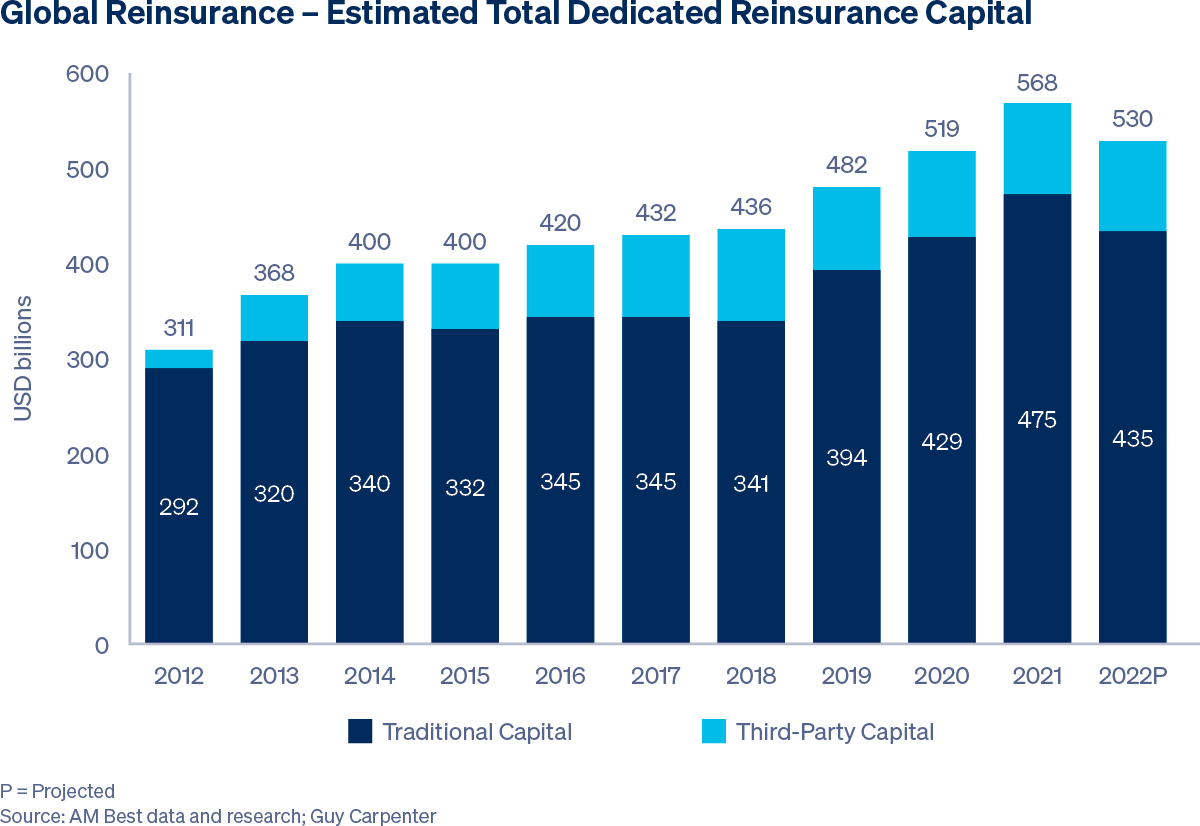

Throughout 2022, trouble has been brewing in the insurance-linked securities (ILS) and retrocession market (in simplified terms, the reinsurance for reinsurance carriers marketplace). Increasing exposures due to natural disasters and other industry perils combined with the ongoing financial and global political volatility have negatively impacted this space.

Prior to Hurricane Ian, the industry was already expecting a hardening market. Ian has served to add further pressure to this space. Much of the capital behind the retrocession market is ILS, and that market cannot move capacity forward until Ian losses are more solidified. Thus, this market needs an influx of new investors with new money in order to re-load – something that will be very difficult to obtain as this line of business has not been lucrative in the last five years. There is also increasing competition from external investment opportunities in treasury bills which are paying outsized returns.

Pricing and Capacity

Growth in the E&S property market has led to carriers seeking to extricate themselves from rate and form requirements in various states, adding flexibility to their ability to enter and exit classes of business. The Stamping Office reported surplus lines year over year premium growth of 32% in the first half of 2022. However, there remains a shortage of capacity to meet consumer demands.

At a high level, it’s safe to say that reductions in capacity and dramatic increases in rate for all CAT-driven and/or loss-driven accounts are expected. Additionally, terms and conditions will be tightened across the board.

There should not be any expectation of “sweetheart” pricing, including large or extremely large expiring line size by today’s standards, attractive attachment point, etc. This is particularly true in the Florida condo marketplace.

James Drinkwater, President of Amwins, shared the following with The Insurer. “Outside of certain classes such as D&O, I think you’ll see a firm rate environment through 2024. We expect to see capacity in specific classes being an additional challenge as well.”

The Lloyd’s market has made rate increases for 19 consecutive quarters. Despite syndicates announcing increased stamp capacity for 2023, it is expected for those increases to be mainly covering higher rates and inflation versus allowing for new business to be written. However, while markets generally do not appear to be broadening their appetites, some will look to capitalize on the hardening property market. Overall, Lloyd’s will not be the answer to all accounts but there may be opportunity on some.

Achieving Success in this Challenging Market

The CAT property market is tough and won’t be getting easier anytime soon. It’s important to work with a wholesale broker who has in-depth knowledge of the marketplace (including your insured’s specific class of business), strategies and carrier relationships to navigate the marketplace and fill towers, as well as access to resources that can get the job done right.

To properly structure CAT deals that protect both the insured and carrier, it’s imperative to not only utilize catastrophe modeling but interpret it correctly. Certain accounts line up much better for carriers that use RMS, while others are better for carriers that use AIR. Understanding this, having the knowledge at your fingertips, and targeting specific markets accordingly provides you with a substantial competitive advantage. Amwins has a dedicated team of actuaries that license full versions of RMS and AIR and can provide consultation on modeling results at no charge to our clients.

Through relationships with more than 440 carriers, Amwins’ property practice places more than 90,000 accounts and $9.4 billion in premium annually. We leverage our data and analytics on these accounts to bring you value-added reports, including a report that shows which of your insureds’ locations are in the path of a storm. We also use the data to build exclusive property capacity that can give you a distinct advantage over your competitors. With boots on the ground in London and Bermuda, Amwins also offers expertise and direct access to these key international marketplaces.

Contact your Amwins broker to learn more and to discuss placement strategies for your accounts.